Last Update 13 Dec 25

Fair value Increased 2.90%517569: Revenue Outlook And Margin Improvement Will Support Bullish Upside

Narrative Update on KEI Industries

Analysts have raised their price target on KEI Industries from ₹4,914 to ₹5,057, citing expectations of slightly faster revenue growth, modestly higher profit margins, and a recalibrated future valuation multiple despite a higher discount rate.

What's in the News

- A board meeting is scheduled for October 15, 2025, to consider and approve the unaudited standalone and consolidated financial results for the quarter and half year ended September 30, 2025, and to consider other business matters (company filing).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from ₹4,914 to ₹5,057, reflecting a modest uplift in estimated fair value.

- Discount Rate has increased slightly from 15.14% to 16.08%, indicating a marginally higher perceived risk or required return.

- Revenue Growth has edged up from 21.00% to 21.92%, pointing to a small improvement in top line growth expectations.

- Net Profit Margin has risen slightly from 7.55% to 7.78%, suggesting a modest enhancement in anticipated profitability.

- Future P/E has declined noticeably from 65.12x to 55.54x, implying a lower valuation multiple applied to projected earnings.

Key Takeaways

- Capacity expansion, product innovation, and automation position KEI for revenue and margin growth beyond market expectations, outperforming industry peers.

- Strategic moves in renewables and digital distribution enhance stability, order growth, and competitive advantage as the industry shifts to higher-value cable solutions.

- KEI faces risks from technological lag, sustainability requirements, sector concentration, input cost volatility, and rising competition pressuring margins and growth.

Catalysts

About KEI Industries- Manufactures, sells, and markets wires and cables in India and internationally.

- Analyst consensus expects capacity expansion to drive mid-to-high-teens growth, but management commentary and recent execution indicate KEI could comfortably exceed 20 percent annual revenue growth from FY27 onward as ramp-up at Sanand coincides with broad secular surges in grid modernization, electrification, and infrastructure investment-implying current growth forecasts are likely understated.

- While consensus expects modest margin benefits from improved scale and export mix, KEI's integration of higher-value EHV cables, increased automation, and enhanced logistics at Sanand are set to unlock significant operating leverage, supporting EBITDA margin expansion of 100 basis points or more-translating to outsized EPS growth versus the broader market view.

- KEI's aggressive push into segments linked to renewable energy infrastructure and electric vehicle charging-forging deep relationships in solar, wind, and EV project supply chains-positions it for transformative, multi-year volume surges as government and private investment in clean energy accelerates, directly boosting top-line and institutional orderbook growth.

- Expansion and digitalization of KEI's pan-India distributor and dealer network, especially in underpenetrated southern and eastern regions, has driven B2C wire segment sales above 50 percent of revenue and is reducing working capital risk; continued deepening here is likely to yield above-industry stability in earnings and cash flow.

- The industry-wide shift toward higher-specification, fire-retardant, and low-loss cables-driven by government quality mandates and customer demand for safety and efficiency-favors large, integrated players like KEI, who can win share from unorganized firms, command premium pricing, and structurally lift net margins over time.

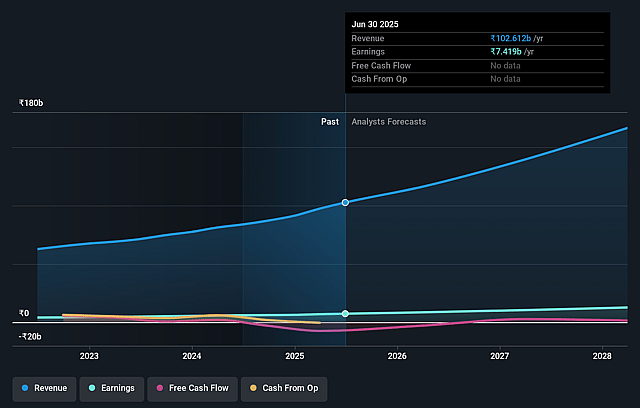

KEI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on KEI Industries compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming KEI Industries's revenue will grow by 21.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 7.5% in 3 years time.

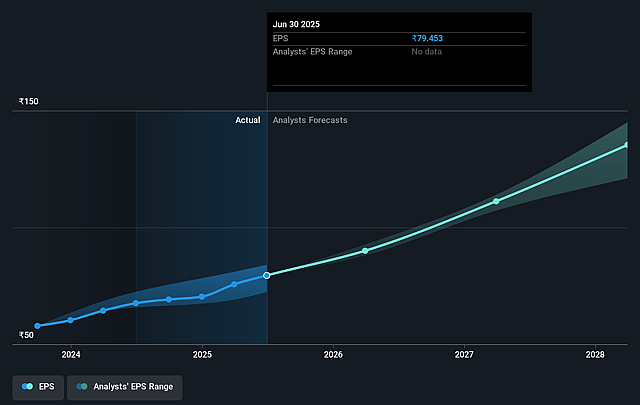

- The bullish analysts expect earnings to reach ₹13.0 billion (and earnings per share of ₹136.02) by about June 2028, up from ₹7.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 65.1x on those 2028 earnings, up from 52.1x today. This future PE is greater than the current PE for the IN Electrical industry at 42.3x.

- Analysts expect the number of shares outstanding to grow by 5.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.14%, as per the Simply Wall St company report.

KEI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing automation and industry digitalization could outpace KEI's manufacturing and product innovation, potentially causing the company to fall behind competitors in advanced smart cable technologies and leading to a gradual loss of revenue and market share.

- Increasing global emphasis on sustainability and green manufacturing exposes KEI to the risk of rising compliance costs and possible margin compression if their product lineup does not evolve rapidly enough towards eco-friendly offerings, threatening net margins over the long run.

- The company's continued heavy reliance on power and infrastructure sector projects, especially within India, makes its revenue and cash flow volatile and susceptible to economic cycles, project delays, or shifts in government policy, which could adversely impact future earnings consistency.

- KEI's limited backward integration in key raw materials such as copper and aluminum leaves it vulnerable to fluctuations in commodity prices; such volatility could squeeze margins and negatively affect profitability, especially if prices spike and the company cannot fully pass on higher costs.

- The potential entry of aggressive new competitors and large multinational conglomerates with greater R&D resources, combined with industry margin pressures from rising input costs, could force KEI to reduce prices or increase marketing and innovation spending, undermining both earnings growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for KEI Industries is ₹4914.31, which represents two standard deviations above the consensus price target of ₹3925.32. This valuation is based on what can be assumed as the expectations of KEI Industries's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5100.0, and the most bearish reporting a price target of just ₹3030.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹172.5 billion, earnings will come to ₹13.0 billion, and it would be trading on a PE ratio of 65.1x, assuming you use a discount rate of 15.1%.

- Given the current share price of ₹3794.85, the bullish analyst price target of ₹4914.31 is 22.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on KEI Industries?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.