Key Takeaways

- Favorable policy changes and a robust project pipeline position Ceigall India for sustained growth and improved margins with reduced competition.

- Strategic diversification into high-value sectors and investment in technology are expected to drive stable earnings and operational efficiencies.

- Heavy reliance on government contracts, execution challenges, declining margins, and funding needs raise concerns over revenue stability, profitability, and financial flexibility amid diversification efforts.

Catalysts

About Ceigall India- Operates as an infrastructure construction company in India.

- A significant project pipeline from NHAI (over ₹3.4 lakh crores in upcoming bids) and the government's continued focus on large-scale infrastructure expansion (metro, highways, T&D, renewables) positions Ceigall India to benefit from robust order inflows, pointing toward sustained long-term revenue growth.

- Recent changes in NHAI/MORTH prequalification criteria and tighter bidding guidelines favor large, experienced contractors like Ceigall, reducing hyper-competition, increasing win rates, and supporting margin expansion over time.

- Successful expansion and diversification into new verticals such as transmission & distribution (T&D) and renewable energy not only diversify revenue streams but open higher-value segments, supporting both topline and margin improvement.

- Strong, visible order book across diverse geographies and sectors, along with the company's ability to consistently win and execute marquee projects, underpins stable earnings growth and reduces volatility, thereby supporting forward earnings projections.

- Ongoing investments in advanced construction technology and project management systems are expected to yield operational efficiencies and cost reductions, directly contributing to improved net margins in the coming years.

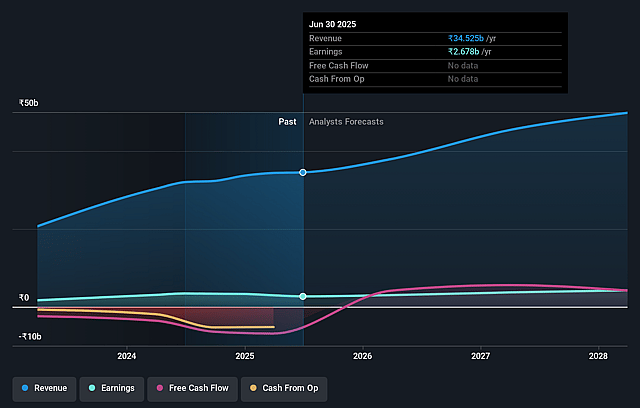

Ceigall India Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ceigall India's revenue will grow by 15.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 8.4% in 3 years time.

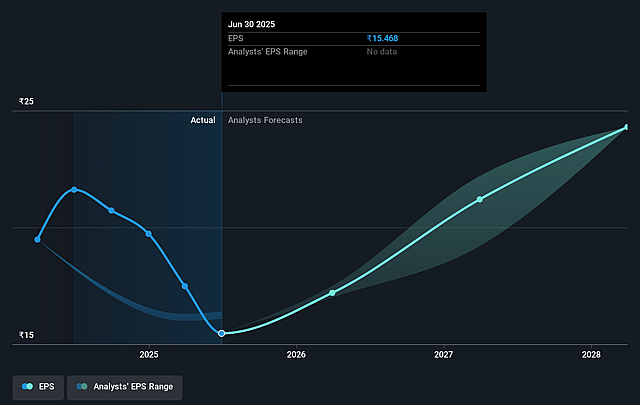

- Analysts expect earnings to reach ₹4.5 billion (and earnings per share of ₹23.52) by about September 2028, up from ₹2.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, up from 18.1x today. This future PE is greater than the current PE for the IN Construction industry at 20.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.91%, as per the Simply Wall St company report.

Ceigall India Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant exposure to government contracts (over 80% of the order book from NHAI) leaves Ceigall India vulnerable to payment delays, order inflows volatility, and revenue disruptions in case of political changes, fiscal tightening, or administrative delays in infrastructure spending.

- Project cancellations and delays, as evidenced by the terminated Bhubaneswar Metro order and the slow progress on HAM projects (e.g., VRK 11 and 12), highlight execution risk and uncertainty around order book conversion, impacting future revenue recognition and earnings visibility.

- While Ceigall is diversifying into new verticals like transmission & distribution and renewable energy, lack of established track record in these segments introduces risks regarding project execution, margin sustainability, and potential cost overruns as new business lines scale up.

- Margins have shown a declining trend (EBITDA dropping from 13.64% in FY24 to 11.42% in Q1 FY26) and remain susceptible to input cost inflation, intense industry competition for large projects, and structural changes in project mix, potentially leading to further net margin erosion if not managed proactively.

- High equity infusion requirements into HAM projects (₹872 crore pending over 2.5 years) may constrain free cash flows and necessitate additional funding should internal accruals fall short, thus pressuring the company's balance sheet and potentially diluting earnings or increasing financing costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹296.0 for Ceigall India based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹342.0, and the most bearish reporting a price target of just ₹256.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹53.1 billion, earnings will come to ₹4.5 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 15.9%.

- Given the current share price of ₹278.44, the analyst price target of ₹296.0 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.