Key Takeaways

- Aggressive digital expansion and strong rural penetration position Manappuram for sustained revenue growth, margin resilience, and industry-leading cost efficiencies.

- Bain Capital's investment and expertise are set to accelerate operational leverage, business transformation, and expansion beyond current market expectations.

- Rising fintech competition, shifting consumer preferences, and regulatory pressures threaten profitability, asset quality, and long-term growth due to concentration risks and declining non-gold segments.

Catalysts

About Manappuram Finance- A gold loan non-banking financial company, provides retail credit products and financial services in India.

- Analysts broadly agree that organized gold loan growth, digital onboarding, and newly competitive pricing will drive core earnings, but the current consensus may underestimate the potential scale; Manappuram's aggressive target of over 20% annual gold AUM growth amid substantial customer additions and high online penetration points to much stronger revenue expansion and margin resilience than currently forecast.

- The analyst consensus highlights RBI regulatory normalization and process improvements as catalysts, but the upcoming Bain Capital investment-bringing both fresh capital and global NBFC expertise-can accelerate business transformation and technology adoption, rapidly improving operational leverage, supporting higher returns on equity, and enabling aggressive expansion across secured lending, well beyond what consensus expects.

- The structural shift in India toward formalized finance and rising financial inclusion in rural and semi-urban markets is likely to exponentially grow Manappuram's addressable market for gold loans and secured products, allowing for outsized, sustained revenue growth due to deepening rural market penetration and first-mover scale advantages.

- The long-term uptrend in gold prices directly enhances Manappuram's collateral base, enabling higher average ticket sizes, lower credit losses, and improved capital efficiency, which together point to both higher loan growth and materially lower risk-adjusted credit costs over time.

- With 82% of gold loans already sourced online and a focus on digital expansion, Manappuram is well positioned to capitalize on industry-leading cost-to-income efficiencies, providing a significant and durable boost to net margins and accelerating compounding of long-term earnings.

Manappuram Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Manappuram Finance compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Manappuram Finance's revenue will grow by 13.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 18.7% today to 33.2% in 3 years time.

- The bullish analysts expect earnings to reach ₹31.8 billion (and earnings per share of ₹37.5) by about July 2028, up from ₹12.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.0x on those 2028 earnings, down from 19.0x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 28.1x.

- Analysts expect the number of shares outstanding to grow by 1.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.0%, as per the Simply Wall St company report.

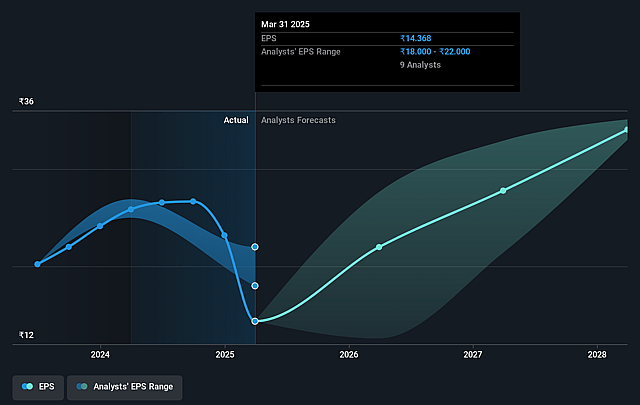

Manappuram Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing digital adoption and the emergence of fintech competitors threaten to erode Manappuram's traditional customer base in gold loans, intensifying pricing competition and putting pressure on net interest margins over time.

- A continued generational shift away from physical gold ownership in India could shrink the addressable gold loan market for Manappuram, leading to slower asset growth and impacting long-term revenue.

- Heightened regulatory scrutiny and possible tightening of gold loan norms by the RBI-including stricter loan-to-value ratios and more frequent interest payment requirements-could increase compliance costs, force changes in product structure, and further compress profitability and earnings.

- Persistent weakness in the microfinance business, with elevated credit costs, rising delinquencies, and declining AUM, signals ongoing asset quality and profitability challenges in non-gold segments and poses a risk to consolidated earnings if stress continues or worsens.

- Heavy reliance on gold loans (59.5 percent of AUM) and geographic concentration expose Manappuram to concentration risk; any stagnation or decline in gold prices, regional disruptions, or increased competition from banks and digital lenders could significantly impact both asset quality and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Manappuram Finance is ₹300.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Manappuram Finance's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹300.0, and the most bearish reporting a price target of just ₹185.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹95.7 billion, earnings will come to ₹31.8 billion, and it would be trading on a PE ratio of 13.0x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹273.3, the bullish analyst price target of ₹300.0 is 8.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.