Catalysts

About Shriram Finance

Shriram Finance is a diversified non banking finance company focused on vehicle finance, MSME lending, gold loans and personal loans across India.

What are the underlying business or industry changes driving this perspective?

- Rapid AUM expansion in cyclical vehicle segments, fueled by strong GDP and auto sales, risks asset quality normalization once freight demand or rural momentum cools. This could erode net margins as credit costs revert higher.

- High dependence on commercial and passenger vehicle funding at a time when government infrastructure spending is uneven across states leaves earnings vulnerable to any slowdown in construction and heavy truck utilization. This may pressure revenue growth and recoveries.

- Rising exposure to MSME and personal loans in new geographies, while near term growth is strong, may outpace the company’s underwriting depth and local expertise. This increases the likelihood of higher Stage 2 and Stage 3 loans and weaker net profitability.

- The strategy to protect or lift net interest margins in an environment where 87 percent of liabilities are fixed and repricing is slow could constrain the ability to pass on lower rates. This may limit competitive pricing and eventually weigh on disbursement volumes and fee income.

- The scaling of gold loans, two wheeler finance and used vehicle funding into a broader retail base, without a commensurate strengthening of collections and repossession infrastructure, heightens downside risk in a weaker rural or employment cycle. This could potentially compress earnings and return on equity.

Assumptions

This narrative explores a more pessimistic perspective on Shriram Finance compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

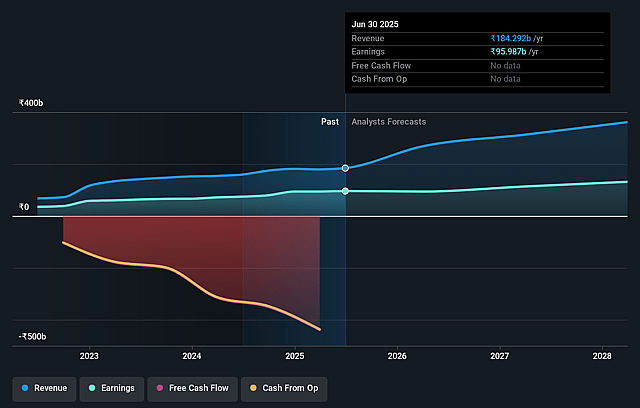

- The bearish analysts are assuming Shriram Finance's revenue will grow by 28.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 52.0% today to 32.4% in 3 years time.

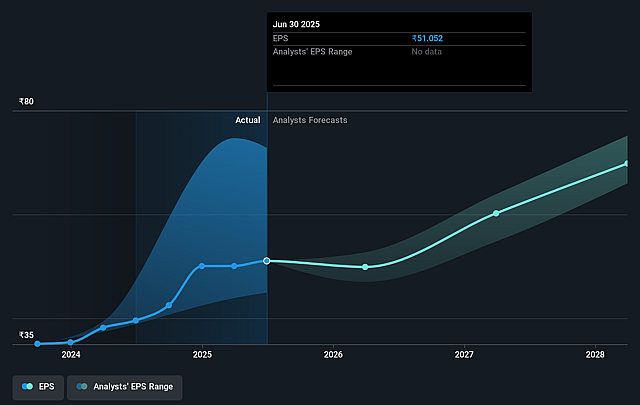

- The bearish analysts expect earnings to reach ₹130.3 billion (and earnings per share of ₹68.25) by about December 2028, up from ₹98.5 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹188.4 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.5x on those 2028 earnings, down from 17.2x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 24.2x.

- The bearish analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.03%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- India's macro backdrop is currently very supportive, with real GDP growth near 7.8%, low inflation and rising GST collections that are likely to feed higher government infrastructure spending. This can sustain robust credit demand and keep Shriram Finance's revenue growth stronger than expected over the long term, supporting earnings.

- Underlying auto and rural cycles appear healthy, with broad based growth in commercial vehicles, two wheelers, three wheelers and tractors, plus strong October demand. This can underpin AUM expansion in Shriram's core segments and limit the expected deterioration in asset quality, thereby protecting net margins and credit costs.

- Despite concerns about asset quality, the company is showing improving Stage 3 ratios, stable Stage 2 plus Stage 3, controlled write offs and declining credit costs. This suggests that risk management and collections are effectively containing stress and could prevent the severe NPA spike needed to materially depress earnings.

- Funding and balance sheet trends are moving in Shriram's favor, with excess liquidity being normalized, cost of funds and leverage declining, a strong liquidity coverage ratio and growing retail deposits. Together these factors can support stable or even improving net interest margins and reduce downside risk to profitability.

- Management is signaling confidence in growth and profitability, targeting NIMs of around 8.25 to 8.5 percent, expecting AUM growth to accelerate modestly in the second half and maintaining a disciplined cost to income ratio. All of these elements point to the potential for sustained earnings growth that could support or lift the share price rather than drive it lower.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Shriram Finance is ₹641.18, which represents up to two standard deviations below the consensus price target of ₹890.24. This valuation is based on what can be assumed as the expectations of Shriram Finance's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1200.0, and the most bearish reporting a price target of just ₹586.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹402.4 billion, earnings will come to ₹130.3 billion, and it would be trading on a PE ratio of 14.5x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹901.75, the analyst price target of ₹641.18 is 40.6% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Shriram Finance?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.