Catalysts

About V.I.P. Industries

V.I.P. Industries is a leading Indian luggage and travel accessories company with a portfolio spanning value to premium brands.

What are the underlying business or industry changes driving this perspective?

- Escalating pricing aggression at the mass end, with cabin luggage being sold near INR 1,100 by new online focused rivals, risks pushing V.I.P. into a defensive discounting cycle. This could structurally cap revenue growth and compress net margins.

- The rapid shift toward e commerce and modern trade, which already account for roughly half of volume, leaves the company exposed to platform exclusive low cost brands that can continue to erode V.I.P.'s share and pressure earnings as volumes stagnate.

- Management's stated reluctance to articulate a clear forward strategy during a shareholder transition raises the risk that portfolio repositioning toward lower ticket products is delayed. This could lead to prolonged revenue underperformance and weaker return on capital.

- The growing dominance of lower price luggage across channels, with nearly 80 percent of the market below INR 3,000, could force sustained mix deterioration away from structurally higher margin premium brands like Carlton. This may weigh on blended gross margins and EBITDA.

- High reliance on liquidation of slow moving inventory and insurance recoveries, combined with ongoing provisions on 15 to 18 percent of the basket, indicates working capital and cash flow may stay strained if consumer uptrading falters and old stock continues to drag on earnings.

Assumptions

This narrative explores a more pessimistic perspective on V.I.P. Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

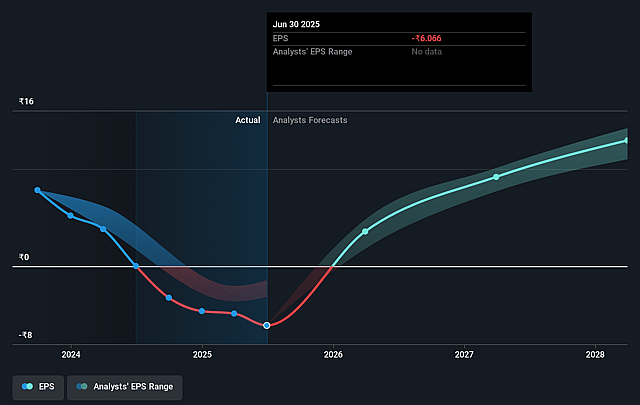

- The bearish analysts are assuming V.I.P. Industries's revenue will grow by 4.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -10.0% today to 9.5% in 3 years time.

- The bearish analysts expect earnings to reach ₹2.1 billion (and earnings per share of ₹14.74) by about December 2028, up from ₹-2.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹3.1 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 28.5x on those 2028 earnings, up from -25.5x today. This future PE is greater than the current PE for the IN Luxury industry at 20.1x.

- The bearish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 16.02%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- India's travel sector fails to maintain its current growth trajectory in hotel occupancies and domestic air traffic, leading to weaker category expansion and limiting any recovery in V.I.P. Industries' volume growth and revenue over the medium term.

- The company is unable to sustain its structural cost discipline, with adjusted gross margin at 48% and adjusted EBITDA margin at 10% coming under pressure, which would reduce the potential for operating leverage to lift net margins and earnings even if the top line stabilizes.

- Premiumization trends reverse or slow, with the Carlton brand no longer delivering double digit growth and hard luggage no longer on a clear growth path, which would weaken the higher margin segment, deteriorate the overall mix, and weigh on gross margin and EBITDA margin.

- Bangladesh manufacturing utilization falls back below 80% or the operation reverts from an operating profit of INR 8 crores to an operating loss, and ongoing inventory and debt reduction efforts stall, which would strain cash flows and limit the potential for future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for V.I.P. Industries is ₹275.0, which represents up to two standard deviations below the consensus price target of ₹371.0. This valuation is based on what can be assumed as the expectations of V.I.P. Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹490.0, and the most bearish reporting a price target of just ₹275.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹22.6 billion, earnings will come to ₹2.1 billion, and it would be trading on a PE ratio of 28.5x, assuming you use a discount rate of 16.0%.

- Given the current share price of ₹351.3, the analyst price target of ₹275.0 is 27.7% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on V.I.P. Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.