Last Update 07 Nov 25

Fair value Decreased 9.98%PRAJIND: Future Cash Flow Gains Will Follow Major US Energy Project

Narrative Update on Praj Industries

Analysts have lowered their price target for Praj Industries from ₹468.33 to ₹421.57, citing tempered revenue growth expectations and a slightly higher discount rate. Improved profit margins have partly offset these changes.

What's in the News

- Board meeting scheduled for November 5, 2025, to consider and approve un-audited financial results for the quarter and half year ended September 30, 2025 (Company filing).

- Praj Industries is supplying advanced low-carbon solutions for a $30 million energy efficiency upgrade at Aemetis Inc.'s ethanol plant in Keyes, California. The project is expected to significantly reduce natural gas usage and increase annual cash flow through energy savings (Client announcement).

- Aemetis project supported by $19.7 million in grants and tax credits, with completion targeted for the second quarter of 2026. The project aims to further reduce the carbon intensity of ethanol fuel and expand eligibility for tax credits (Client announcement).

- Shareholders approved the appointment of M/s MSKA & Associates as statutory auditors at the Praj Industries AGM held on August 11, 2025 (Company filing).

Valuation Changes

- Consensus Analyst Price Target decreased from ₹468.33 to ₹421.57, reflecting a reduction of approximately 10%.

- Discount Rate has risen slightly from 15.00% to 15.21%.

- Revenue Growth expectations have fallen significantly, from 22.69% to 13.69%.

- Net Profit Margin improved from 6.48% to 8.13%.

- The future P/E ratio is now projected at 31.03x, down from 34.77x previously.

Key Takeaways

- Regulatory moves and global decarbonization trends are set to boost Praj's order inflow, revenue prospects, and earnings visibility across advanced biofuels and biochemicals.

- Product innovation, margin-accretive offerings, and international expansion are diversifying revenues, stabilizing margins, and positioning Praj for sustained long-term growth.

- Overdependence on a slow bioenergy sector, project delays, and mounting global trade barriers are straining revenue growth, profitability, cash flow, and earnings stability.

Catalysts

About Praj Industries- Operates in the field of bio-based technologies and engineering in India and internationally.

- Anticipated regulatory action to increase ethanol blending mandates (potential moves beyond EBP20, possible diesel blending, and flex-fuel vehicle adoption) in India and similar developments internationally (including Brazil and the U.S. via 45Z credits) could reinvigorate order inflow, supporting multi-year revenue and earnings growth.

- The global transition toward renewable fuels-driven by rising corporate net-zero goals, policy incentives like SAF (Sustainable Aviation Fuel) mandates, and decarbonization trends-is expanding the total addressable market for advanced biofuels, compressed biogas, and biochemicals, benefitting Praj's future top line and improving earnings visibility.

- Advancements and commercialization of higher-margin offerings such as CBG-bio-bitumen dual modules, value-added products (distillers corn oil, rice protein), bioplastics, and CO2 capture solutions are expected to drive profitability by diversifying the revenue mix and pushing net margins higher over time.

- Execution of international expansion through technology licensing and EPC projects, alongside efforts to reduce reliance on domestic ethanol mandates, are likely to smoothen revenue volatility and stabilize margins as geographic diversification deepens.

- Strategic investments in innovation and partnerships (e.g., with BPCL, IATA/ISMA for SAF certification, and Uhde for bioplastics) position Praj to capture secular growth in circular economy and waste valorization markets, setting up new recurring revenues and long-term margin improvement.

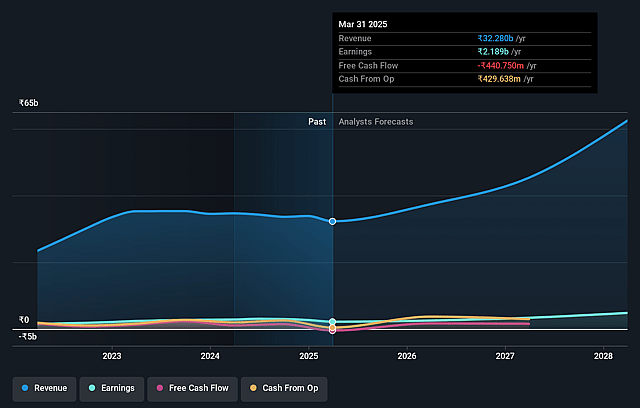

Praj Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Praj Industries's revenue will grow by 22.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 6.5% in 3 years time.

- Analysts expect earnings to reach ₹3.8 billion (and earnings per share of ₹18.46) by about September 2028, up from ₹1.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, down from 54.2x today. This future PE is greater than the current PE for the IN Construction industry at 20.9x.

- Analysts expect the number of shares outstanding to grow by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.0%, as per the Simply Wall St company report.

Praj Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged uncertainty around additional government mandates for ethanol blending beyond EBP20 in India, combined with current overcapacity, could significantly slow domestic order inflows, limiting top-line revenue growth.

- Heavy dependence on the bioenergy sector, with slow materialization of growth opportunities in CBG, SAF, and bioplastics, increases vulnerability to sector-specific demand swings and delays, potentially resulting in erratic revenues and lower earnings resilience.

- High fixed costs at the GenX facility, compounded by delayed project execution and order booking due to geopolitical factors (notably U.S. tariffs), are straining margins and have led to weak absorption of overheads, directly impacting net margins and profitability.

- Persistent liquidity challenges among key domestic customers, especially in the sugar and grain-based ethanol plant segment, are resulting in deferred project execution cycles, elevated receivables, and working capital strain, adversely affecting cash flow and earnings quality.

- Intensifying global trade barriers and regulatory protectionism-such as new U.S. tariffs on engineering exports-are delaying export order conversion and heightening operational risks, threatening both international revenue diversification and overall earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹468.333 for Praj Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹580.0, and the most bearish reporting a price target of just ₹393.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹58.5 billion, earnings will come to ₹3.8 billion, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 15.0%.

- Given the current share price of ₹412.7, the analyst price target of ₹468.33 is 11.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.