Key Takeaways

- Integration of new businesses and focus on premium, advanced plastics are set to drive higher margins, accelerated growth, and increased per-vehicle content.

- Expansion into EV-agnostic tech, aftermarket, and international markets positions Lumax for industry-leading growth, improved pricing power, and less cyclical, higher-quality earnings.

- Shifts in vehicle technology, reliance on few customers, rising competition, and sustainability trends threaten Lumax's revenue, margins, and financial flexibility.

Catalysts

About Lumax Auto Technologies- Manufactures and sells in automotive components in India.

- While analyst consensus expects integration of Greenfuel Energy Solutions to incrementally drive revenue and margins, the exceptionally strong initial margin profile (22 percent EBITDA) and growing industry shift to alternate fuels suggest this segment could quickly exceed current revenue projections and become a disproportionately large driver of group-level margin and earnings expansion within 2 to 3 years.

- Analysts broadly agree premiumization and advanced plastics will lift revenue and margins, but the company's 53 percent quarterly and 27 percent annual growth in advanced plastics, sustained by a robust ₹750 crore order book and rising BEV and feature-rich vehicle launches, points to the possibility of a step-change in per-vehicle content and an accelerated trajectory for both topline and net profit.

- The trajectory of technological adoption in India-especially rapid electrification and growing regulatory pressure for cleaner, connected, and safer vehicles-positions Lumax's diversified and expanding suite of EV-agnostic, ADAS, telematics, and sensor offerings to outpace both industry and peer growth, enabling sustained high-value order wins that are positive for long-term revenue and margin expansion.

- Recent acquisitions and the completion of full ownership in IAC, combined with an explicit six-year roadmap (BRIDGE) to transition Lumax from a Tier-1 supplier to a Tier-0.5 systems integrator with integrated design and HMI/telematics capabilities, signal a structural leap in addressable market and pricing power that could result in a much higher sustained return on capital employed and operating leverage over the coming cycle.

- The company's aggressive long-term plan to ramp up aftermarket and international portfolio-supported by three new strategic product launches targeting 2-wheelers, 4-wheelers, and commercial vehicles domestically, and the planned roll-out of 22 HMI products through global JV partners-sets the stage for a step change in earnings quality and diversified revenue streams that are less cyclical and command higher net margins.

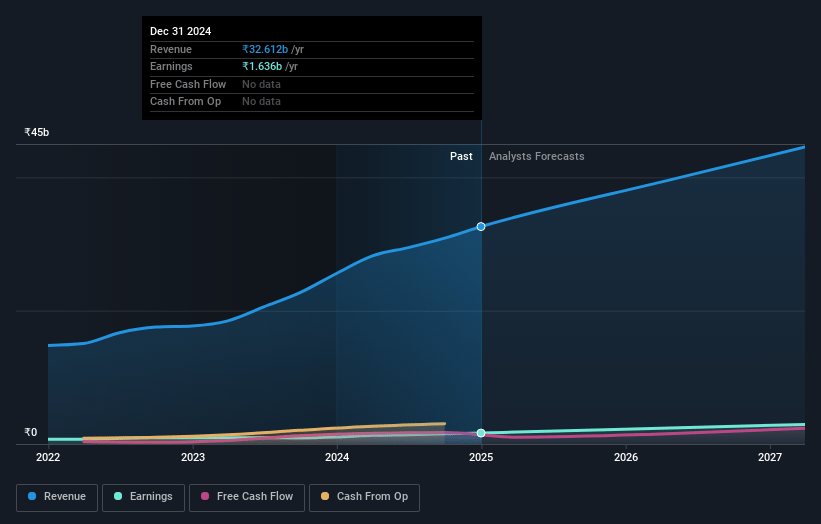

Lumax Auto Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lumax Auto Technologies compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lumax Auto Technologies's revenue will grow by 20.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.9% today to 8.5% in 3 years time.

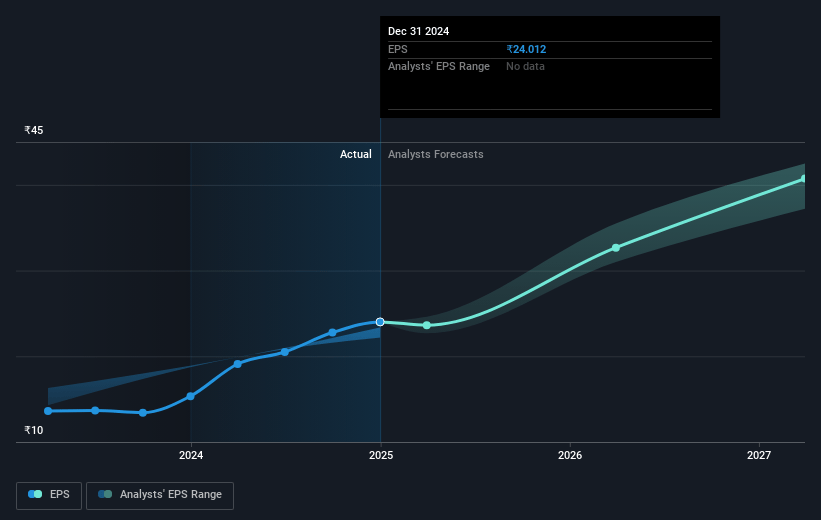

- The bullish analysts expect earnings to reach ₹5.4 billion (and earnings per share of ₹79.41) by about July 2028, up from ₹1.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 43.7x today. This future PE is lower than the current PE for the IN Auto Components industry at 31.8x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.14%, as per the Simply Wall St company report.

Lumax Auto Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating adoption of electric vehicles globally threatens Lumax's core business in traditional auto components like lighting systems and plastic interiors, leading to the risk of shrinking addressable markets and a potential drag on future revenues and earnings growth.

- Heavy dependence on a limited number of OEMs, such as the high concentration of IAC's business with Mahindra & Mahindra and relatively slow customer diversification, exposes Lumax to contract or procurement risks that may cause revenue instability if key OEM relationships weaken or shift procurement policies.

- The auto-component sector is facing increasing global competition, commoditization, and growing bargaining power from OEMs, which could drive pricing pressure and squeeze Lumax's already moderate net margins and future earnings.

- The industry shift towards sustainability, circular economy, and longer vehicle replacement cycles threatens volume growth by encouraging manufacturers and consumers to reuse parts, which may negatively impact Lumax's topline and slow expansion in its aftermarket revenues.

- Ongoing high capital expenditure and working capital requirements to keep pace with rapid technology evolution in lighting, mechatronics, and connected vehicle solutions may constrain Lumax's free cash flows and profitability, increasing financial strain if margin expansion does not keep up with these investments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lumax Auto Technologies is ₹1375.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lumax Auto Technologies's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1375.0, and the most bearish reporting a price target of just ₹767.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹64.0 billion, earnings will come to ₹5.4 billion, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹1140.9, the bullish analyst price target of ₹1375.0 is 17.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.