Key Takeaways

- Generative AI, automation, and client insourcing threaten LTTS's pricing power, margin stability, and long-term profitability amid fierce global competition and rising compliance demands.

- Overreliance on concentrated sectors, Indian talent, and offshore models exposes LTTS to revenue volatility, cost pressures, and weakening of its addressable market.

- Business diversification, innovation in proprietary platforms, and international expansion are expected to drive sustainable growth while reducing dependence on single sectors or markets.

Catalysts

About L&T Technology Services- Operates as an engineering research and development services company in India, North America, Europe, and internationally.

- Rapid advances in generative AI and automation threaten to commoditize many of L&T Technology Services' core digital engineering offerings, which could significantly undermine long-term pricing power and lead to downward pressure on both revenue and gross margins as clients increasingly demand greater productivity with less spend.

- Geopolitical fragmentation and increasing localization of global supply chains may sharply reduce the volume of offshore engineering and R&D contracts awarded to Indian providers, eroding LTTS's addressable market and limiting future revenue growth, especially as multinationals seek to diversify away from concentrated outsourcing models.

- Persistent high client concentration in sectors such as mobility (automotive, transportation) and telecom exposes LTTS to substantial revenue volatility, as downturns or disruptions in these verticals-already evident with automotive deal pauses and cancellations-can lead to abrupt declines in top-line growth and ongoing instability in net earnings.

- Overreliance on Indian engineering talent leaves LTTS acutely sensitive to rising wage costs, increased attrition, and a shrinking labor pool, which will intensify operating cost pressures and are likely to compress net margins over time, especially as LTTS attempts to scale high-value delivery for global clients.

- The accelerating trend of large clients insourcing advanced engineering and digital services, combined with sustained pricing pressure due to crowdsourcing, open-source alternatives, and fierce competition, threatens to structurally reduce LTTS's long-term profitability and throws into question the company's ability to maintain or grow margins as it faces higher compliance burdens and operational complexity.

L&T Technology Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on L&T Technology Services compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming L&T Technology Services's revenue will grow by 8.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.5% today to 12.6% in 3 years time.

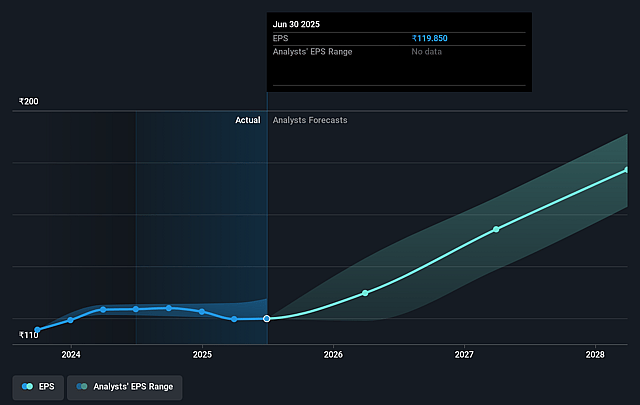

- The bearish analysts expect earnings to reach ₹17.9 billion (and earnings per share of ₹168.6) by about September 2028, up from ₹12.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.8x on those 2028 earnings, down from 35.1x today. This future PE is lower than the current PE for the IN Professional Services industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.09%, as per the Simply Wall St company report.

L&T Technology Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Robust large deal wins and a growing order backlog across all three business segments provide strong revenue visibility, which may lead to sustained top-line growth over the long term.

- Diversification into high-growth areas such as sustainability, digital engineering, and MedTech reduces dependence on any single sector, helping to protect both revenues and net margins from volatility in specific verticals like automotive.

- Strategic investments in proprietary AI platforms and in-house intellectual property, such as PLxAI and LTTS iDriVe, are expected to improve gross margins and support higher recurring earnings through differentiated offerings.

- Expansion into international markets, including new design centers in North America and a pipeline for Middle East revenues, indicates an intention and capacity to broaden the client base, potentially increasing overall revenues and reducing customer concentration risk.

- The company's ongoing focus on operational efficiency-including AI-led automation, cost optimization in SG&A, and higher offshore contribution-is likely to improve net margins and drive earnings growth over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for L&T Technology Services is ₹3477.38, which represents two standard deviations below the consensus price target of ₹4555.84. This valuation is based on what can be assumed as the expectations of L&T Technology Services's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5770.0, and the most bearish reporting a price target of just ₹3460.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹142.6 billion, earnings will come to ₹17.9 billion, and it would be trading on a PE ratio of 29.8x, assuming you use a discount rate of 13.1%.

- Given the current share price of ₹4205.9, the bearish analyst price target of ₹3477.38 is 21.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.