Key Takeaways

- Intensifying digital competition and financial inclusion initiatives are shrinking Manappuram's gold loan market, pressuring revenue and long-term growth prospects.

- Weaker digital transformation, shrinking margins, and asset quality concerns in non-gold segments will further erode profitability and constrain earnings growth.

- Focus on core gold loan business, secured lending, digital transformation, regulatory tailwinds, and strategic partnerships is driving resilience, operational efficiency, and sustainable long-term profitability.

Catalysts

About Manappuram Finance- A gold loan non-banking financial company, provides fund-based and fee-based financial services in India.

- The ongoing shift towards digital and fintech-led financial services is intensifying competition and diminishing the relevance of legacy NBFCs such as Manappuram. As technologically advanced platforms offer users more convenient and competitive credit options, customer acquisition and retention will become increasingly challenging, leading to long-term declines in both loan book growth and yields, ultimately pressuring top-line revenue growth.

- Rising banking penetration, enhanced financial literacy, and government-sponsored financial inclusion programs are gradually reducing borrower reliance on informal lending channels like gold loans-the company's core segment. This structural shift is expected to shrink Manappuram's addressable market over time, resulting in stagnant or even shrinking loan disbursements and downward pressure on revenue.

- Overdependence on the gold loan portfolio, which management aims to raise to 75% of total AUM, and a conscious strategy of yield cuts to compete with leading NBFCs will compress net interest margins. This reduced profitability will be exacerbated as high-ticket, low-yield segments gain share, while volume growth fails to offset rate declines, causing operating profits and net margins to weaken.

- The company's less developed digital transformation, compared to agile fintech rivals and major banks, is likely to maintain higher operating expenses due to ongoing reliance on physical branches and manual underwriting. As the cost-to-income ratio deteriorates and competitors scale efficiently, return on assets and earnings are set to decline.

- Asset quality concerns remain acute, especially in the non-gold portfolios such as microfinance, MSME, and vehicle finance, where credit costs and GNPA ratios have elevated. Persistently high provisioning requirements, together with regulatory headwinds around collateral and operational guardrails, will erode net profit further and constrain growth in consolidated earnings.

Manappuram Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Manappuram Finance compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Manappuram Finance's revenue will grow by 31.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 20.1% today to 30.9% in 3 years time.

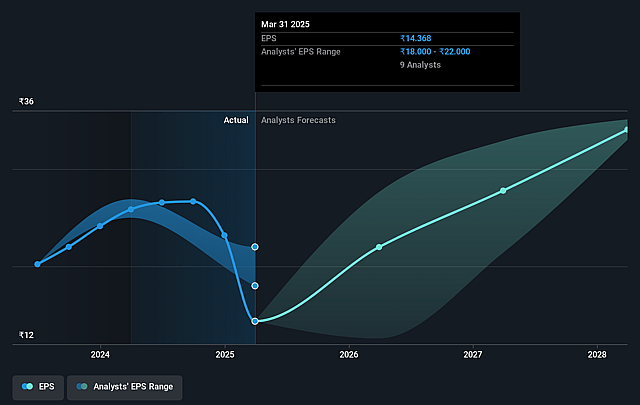

- The bearish analysts expect earnings to reach ₹28.2 billion (and earnings per share of ₹33.27) by about August 2028, up from ₹8.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, down from 28.2x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 4.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.44%, as per the Simply Wall St company report.

Manappuram Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The gold loan business, which is the core strength of Manappuram Finance, continues to gain market share and remains resilient, supported by calibrated reduction in lending rates aimed at increasing higher-ticket and quality customers. This strategy, along with expectations of robust gold loan AUM growth and growing demand among middle and upper-middle income customers, strongly supports long-term revenue and profit expansion.

- The company is strategically shifting its focus toward secured lending-targeting a consolidated portfolio mix where gold loans constitute 75% and unsecured microfinance falls below 10% of total AUM. This risk mitigation and shift to safer assets is likely to stabilize earnings, improve asset quality, and support sustainable profitability.

- Manappuram is leveraging digital transformation through online sourcing of gold loans (now at 85% of the loan book), performance-driven branch network optimization, and co-lending initiatives with banks. These steps are expected to enhance operational efficiency, lower cost-to-income ratios, and contribute to higher net margins over time.

- Regulatory trends are becoming more favorable for NBFCs, with harmonization of RBI's co-lending guidelines and a level playing field in gold loan regulation, supporting easier compliance, better customer access, and expanded addressable market, thereby improving both revenue growth prospects and funding costs.

- The recent investment and partnership with Bain Capital will bring fresh capital and best-in-class expertise, enabling Manappuram to accelerate its growth ambitions, expand digital and product capabilities, and weather sector volatilities, reinforcing book value growth and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Manappuram Finance is ₹194.67, which represents two standard deviations below the consensus price target of ₹258.08. This valuation is based on what can be assumed as the expectations of Manappuram Finance's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹305.0, and the most bearish reporting a price target of just ₹185.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹91.3 billion, earnings will come to ₹28.2 billion, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 16.4%.

- Given the current share price of ₹266.15, the bearish analyst price target of ₹194.67 is 36.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.