Key Takeaways

- Expansion of gold loan offerings, digital adoption, and upgraded customer mix support growth in revenue, market share, and margins.

- Strategic partnerships, cost efficiencies, and capital infusions enable profitability gains and stability across gold and non-gold lending segments.

- Reliance on gold loans amid asset quality challenges in other segments, flat customer growth, and tightening regulations threaten revenue diversification, margin stability, and long-term growth.

Catalysts

About Manappuram Finance- A gold loan non-banking financial company, provides fund-based and fee-based financial services in India.

- Expansion of gold loans, leveraging branch network (including new gold loan offerings at Asirvad branches) and aggressive shift to higher-ticket gold loan customers are expected to drive volume growth, supported by increasing financial inclusion and formalization of gold assets in India. This is likely to boost revenue growth and long-term market share.

- Gradual reduction in gold loan yields to align with market leaders-enabled by digitization, pricing flexibility, and cost of funds improvement-alongside rising digital disbursement (>85% online), should allow scale benefits to offset yield compression, supporting stable to improved net margins as the customer mix upgrades.

- Augmented by digital adoption, co-lending arrangements with banks, and regulatory harmonization (notably RBI's new co-lending norms), Manappuram is positioned to acquire customers at lower costs and sustain competitive operating metrics, leading to enhanced profitability and cost-to-income ratio improvement.

- Turnaround in non-gold segments, with microfinance losses moderating and strong underwriting/collection frameworks in place, indicates reduced credit costs and improved earnings visibility in coming quarters, enhancing consolidated earnings stability.

- Infusion of long-term capital and strategic support from Bain Capital, combined with strong rural and semi-urban reach, creates catalytic potential for expanding into underpenetrated segments and scaling up diversified secured lending, positively impacting book value growth and long-term return metrics.

Manappuram Finance Future Earnings and Revenue Growth

Assumptions

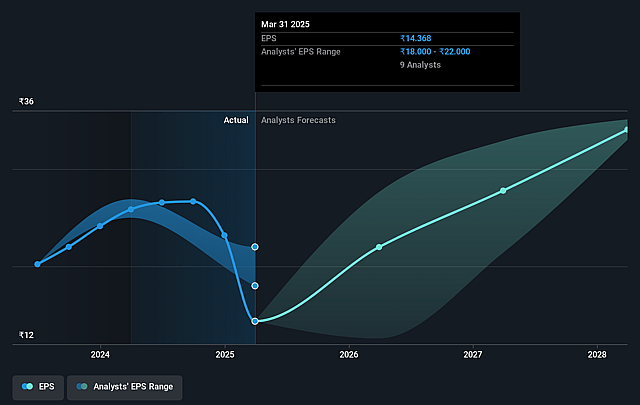

How have these above catalysts been quantified?- Analysts are assuming Manappuram Finance's revenue will grow by 34.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.1% today to 34.1% in 3 years time.

- Analysts expect earnings to reach ₹33.3 billion (and earnings per share of ₹29.59) by about August 2028, up from ₹8.0 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, down from 28.2x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 4.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.45%, as per the Simply Wall St company report.

Manappuram Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is strategically reducing its gold loan yields from 22% to an expected 18% over 4–6 quarters to match peers and attract higher-ticket customers, which, unless fully offset by volume growth, could significantly compress net interest margins and overall profit levels, especially in a competitive environment.

- Microfinance (Asirvad) continues to experience elevated stress and high credit costs, with asset quality issues (1.4% net NPA, significant losses), and management now intends to cap microfinance at just 10% of AUM; this heightens dependence on gold loans and slows revenue diversification, while continued MFI stress impacts consolidated earnings.

- Non-gold segments (vehicle, MSME, and affordable housing) are in a "consolidation phase" following asset quality deterioration (vehicle finance GNPA at 9.2%, MSME unsecured book losses); strategic pullback and slow growth here limit the company's ability to diversify revenue streams and stabilize earnings growth amidst volatility in the gold business.

- Customer growth in the core gold segment has been flat despite yield cuts, with AUM growth driven primarily by ticket size increases rather than new customer acquisition; if this trend persists, sustainable long-term revenue growth may be at risk, especially if upmarket customer segments become saturated or price-sensitive.

- Regulatory constraints (RBI requiring approval for new branches beyond 1,000, compliance with stricter co-lending, KYC, and asset quality norms) may impede branch expansion and AUM growth, while broader industry tightening and digital-first disruption could gradually reduce traditional NBFCs' market share, pressuring both top-line and earnings sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹258.077 for Manappuram Finance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹305.0, and the most bearish reporting a price target of just ₹185.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹97.6 billion, earnings will come to ₹33.3 billion, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 16.4%.

- Given the current share price of ₹266.05, the analyst price target of ₹258.08 is 3.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.