Last Update 01 Nov 25

Fair value Increased 3.46%Narrative Update: Shriram Finance Analyst Price Target Revision

Analysts have raised their fair value estimate for Shriram Finance from ₹716.68 to ₹741.45. This revision reflects incremental improvements in revenue growth expectations, even with a slightly higher discount rate and minimal changes to profit margin and valuation multiples.

What's in the News

- The Board of Directors of Shriram Finance has scheduled a meeting on October 31, 2025 to consider and approve unaudited financial results for the quarter and half-year ended September 30, 2025. Other agenda items include discussing an interim dividend for FY 2025-26 and potential fundraising.

- Shriram Finance denied rumors on October 1, 2025 regarding Mitsubishi UFJ Financial Group's alleged plans to acquire a 20% stake for $2.6 billion, stating that such reports are based on speculation and that management has no knowledge or control over related share price movements. (Company exchange filing)

- Earlier the same day, it was reported that Mitsubishi UFJ Financial Group was in advanced talks to acquire a significant stake in Shriram Finance in what could be the largest ever foreign acquisition of an Indian non-banking finance company. (The Economic Times)

Valuation Changes

- Consensus Analyst Price Target increased from ₹716.68 to ₹741.45, reflecting a modest upward revision.

- Discount Rate edged up slightly from 16.47% to 16.61%.

- Revenue Growth rose marginally, moving from 27.14% to 27.70%.

- Net Profit Margin declined slightly from 36.11% to 35.73%.

- Future P/E increased modestly from 15.58x to 15.65x.

Key Takeaways

- Anticipated reduction in borrowing costs and improved asset quality could enhance revenue and net margins.

- Strategic focus on used vehicle financing and economic growth is expected to drive revenue and earnings.

- Stagnant commercial vehicle sales and rising Stage 2 loans threaten Shriram Finance's asset quality, profitability, and future earnings amid liquidity and supply challenges.

Catalysts

About Shriram Finance- A non-banking finance company, primarily engages in the provision of financing services in India.

- The anticipated decline in borrowing costs due to the Reserve Bank of India cutting the repo rate could lead to reduced interest expenses, positively impacting net margins.

- Improved predictions for the monsoon and a stronger rural economy are expected to boost credit demand and improve asset quality, potentially leading to higher revenues and better net margins.

- Growth in India's GST collection and expected government infrastructure spending could increase credit demand and improve asset quality, impacting revenues positively.

- A strategic focus on used vehicle financing, especially given the low supply of new vehicles between 2019 and 2021, can bolster the portfolio and drive revenue growth as economic activity picks up.

- Plans to normalize liquidity and the gradual cost reduction in borrowing could improve net interest margins, positively impacting earnings.

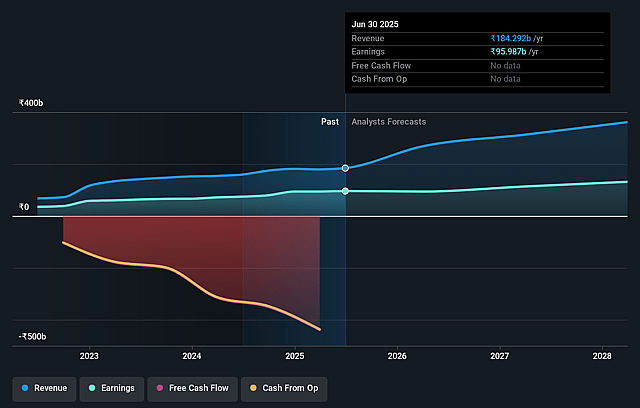

Shriram Finance Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Shriram Finance's revenue will grow by 27.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 52.1% today to 36.1% in 3 years time.

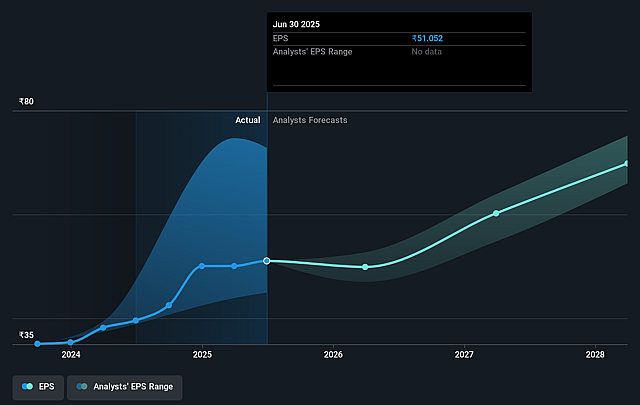

- Analysts expect earnings to reach ₹136.8 billion (and earnings per share of ₹72.93) by about September 2028, up from ₹96.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 11.5x today. This future PE is lower than the current PE for the IN Consumer Finance industry at 27.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.47%, as per the Simply Wall St company report.

Shriram Finance Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The commercial vehicle (CV) sales have remained flat, and supply issues are noted within the used vehicle market, impacting the potential growth in Shriram Finance's core area, affecting revenue streams.

- There's been a notable stress in certain geographies, particularly in Central India, which has affected Stage 2 loans, potentially influencing future asset quality and thereby impacting net margins.

- The net interest margin (NIM) has declined due to excess liquidity on the balance sheet, a factor that may pressure earnings if not effectively managed.

- The technical write-off of ₹2,345 crore in fully provided assets reduced the gross Stage 3 percentage, but it could indicate underlying asset quality issues that might impact future earnings if recovery efforts falter.

- Rising Stage 2 categories in segments like passenger vehicles and MSMEs could indicate potential stress, threatening asset quality and profitability if these loans transition to Stage 3.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹716.677 for Shriram Finance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹830.0, and the most bearish reporting a price target of just ₹578.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹378.8 billion, earnings will come to ₹136.8 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 16.5%.

- Given the current share price of ₹586.15, the analyst price target of ₹716.68 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.