Key Takeaways

- Government-backed infrastructure programs and expansion into higher-margin segments are expected to drive sustained revenue growth and diversify the project portfolio.

- Strong asset quality, effective risk management, and technological adoption support improved profitability and stable long-term earnings outlook.

- Reliance on government projects, exposure to interest and forex risks, and rising competition threaten HUDCO's revenue growth, loan utilization, and profitability sustainability.

Catalysts

About Housing and Urban Development- Provides loans and financing for housing and urban development projects in India.

- The company stands to benefit from a sustained increase in urban infrastructure spending, driven by continued urbanization and government-backed programs such as the Urban Challenge Fund, PMAY 2.0, and Viksit Bharat, which should fuel a multi-year pipeline of large projects and lift both loan book growth and top-line revenue.

- HUDCO's expansion into new, higher-margin segments-including private sector urban financing, mobility (metros, rapid rail, e-mobility), and water projects-as well as its move to serve new states and regions increases addressable market size, diversifies its project mix, and could boost revenue growth while reducing earnings cyclicality.

- The adoption of new technologies, improved treasury management, and data-driven monitoring of projects (as seen in proactive hedging, uniform disbursement practices, and asset resets) is likely to drive operational efficiency, support stable or improved net interest margins, and enhance profitability over time.

- Exceptionally low and declining NPAs, over 70% of loans guaranteed by government entities, and a well-capitalized balance sheet position the company for stronger returns with minimal credit loss, supporting both net margin expansion and higher return on assets.

- Large and growing sanction and disbursement pipelines-underpinned by multi-year government commitments, strong demand from states, and opportunities for public-private partnerships-provide long-term visibility into revenue and earnings growth, supporting the potential for upward earnings revisions and stock re-rating.

Housing and Urban Development Future Earnings and Revenue Growth

Assumptions

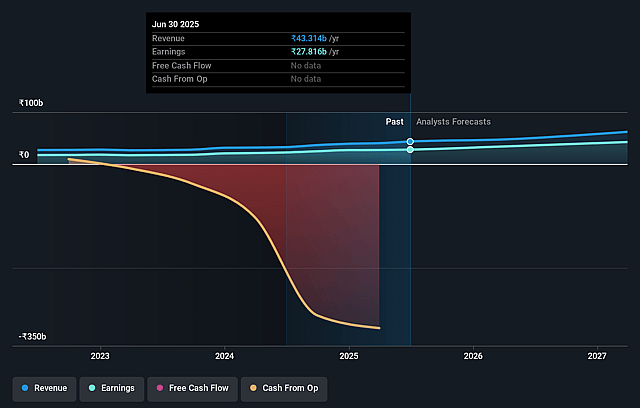

How have these above catalysts been quantified?- Analysts are assuming Housing and Urban Development's revenue will grow by 20.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 64.2% today to 73.3% in 3 years time.

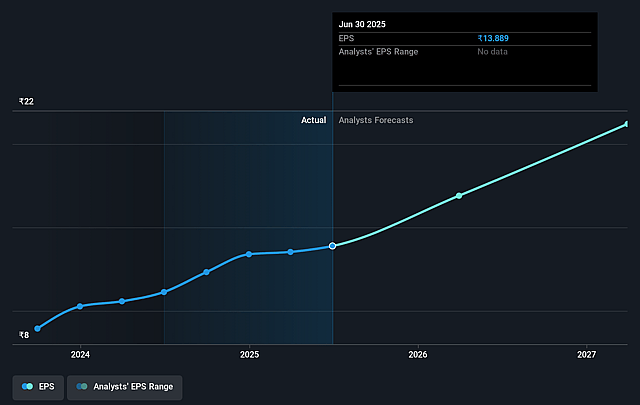

- Analysts expect earnings to reach ₹55.3 billion (and earnings per share of ₹27.7) by about September 2028, up from ₹27.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, down from 15.6x today. This future PE is lower than the current PE for the IN Diversified Financial industry at 23.5x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.42%, as per the Simply Wall St company report.

Housing and Urban Development Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- HUDCO's rapid loan book and disbursement growth is heavily reliant on continued government CapEx momentum and the implementation of large infrastructure programs; any slowdown or delay in government project execution (at central or state levels), budgetary provisions, or policy support could lead to underutilized sanction pipelines, impairing revenue growth and disbursement velocity over the long term.

- The company's asset-liability structure reveals a sizable portion of borrowings are at fixed rates with a 5-year average maturity, whereas the lending book is semi-fixed with annual resets; a rising or persistently high interest rate environment could compress net interest margins (NIM) and weigh on earnings if funding costs cannot be sufficiently repriced.

- HUDCO's use of foreign currency borrowings exposes it to mark-to-market and forex risks, as evidenced by recent CHF-related losses; ongoing global currency volatility or inadequate hedging could produce recurring losses or earnings volatility, impacting net profitability.

- The company's dependence on government guarantees and budget support for 70%+ of the loan book limits direct credit losses, but does not insulate HUDCO from project implementation delays, cost overruns, or administrative bottlenecks, which over multiple years could lead to muted loan growth, delayed revenue recognition, and operational inefficiencies.

- Increasing competition from banks, private sector lenders, and new alternative finance players in infrastructure and urban sector lending could put pressure on HUDCO's yield, fees, and project pipeline over time; should technological disruption or regulatory change advantage more agile competitors, HUDCO risks stagnating revenue and shrinking margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹270.0 for Housing and Urban Development based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹75.5 billion, earnings will come to ₹55.3 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 14.4%.

- Given the current share price of ₹216.44, the analyst price target of ₹270.0 is 19.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.