Key Takeaways

- Enhanced win rates from new segment-focused sales and AI-led platform rollouts could propel long-term revenue and margin growth well beyond current expectations.

- Leadership in sustainability and strong international expansion position the company for superior, diversified earnings momentum and expanded pricing power.

- Disruptive innovation, client concentration, wage pressures, and increased competition threaten LTTS's revenue growth, margin sustainability, and international market position.

Catalysts

About L&T Technology Services- Operates as an engineering research and development services company in India, North America, Europe, and internationally.

- Analysts broadly agree that large deal wins and record high TCV will fuel future growth, but the market is underestimating the probability of a step-change in earnings as LTTS's new segment-focused sales teams and expanded global design centers create a structural uplift in win rates and accelerate revenue conversion, potentially pushing annualized revenues well beyond current medium-term targets.

- While the consensus sees technology investments and AI as margin-enhancers, LTTS's early commercialization of proprietary platforms such as PLxAI and the planned rollout of additional AI-led frameworks could drive nonlinear margin expansion, making high-teens EBIT margins plausible and supporting a significant re-rating in profitability multiples.

- LTTS's leadership in sustainability and plant modernization solutions positions it as a direct beneficiary of the accelerating global shift toward green engineering and digital factories, enabling it to access a multi-year, high-growth pipeline that could significantly outpace sector revenue growth averages.

- Rising complexity and shortening lifecycles in product engineering globally are intensifying the need for specialized R&D outsourcing; LTTS's deep vertical expertise and recent recognition as a leader by top analysts sharply expands its pricing power, allowing for premium contracts and further net margin expansion in coming years.

- Expansion into high-growth international markets, including the US, Europe, and the Middle East, alongside a rapidly growing active-client base and clear progress in client mining, is set to deliver robust, diversified revenue growth, reduce volatility, and improve overall earnings quality as more clients graduate into higher spending tiers.

L&T Technology Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on L&T Technology Services compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming L&T Technology Services's revenue will grow by 15.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.5% today to 12.5% in 3 years time.

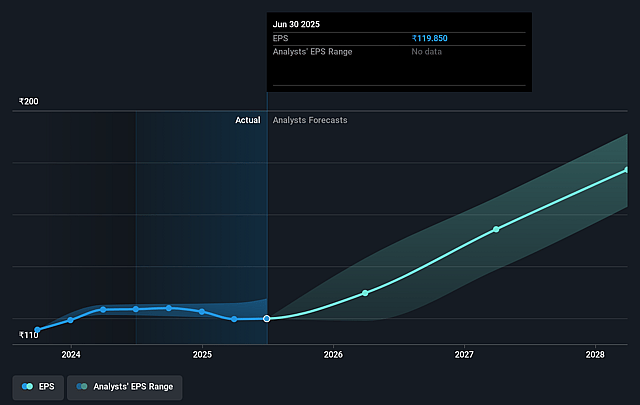

- The bullish analysts expect earnings to reach ₹21.3 billion (and earnings per share of ₹201.24) by about September 2028, up from ₹12.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.5x on those 2028 earnings, up from 35.1x today. This future PE is greater than the current PE for the IN Professional Services industry at 30.6x.

- Analysts expect the number of shares outstanding to grow by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.09%, as per the Simply Wall St company report.

L&T Technology Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased automation, AI adoption, and disruptive innovation by clients themselves-particularly in the automotive sector and smart manufacturing-may reduce the need for LTTS's traditional engineering services, which could compress their long-term revenue growth.

- Heightened geopolitical tensions and a trend towards supply chain localization could lead global clients in North America and Europe to favor domestic or regional technology service providers, thereby shrinking LTTS's international revenue base and impacting earnings stability.

- The company's ongoing reliance on a small number of large accounts, with recent declines noted in revenue from top 20 clients due to automotive sector volatility, exposes LTTS to the risk of sudden revenue drops if key clients shift spend to competitors or take work in-house.

- Persistent industry-wide wage inflation and high attrition rates in India could continue to apply pressure to LTTS's operational costs, while limited pricing power or slow transition to higher-margin digital solutions may erode net margins over time.

- Growing commoditization of engineering services and consolidation among large clients can intensify price competition and restrict pricing flexibility for LTTS, creating long-term margin pressure and challenging the sustainability of current earnings levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for L&T Technology Services is ₹5634.31, which represents two standard deviations above the consensus price target of ₹4555.84. This valuation is based on what can be assumed as the expectations of L&T Technology Services's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5770.0, and the most bearish reporting a price target of just ₹3460.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹170.2 billion, earnings will come to ₹21.3 billion, and it would be trading on a PE ratio of 40.5x, assuming you use a discount rate of 13.1%.

- Given the current share price of ₹4205.9, the bullish analyst price target of ₹5634.31 is 25.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.