Last Update 20 Dec 25

Fair value Increased 1.64%531213: Interim Dividend And Margin Outlook Will Shape Balanced Future Performance

Narrative Update on Manappuram Finance

Analysts have modestly raised their price target on Manappuram Finance from ₹305 to ₹310, reflecting improved expectations for faster revenue growth, slightly higher profit margins, and a lower implied future valuation multiple.

What's in the News

- A board meeting is scheduled on October 30, 2025, to review unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025 (company filing).

- The board will also consider the declaration of an interim dividend for shareholders at the same October 30, 2025, meeting (company filing).

Valuation Changes

- The Fair Value Estimate has risen slightly from ₹305.0 to ₹310.0, indicating a modestly higher intrinsic valuation.

- The Discount Rate has fallen slightly from 16.56 percent to 16.01 percent, reflecting a marginally lower perceived risk or cost of equity.

- The Revenue Growth assumption has risen meaningfully from 36.35 percent to 45.77 percent, pointing to stronger expected top line expansion.

- The Net Profit Margin forecast has increased slightly from 31.62 percent to 33.92 percent, suggesting a small improvement in expected profitability.

- The future P/E multiple has fallen significantly from 14.49x to 11.13x, implying that the revised valuation relies less on high terminal market multiples.

Key Takeaways

- Digital adoption and AI-driven underwriting are transforming operational efficiency, expanding the client base, and enabling margin growth through enhanced sourcing and reduced costs.

- Strategic partnerships, scalability through co-lending, and regulatory shifts position Manappuram to capture premium markets, improve asset quality, and accelerate revenue and earnings growth.

- Heavy reliance on gold loans combined with rising competition, credit quality issues, and limited diversification exposes the company to growth, regulatory, and profitability risks.

Catalysts

About Manappuram Finance- A gold loan non-banking financial company, provides fund-based and fee-based financial services in India.

- While analyst consensus expects gold loan growth to be offset by lower yields, this overlooks the accelerating shift of affluent and middle-class borrowers-previously untapped-into organized gold loans due to formalization and digital adoption, enabling Manappuram to significantly expand its average ticket size and total addressable market, which could drive a step change in revenue and AUM growth well beyond current estimates.

- Analysts broadly agree that process overhauls and digital lending will boost operational efficiency, but they may underappreciate the impact of Manappuram's rapid digitization and AI-driven underwriting, which is already sourcing 85% of gold loans online, likely compressing cost-to-income ratios and meaningfully expanding net margins over the medium term.

- The co-lending model with banks and the rollout of gold loans through Asirvad's vast branch network is poised to unlock rapid scalability in gold loans and reach underserved rural markets, allowing for leveraged market share gains and a strong structural revenue uplift.

- Bain Capital's partnership brings not just funding but global best practices and financial sector expertise, which could catalyze capital efficiency, improve risk management, and enable bolt-on acquisitions or more aggressive expansion, all of which can accelerate earnings growth and fortify balance sheet strength.

- As tighter regulations and data infrastructure improvements accelerate the shift away from informal lenders, Manappuram's early-mover advantage and diversified secured lending focus position it to capture premium asset quality loans and lower credit costs, which will both stabilize and expand future earnings.

Manappuram Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Manappuram Finance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Manappuram Finance's revenue will grow by 36.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 20.1% today to 31.6% in 3 years time.

- The bullish analysts expect earnings to reach ₹32.0 billion (and earnings per share of ₹37.86) by about September 2028, up from ₹8.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 30.5x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 28.5x.

- Analysts expect the number of shares outstanding to grow by 4.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.56%, as per the Simply Wall St company report.

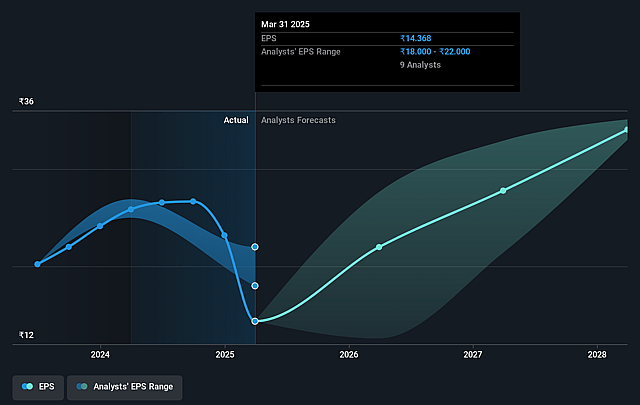

Manappuram Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition from commercial banks, fintech firms, and other NBFCs in the gold loan segment is leading to a secular trend of yield compression, as seen in Manappuram's phased reduction of gold loan rates from above 22 percent to a targeted range near 18 percent, which is likely to put long-term pressure on net interest margins and overall earnings.

- Manappuram's stated strategy to increase the gold loan share to 75 percent of consolidated AUM and ongoing challenges in diversifying beyond gold loans heightens its vulnerability to gold price volatility, collateral risks, and single-product dependence, threatening the stability and future growth of revenue streams.

- The company's non-gold portfolios, notably microfinance and vehicle finance, continue to exhibit elevated GNPA ratios (for example, 9.2 percent in vehicle finance) and periodic losses, indicating persistently high credit risk which could push up credit costs and erode net profits, especially if asset quality fails to recover.

- Ongoing stress and regulatory tightening in the microfinance sector, coupled with a conscious reduction in the microfinance book to below 10 percent of AUM, suggest limited growth avenues outside core gold lending, constraining revenue diversification and exposing the business to regulatory headwinds.

- Structural shifts in borrower preferences toward digital products, unsecured loans, and alternative credit sources in semi-urban and rural India, combined with regulatory hurdles (such as branch expansion restrictions and possible LTV caps), could limit customer base expansion and ultimately cap long-term AUM and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Manappuram Finance is ₹305.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Manappuram Finance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹305.0, and the most bearish reporting a price target of just ₹185.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹101.1 billion, earnings will come to ₹32.0 billion, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 16.6%.

- Given the current share price of ₹288.2, the bullish analyst price target of ₹305.0 is 5.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Manappuram Finance?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.