Catalysts

About Praj Industries

Praj Industries is an engineering and technology company focused on bioenergy, industrial water solutions and process engineering for high value manufacturing sectors.

What are the underlying business or industry changes driving this perspective?

- Although Praj is positioned to benefit from global low carbon ethanol initiatives such as the United States 45Z tax credit and its first commercial low carbon project, the heavy dependence on timely policy continuity and evolving tariff regimes could slow project conversions from inquiries to firm orders and limit export led revenue growth.

- While the company has made demonstrable progress in sustainable aviation fuel with an operating alcohol to jet demo plant that enhances customer confidence, delays in airlines and refiners committing to large scale capex and feedstock contracts may push back commercialization and constrain high margin technology income and earnings visibility.

- Despite India’s growing push for a gas based economy, Praj’s compressed biogas opportunity remains tied to the pace of national gas grid expansion and city gas connectivity, and any lag in this infrastructure build out could defer scale up of CBG orders and keep revenue and operating leverage below earlier expectations.

- Although Praj’s PHS and ultrapure water offerings are aligned with emerging demand from lithium batteries, semiconductors and solar manufacturing, slow on ground execution of these capex cycles and stringent qualification timelines can stretch order conversion and ramp up, muting near term contribution to consolidated margins.

- While the company has invested ahead of the curve in GenX capacity to serve energy transition and conventional oil and gas markets, the prolonged underutilization and delayed shift in customer mix could keep fixed cost absorption weak and cap improvement in consolidated EBITDA margin and net profit even if headline revenues grow.

Assumptions

This narrative explores a more pessimistic perspective on Praj Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

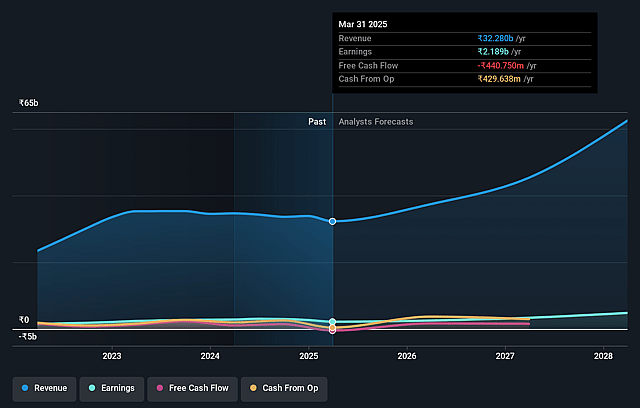

- The bearish analysts are assuming Praj Industries's revenue will grow by 11.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.3% today to 6.4% in 3 years time.

- The bearish analysts expect earnings to reach ₹2.8 billion (and earnings per share of ₹15.23) by about December 2028, up from ₹1.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as ₹3.7 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 31.8x on those 2028 earnings, down from 53.0x today. This future PE is greater than the current PE for the IN Construction industry at 17.7x.

- The bearish analysts expect the number of shares outstanding to decline by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.27%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Successful commissioning of the first low carbon ethanol project in the U.S., combined with a strong inquiry pipeline under the 45Z tax credit regime, could trigger a sustained export upswing, driving faster than expected revenue growth and operating leverage in the BioEnergy segment, which would likely support a higher share price through stronger earnings.

- The operational ramp up of Praj’s alcohol to jet sustainable aviation fuel demo plant, along with tightening global decarbonization norms for aviation, could accelerate customer capex decisions, adding a new high margin revenue stream and structurally lifting consolidated net margins and long-term earnings.

- Policy moves to expand ethanol usage beyond EBP20, including isobutanol based diesel blending and export oriented 2G ethanol, together with Praj’s proven 2G technology and operational IOCL plant, may enlarge the addressable market materially, leading to higher order inflows, improved revenue visibility and stronger profit growth.

- Steady development of India’s gas grid and city gas distribution, coupled with Praj’s early reference plants in compressed biogas and Napier grass projects, could unlock a multi year CBG capex cycle, supporting recurring orders, better fixed cost absorption in engineering and a meaningful uplift in consolidated EBITDA margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Praj Industries is ₹319.0, which represents up to two standard deviations below the consensus price target of ₹399.43. This valuation is based on what can be assumed as the expectations of Praj Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹500.0, and the most bearish reporting a price target of just ₹319.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be ₹43.8 billion, earnings will come to ₹2.8 billion, and it would be trading on a PE ratio of 31.8x, assuming you use a discount rate of 15.3%.

- Given the current share price of ₹304.4, the analyst price target of ₹319.0 is 4.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Praj Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.