Key Takeaways

- Rapid digital adoption and innovative technology upgrades are driving higher margins, operational efficiency, and positioning Fino for market-leading growth in digital banking.

- Unique rural reach, a scalable distribution model, and expansion into new fee-yielding products create strong tailwinds for customer acquisition and long-term earnings growth.

- Fino Payments Bank faces pressure from digital disruption, regulatory changes, margin compression, government competition, and high operating costs, challenging its growth, profitability, and business model sustainability.

Catalysts

About Fino Payments Bank- Provides various types of financial services in India.

- Analysts broadly agree that Fino's digital revenue will grow from 21% in FY25 to above 25% in FY26, but the true upside is that nearly half of throughput is already digital, with UPI market share jumping rapidly and digital business revenue multiplying more than fourfold last year, pointing to the potential for digital to reach over 35% of revenue much faster than expected, significantly boosting net margins due to the scalable, low-cost nature of digital banking.

- Analyst consensus sees the on us transaction migration as incrementally accretive for revenue per customer, yet this shift is already leading to substantially higher renewal rates, deeper account monetization, and faster cohort improvement, meaning revenue per customer and annuity income can surge at a pace and scale well beyond current market models, providing greater operating leverage and supporting strong growth in earnings.

- India's drive for inclusive digital financial services, supported by government policy and direct benefit transfers, is accelerating customer adoption in rural and semi-urban areas where Fino's unrivaled reach covers 97% of PIN codes, presenting a unique, underappreciated advantage to exponentially increase customer acquisition and deposits, which will be highly accretive for both revenue and ARPU over time.

- Fino's merchant-led distribution strategy and ongoing expansion into fee-yielding products (including insurance, gold loans, and micro-credit referrals) have already shown a sixfold increase in merchant loan disbursements, indicating Fino is positioned to tap a massive, underserved lending and cross-selling opportunity that can structurally lift fee income and margins as regulatory permissions expand.

- Fino's core banking and technology overhaul, including in-house UPI switch and imminent AI-driven real-time risk management, is not only reducing costs and boosting efficiency, but sets the stage for industry-leading product innovation and transaction resilience-creating a competitive moat that could drive sustainable margin expansion and allow Fino to take disproportionate share of India's rising digital transaction volumes.

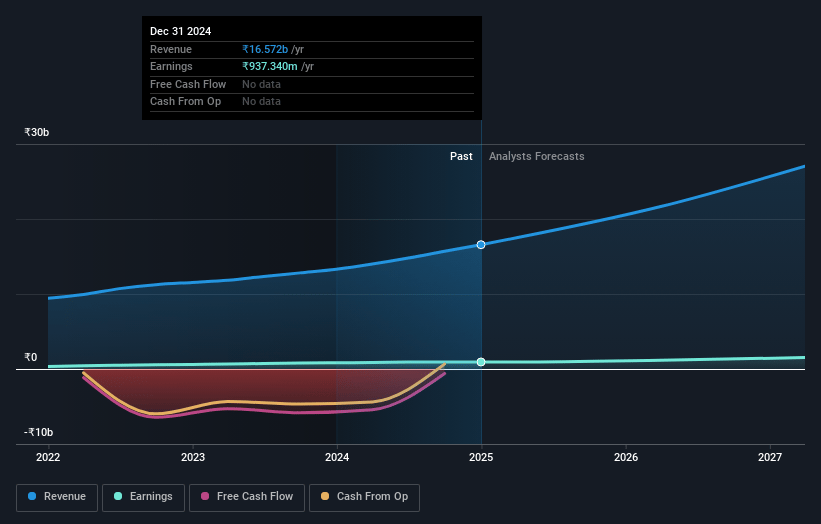

Fino Payments Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Fino Payments Bank compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Fino Payments Bank's revenue will grow by 23.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 5.3% today to 6.0% in 3 years time.

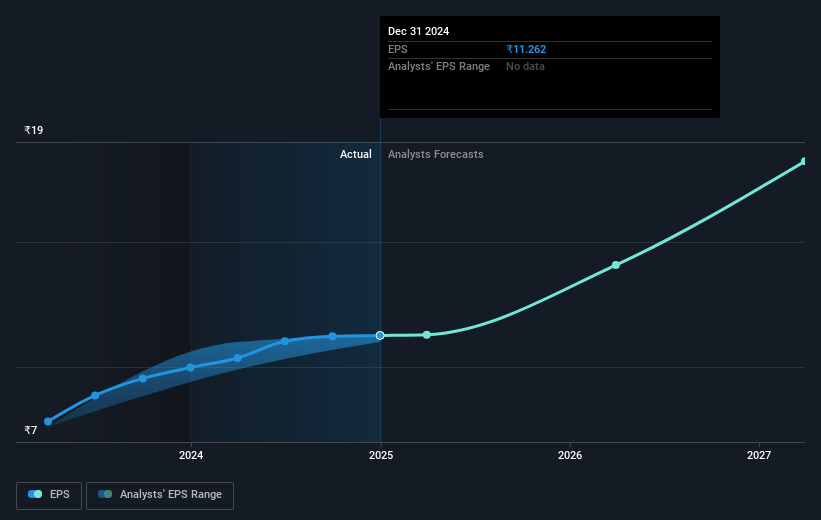

- The bullish analysts expect earnings to reach ₹2.0 billion (and earnings per share of ₹24.06) by about July 2028, up from ₹925.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, down from 25.0x today. This future PE is greater than the current PE for the IN Banks industry at 12.8x.

- Analysts expect the number of shares outstanding to decline by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.55%, as per the Simply Wall St company report.

Fino Payments Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rise of fully digital neobanks and changing customer behavior towards self-service digital platforms may erode Fino Payments Bank's core agent-assisted and phygital model, leading to a potential decline in competitive differentiation, customer retention, and future revenue growth.

- Regulatory changes and increased scrutiny, particularly around remittance transactions and digital fraud, have already resulted in significant drops in transaction-based income, and further tightening or compliance requirements may increase operational expenses and suppress net margin improvement.

- Government-led financial inclusion initiatives and direct benefit transfer schemes through state-owned institutions reduce reliance on intermediary payments banks like Fino, risking long-term declines in transaction volumes and pressure on overall topline and earnings.

- Fino remains highly dependent on fee-based income streams such as remittance and cash management, both of which have shown margin compression due to regulatory and competitive pressures, limiting the ability to expand net margins and diversify revenue in a sustainable manner.

- Persistent high customer acquisition and servicing costs, particularly among rural and underbanked segments, alongside necessary heavy investments in technology to keep pace with industry standards and address cybersecurity, may constrain cost-to-income improvements and expose the business to ongoing operational and profitability risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Fino Payments Bank is ₹390.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Fino Payments Bank's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹390.0, and the most bearish reporting a price target of just ₹300.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹33.1 billion, earnings will come to ₹2.0 billion, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 12.5%.

- Given the current share price of ₹278.3, the bullish analyst price target of ₹390.0 is 28.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.