Key Takeaways

- International expansion, strategic acquisitions, and innovative product development are strengthening market position, reducing geographic risk, and increasing recurring revenue streams.

- Growing regulatory and cybersecurity requirements are boosting demand for core offerings, supporting margin resilience and scalable growth through expanded partnerships and product differentiation.

- Heavy dependence on acquisitions, regulatory delays, competitive pressures, and industry shifts threaten eMudhra's growth, profitability, and ability to maintain differentiation in core offerings.

Catalysts

About eMudhra- Provides trust and enterprise solutions to individuals and organizations worldwide.

- The company's expansion into international markets-particularly with the acquisition of Cryptas in the DACH region and expansion into Central Asia-positions it to benefit from growing demand for digital trust services globally. This geographic diversification and participation in regions with advanced digital compliance requirements are likely to support robust revenue growth and decrease reliance on the Indian market.

- Increasing regulatory demands for secure digital identities, eSignatures, and paperless workflows-combined with heightened cybersecurity needs across governments and enterprises-are expanding the addressable market for eMudhra's core offerings. These trends should drive stronger recurring revenue streams and higher average contract values.

- Strategic acquisitions such as AI Cyberforge are enabling eMudhra to quickly add in-demand credential and secrets management capabilities, allowing participation in more lucrative RFPs and deepening product differentiation. This should support margin resilience and boost SaaS-based recurring revenues.

- Continued investment in innovation, especially in areas such as Converged Identity, Data Privacy, and integration of generative AI, enhances the product pipeline and positions the company ahead of anticipated regulatory and cyber threat shifts. This is likely to positively impact net margins through product upgrades and cross-sell opportunities.

- Expanding partnerships and reselling arrangements-especially in new territories-allow access to additional enterprise and government customers without substantial increases in SG&A. This supports scalable top-line growth and improves operating leverage, benefiting overall earnings.

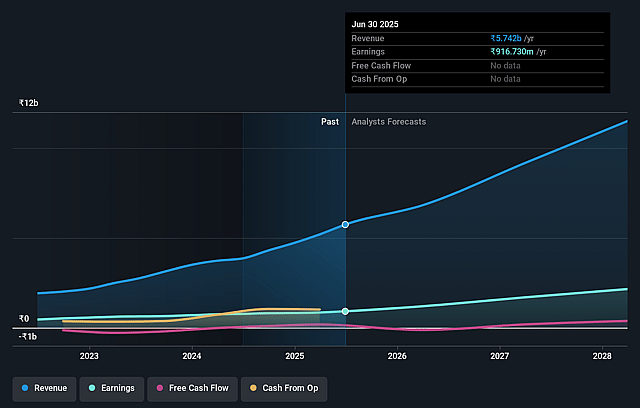

eMudhra Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming eMudhra's revenue will grow by 28.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.0% today to 19.3% in 3 years time.

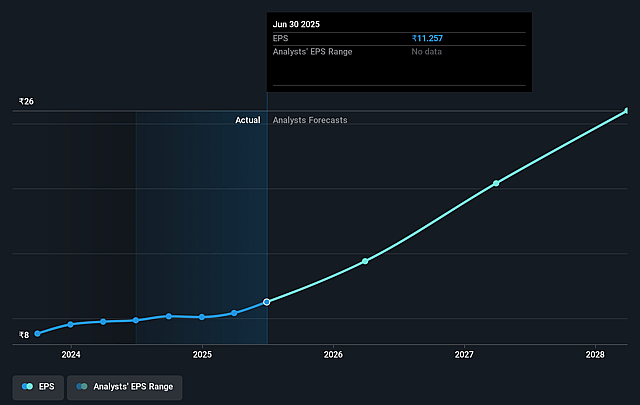

- Analysts expect earnings to reach ₹2.4 billion (and earnings per share of ₹24.59) by about September 2028, up from ₹916.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 52.5x on those 2028 earnings, down from 64.4x today. This future PE is greater than the current PE for the IN Professional Services industry at 29.1x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.03%, as per the Simply Wall St company report.

eMudhra Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued reliance on inorganic growth through acquisitions poses integration and synergy risks; failed integration, prolonged transition periods (as noted with Cryptas), and potential losses from acquired businesses can weigh on future net margins and profitability.

- The company's expansion into new international markets like the U.S. and Europe faces challenges related to brand recognition, operational scaling, and entrenched competition, which could slow meaningful top-line growth and increase SG&A costs, impacting overall earnings.

- Regulatory uncertainties (such as delayed approvals for mobile PKI and expanded eStamping use) limit the company's ability to penetrate the SME and retail segments; slow regulatory progress could constrain addressable market size and long-term revenue growth.

- Intensifying price competition in the Indian digital certification market, as evidenced by the need to increase commissions and reduce prices to win back partners, could compress gross margins and pressure overall net income.

- Increasing automation, the emergence of AI, and secular industry shifts (such as greater use of decentralized identity or open-source solutions) threaten to commoditize eMudhra's core digital signature offerings, risking future organic revenue growth and eroding product differentiation over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹1045.0 for eMudhra based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹12.2 billion, earnings will come to ₹2.4 billion, and it would be trading on a PE ratio of 52.5x, assuming you use a discount rate of 13.0%.

- Given the current share price of ₹725.75, the analyst price target of ₹1045.0 is 30.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.