Key Takeaways

- Intensifying competition, regulatory pressures, and technological disruption threaten profit margins and challenge the sustainability of KEI's current business model.

- Heavy reliance on cyclical infrastructure spending and volatile raw material costs increases revenue unpredictability and working capital risks.

- Expansion into global markets, increased production capacity, and rising demand in core sectors are positioned to boost long-term revenue growth and profitability.

Catalysts

About KEI Industries- Manufactures, sells, and markets wires and cables in India and internationally.

- As the global energy transition accelerates and ESG norms become more stringent, KEI Industries is likely to face rising compliance costs and capital requirements to upgrade manufacturing processes to meet green standards. This may squeeze net margins, particularly as fresh capacity from Sanand comes online and ramps up, straining profitability if environmental costs escalate faster than expected.

- Increasing geopolitical tensions and the spread of trade protectionism threaten the stability of global supply chains, especially for key raw materials like copper and aluminum. KEI is heavily dependent on stable input costs for its cable manufacturing, so any disruption or price volatility could compress EBITDA margins and increase working capital requirements, undermining earnings growth and potentially delaying scale-up of export operations.

- KEI's business model remains heavily exposed to cyclical infrastructure project spending, both domestically and in export markets, with most orders short-term in nature and a significant portion of revenue driven by EPC and institutional projects. This dependence leaves topline growth vulnerable to slowdowns in government or private capital expenditure cycles and reduces revenue predictability in the event of project pipeline gaps.

- The industry's low barriers to entry continue to encourage new competitors-both organized and unorganized-into the wire and cable space, intensifying competition in core markets. Lacking high product differentiation, KEI could be forced into price wars or pressured to increase dealer incentives, resulting in potential erosion of net margins and a major drag on profitability as new capacity outpaces sustainable demand.

- Rapid technological innovation, including smart-grid solutions and advancements in wireless power transmission, raises the risk that conventional cables may become partially or wholly obsolete faster than anticipated. If adoption of these technologies accelerates, it could significantly shrink the addressable market for traditional cable products, reducing revenue growth prospects and increasing the risk that recent heavy capital investments in manufacturing will be underutilized.

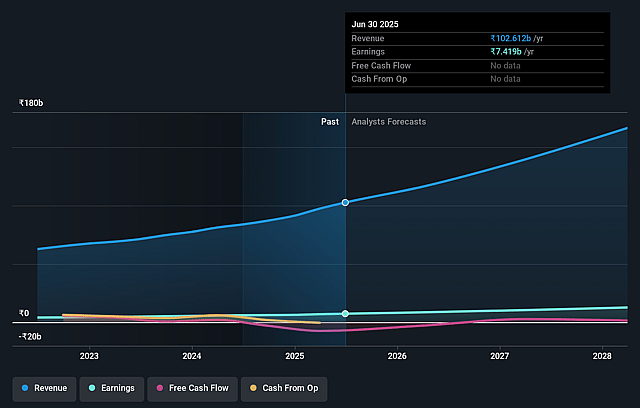

KEI Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on KEI Industries compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming KEI Industries's revenue will grow by 17.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 7.2% today to 7.4% in 3 years time.

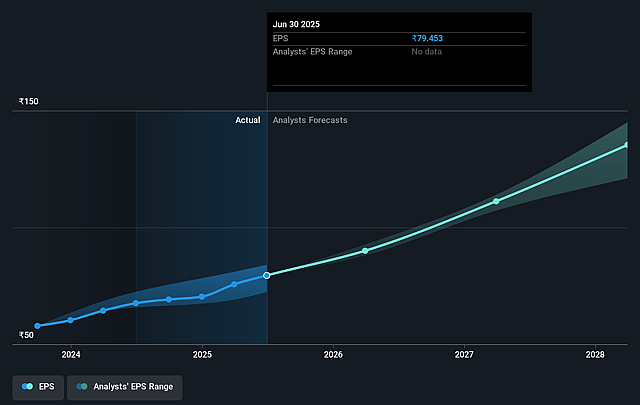

- The bearish analysts expect earnings to reach ₹12.5 billion (and earnings per share of ₹130.22) by about September 2028, up from ₹7.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 46.9x on those 2028 earnings, down from 52.6x today. This future PE is greater than the current PE for the IN Electrical industry at 38.0x.

- Analysts expect the number of shares outstanding to grow by 5.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 15.65%, as per the Simply Wall St company report.

KEI Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- KEI Industries is experiencing strong top-line growth across key segments, with net sales increasing by 25.44% and profit after tax up by over 30% year-on-year, indicating robust demand and operational execution, which may translate into sustained revenue and earnings growth over the coming years.

- Large-scale investments in new facilities such as the Sanand plant, with targeted commercial production ramping up from FY '26 and full utilization in the next three years, are likely to enhance production capacity significantly, supporting high double-digit annual revenue growth and eventual improvements in operating margins.

- Export sales have more than doubled year-on-year, with targets to increase export revenue share to 17-20% by tapping new regions such as the U.S. and Europe; this diversification reduces domestic market risk and potentially lifts company-wide profitability and topline.

- The company reports continuing healthy operating margins, with management targeting 10.5%–11% EBITDA margin and upside potential as the export mix grows and logistic efficiencies from new plants come through, possibly leading to improved profitability and net margins over time.

- Strong industry demand drivers are in play, including the rapid buildout in renewable energy, data centers, electric vehicle infrastructure, and grid projects in India and globally, which align directly with KEI's core product offerings, increasing the company's long-term revenue and order pipeline visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for KEI Industries is ₹3342.8, which represents two standard deviations below the consensus price target of ₹4345.52. This valuation is based on what can be assumed as the expectations of KEI Industries's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹5100.0, and the most bearish reporting a price target of just ₹3150.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹167.2 billion, earnings will come to ₹12.5 billion, and it would be trading on a PE ratio of 46.9x, assuming you use a discount rate of 15.6%.

- Given the current share price of ₹4080.55, the bearish analyst price target of ₹3342.8 is 22.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.