Last Update01 May 25Fair value Increased 0.11%

Key Takeaways

- Strong growth in retail and CASA deposits boosts revenue prospects, while reduced high-cost borrowings and a lower credit-to-deposit ratio improve net margins.

- Advances in credit card offerings and asset quality, plus strategic capital raises, highlight the bank's growth potential and possible stock undervaluation.

- Continued reliance on capital raises, microfinance stress, high credit-to-deposit ratio, and deposit rate adjustments could strain earnings, liquidity, and profitability.

Catalysts

About IDFC First Bank- Engages in the provision of various banking and financial services to corporates, individuals, multi-national companies, SMEs/entrepreneurs, financial institutions, and the government in India.

- IDFC First Bank is seeing strong growth in customer deposits, particularly in retail deposits and CASA deposits, which indicates a solid foundation for future revenue growth. The bank's deposits increased by 25% year-over-year, which is expected to support expansion and improve liquidity, positively impacting revenue and earnings.

- The bank's efforts in reducing high-cost legacy borrowings and bringing down the credit-to-deposit ratio from 98.4% to 93.9% indicate a strategic focus on improving net margins. The focus on managing costs of funds also suggests a positive trajectory for future earnings growth.

- IDFC First Bank has achieved significant progress in product areas like credit cards, where the bank reports operational breakeven within four years, and observes strong growth in gross spends by 40% in FY25. These high-growth areas are expected to drive revenue and improve the bank's net interest margins.

- The improvement in asset quality metrics, despite the challenges in the microfinance sector, suggests a strengthening of the credit portfolio, which is likely to impact future earnings positively. The gross NPA and net NPA ratios are stable or improving, which bodes well for future net margins and profitability.

- The bank has undertaken strategic capital raises, indicative of an ambitious growth trajectory to enhance its capital adequacy and fund expansion plans. This positions IDFC First Bank to increase its return on equity and improve earnings, suggesting that the stock could be undervalued relative to its growth potential.

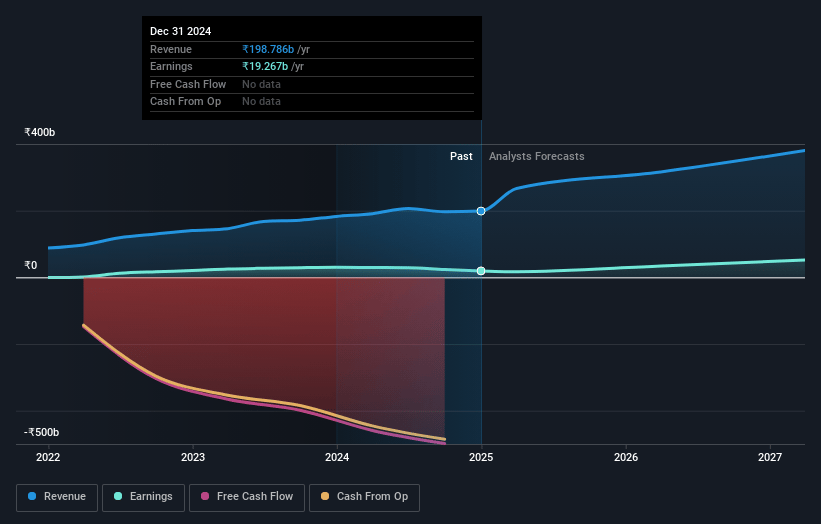

IDFC First Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IDFC First Bank's revenue will grow by 28.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 16.8% in 3 years time.

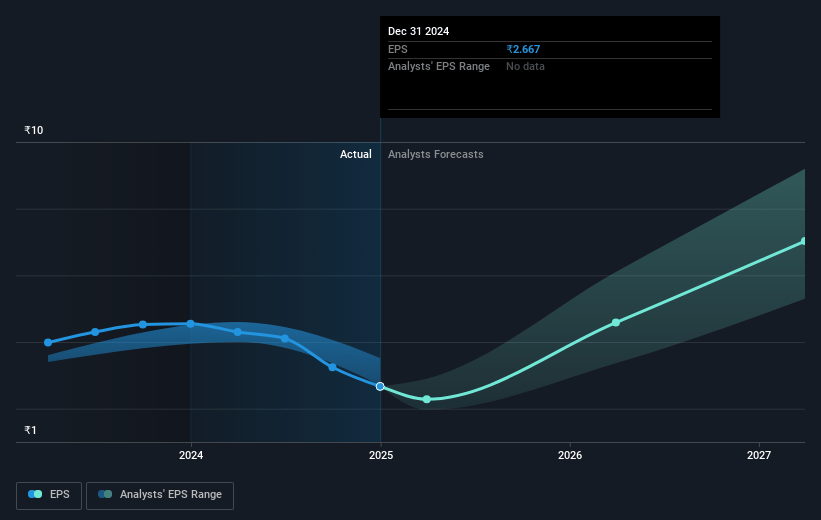

- Analysts expect earnings to reach ₹74.7 billion (and earnings per share of ₹8.67) by about May 2028, up from ₹14.9 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, down from 31.9x today. This future PE is greater than the current PE for the IN Banks industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 3.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.01%, as per the Simply Wall St company report.

IDFC First Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on ongoing capital raises and dilution of equity, having raised ₹21,000 crores of capital in five years, could strain future earnings and dilute shareholder value if the bank fails to achieve targeted returns on equity. (Earnings)

- The microfinance segment is experiencing stress, with increased slippages and credit costs impacting overall profitability. While improvements are noted, the continuation of these challenges could pressure margins and earnings. (Net margins)

- The bank's credit-to-deposit ratio, while decreasing, remains relatively high at 93.9%, which could constrain liquidity and limit the ability to fund loan growth from deposits. Pressure to reduce this ratio further could impact revenue generation. (Liquidity and revenue)

- The reduction in deposit interest rates, notably on fixed deposits, to align with larger banks could affect the bank's existing deposit base if customers seek higher returns elsewhere, impacting CASA ratios and potentially increasing the cost of funds if not managed carefully. (Cost of funds)

- Operating expenses have been a focus, with a commitment to keeping growth around 12%-13% while revenue grows at over 20%. If operating leverage plans don't materialize as expected, this mismatch could lead to pressure on net income growth and profitability. (Operating margins)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₹69.316 for IDFC First Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹85.0, and the most bearish reporting a price target of just ₹49.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₹443.8 billion, earnings will come to ₹74.7 billion, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 14.0%.

- Given the current share price of ₹64.89, the analyst price target of ₹69.32 is 6.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.