Narratives are currently in beta

Key Takeaways

- Diversifying into non-railway infrastructure projects could enhance revenue streams and profitability in future quarters.

- Gaining cheaper funding from bond markets can reduce costs and improve net margins and overall profitability.

- Diversification and low-cost funding strategies position Indian Railway Finance Corporation for stable revenue, higher profit margins, and growth beyond railway projects.

Catalysts

About Indian Railway Finance- Engages in leasing of rolling stock assets, railway infrastructure assets in India.

- The Indian Railway Finance Corporation (IRFC) is recalibrating growth plans and targeting higher yields and margins in the future quarters, which suggests a potential positive impact on future net margins and earnings growth.

- The company's strategic intent to diversify beyond Indian Railways into other lucrative railway-related infrastructure projects could increase revenue streams and enhance profitability, affecting future revenue positively.

- IRFC's participation in new projects, like coal mining development, and their success as the lowest bidder, indicates a shift towards higher-margin projects outside traditional railway financing, which may improve net margins and earnings.

- The focus on obtaining cheaper funding and actively mobilizing resources in various bond markets is anticipated to reduce funding costs, which could enhance net margins and improve overall profitability.

- The company's strategic shift towards businesses yielding higher returns, such as backward and forward-linked railway infrastructure projects, is expected to increase net interest margins and boost earnings without substantial changes in asset growth.

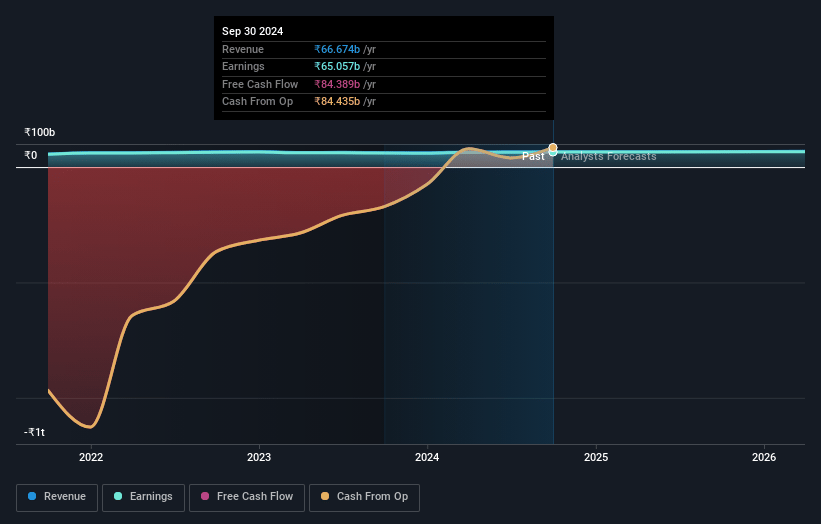

Indian Railway Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Indian Railway Finance's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 97.5% today to 97.7% in 3 years time.

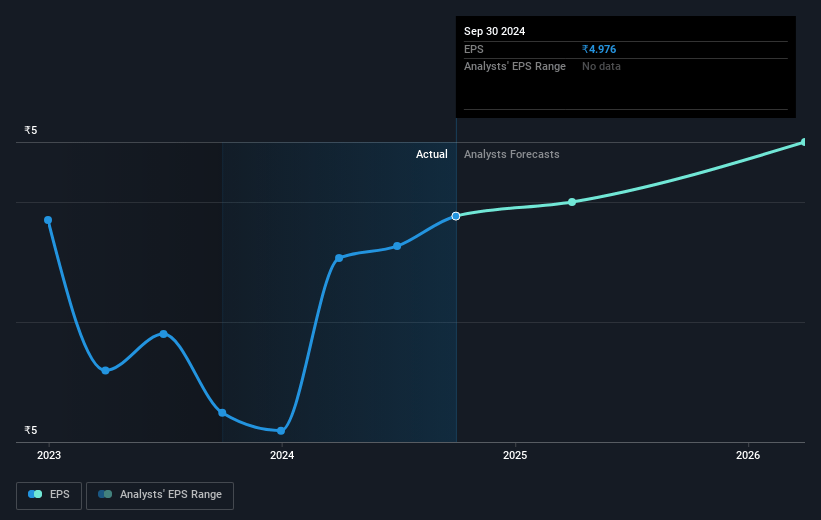

- Analysts expect earnings to reach ₹69.2 billion (and earnings per share of ₹5.24) by about January 2028, up from ₹65.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 28.3x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 25.2x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 20.13%, as per the Simply Wall St company report.

Indian Railway Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Indian Railway Finance Corporation (IRFC) maintains a strong financial position with zero non-performing assets (NPAs) and a high capital adequacy ratio, indicating robust risk management which may support stable revenue and earnings.

- The company is exploring new business areas beyond Indian Railways and successfully competed against established banks and non-banking financial companies (NBFCs) to become the lowest bidder for a key coal mining project, potentially boosting future revenue streams and profit margins.

- IRFC has a tax-free status due to unabsorbed depreciation, which effectively makes it a zero-tax company for at least the next several years, aiding in maintaining high net margins.

- The company's strategy to diversify its asset mix with higher-margin businesses is geared towards increasing profitability even if the overall asset base remains stable, which could support profit growth and improve net margins over time.

- IRFC's access to low-cost funding allows it to offer competitive rates while still achieving higher margins in new projects compared to core railway funding, potentially leading to improved earnings and net interest margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹50.0 for Indian Railway Finance based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹70.8 billion, earnings will come to ₹69.2 billion, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 20.1%.

- Given the current share price of ₹141.73, the analyst's price target of ₹50.0 is 183.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives