Key Takeaways

- Strategic expansion beyond the core region and digital transformation are set to drive credit growth, improve efficiency, and boost customer engagement.

- Strengthened asset quality, disciplined underwriting, and a resilient low-cost deposit base support stable margins and sustainable profitability.

- Heavy regional concentration, asset quality challenges, rising funding costs, and intensifying digital competition threaten the bank's profitability and long-term growth prospects.

Catalysts

About Jammu and Kashmir Bank- Provides various banking products and services.

- Strong focus on expanding retail lending beyond Jammu & Kashmir-with plans to shift the loan mix to a more balanced 50:50 between the core region and the rest of India-positions the bank to benefit from rising economic activity, urbanization, and government-led investments in northern India, supporting future credit growth and revenue expansion.

- Accelerated digital adoption-including completion of end-to-end digitized loan journeys, robust customer-facing mobile apps, and use of automation/analytics for credit monitoring-strengthens operational efficiency, improves customer acquisition and retention, and supports net margin expansion over time.

- Enhanced underwriting standards, dedicated recovery teams, and realignment of repayment schedules are expected to further reduce slippages and improve asset quality, leading to lower credit costs and higher sustainable earnings.

- High and improving CASA deposit base, coupled with technology-driven customer engagement, allows the bank to maintain low funding costs relative to peers, preserving resilient net interest margins and supporting long-term profitability.

- The central and state government's continued commitment to large-scale infrastructure and economic development in the Jammu & Kashmir region creates a catalyst for increased banking activity, new project financing opportunities, and healthy loan growth, which should positively impact revenue and earnings growth.

Jammu and Kashmir Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Jammu and Kashmir Bank's revenue will grow by 10.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.4% today to 19.9% in 3 years time.

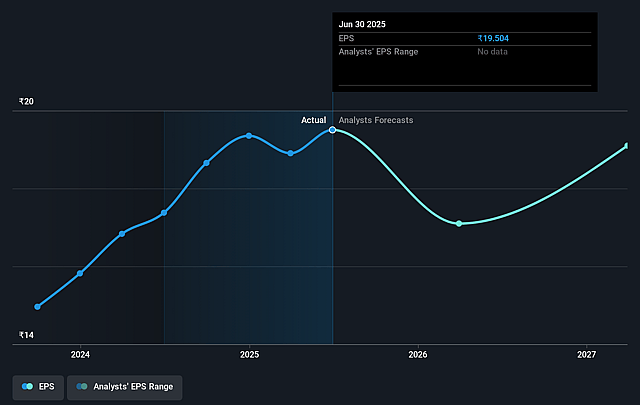

- Analysts expect earnings to reach ₹19.2 billion (and earnings per share of ₹17.39) by about August 2028, down from ₹21.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from 5.3x today. This future PE is greater than the current PE for the IN Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.88%, as per the Simply Wall St company report.

Jammu and Kashmir Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The bank remains highly concentrated in the Jammu and Kashmir region (currently 70%+ of the loan book), making it vulnerable to geopolitical instability, security incidents, and region-specific economic disruptions, which could cause volatility in asset quality and earnings.

- Muted loan growth (6.1% YoY), including degrowth in Rest of India and corporate loans, suggests that despite planned diversification, there is execution risk in achieving targeted credit expansion, potentially limiting future revenue and earnings growth.

- The declining CASA ratio (from 47.01% to 45.71%) and reliance on higher-cost term deposits to offset this trend could drive up funding costs and compress net interest margins, negatively affecting profitability.

- Asset quality improvement, while emphasized, remains challenged by elevated gross NPA (3.5% up slightly this quarter), legacy NPA in NBFC exposures, risks from tourism-linked sectors, and continued slippages-posing a threat to net margins and future write-downs.

- Intensifying competition from larger private sector banks and digital-first banks, coupled with increased customer adoption of digital financial services, may pressure Jammu and Kashmir Bank's market share and non-interest fee income, leading to slower long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹153.0 for Jammu and Kashmir Bank based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹96.3 billion, earnings will come to ₹19.2 billion, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 14.9%.

- Given the current share price of ₹103.69, the analyst price target of ₹153.0 is 32.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.