Key Takeaways

- Looming technology shifts and regulatory pressures threaten legacy product relevance, compressing margins and endangering future earnings unless Lumax pivots quickly to advanced electronics and compliance.

- High dependence on a few major OEMs and global supply chain risks expose Lumax to revenue concentration challenges, potential procurement issues, and constrained cash flow.

- Strategic expansion into clean mobility, premiumization, and automotive technology positions Lumax for sustained growth, improved margins, and financial stability.

Catalysts

About Lumax Auto Technologies- Manufactures and sells in automotive components in India.

- The accelerating push by global and domestic auto OEMs towards electric vehicles, alternative drivetrains, and next-generation connected vehicle technologies could render many of Lumax Auto Technologies' legacy automotive components obsolete, threatening the company's medium-term revenue growth and severely challenging its ability to maintain market share as the composition of vehicles rapidly changes.

- Ongoing localization drive by major OEMs, coupled with rising global trade protectionism, puts at risk Lumax's access to export markets and exposes the company to supply chain disruptions; this could result in stagnant or reduced revenues while simultaneously adding to procurement and compliance costs and constraining free cash flow.

- The company's high reliance on a few large OEM customers, such as Maruti Suzuki and Mahindra & Mahindra, creates significant revenue concentration risk; any slowdown, renegotiation, or shift in purchasing policy by these key clients could cause a disproportionate impact on top-line growth and earnings stability.

- As automotive electronics and ADAS integration accelerates in India and globally, tier-1 suppliers with proprietary R&D, robust electronic IP, and deep technology partnerships are best positioned to win new business; Lumax's slower pivot to advanced electronics and software-defined vehicle solutions, combined with legacy-heavy manufacturing infrastructure, threatens to compress margins and erode future earnings.

- Increasing regulatory, capital expenditure, and ESG compliance requirements-especially as emission norms tighten and safety standards evolve-are likely to drive up operating costs and depress net profit margins if Lumax cannot quickly adapt supply chains and upgrade technology, intensifying pressure on return on capital employed over the next business cycle.

Lumax Auto Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lumax Auto Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lumax Auto Technologies's revenue will grow by 10.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.9% today to 9.9% in 3 years time.

- The bearish analysts expect earnings to reach ₹4.8 billion (and earnings per share of ₹70.89) by about July 2028, up from ₹1.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 43.7x today. This future PE is lower than the current PE for the IN Auto Components industry at 31.8x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 14.14%, as per the Simply Wall St company report.

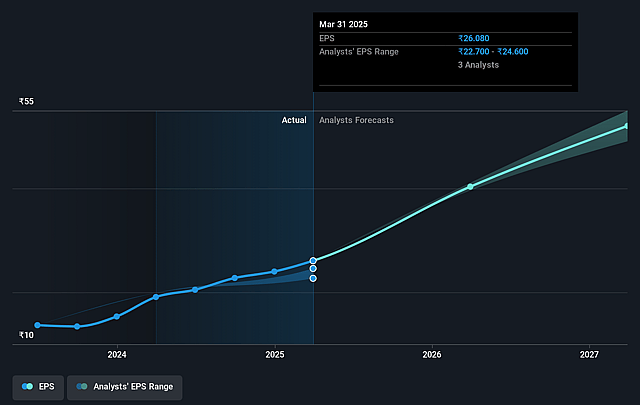

Lumax Auto Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's robust and diversified order book of ₹1,300 crores, including substantial exposure to high-growth segments like BEVs (battery electric vehicles) and advanced plastics, enhances revenue visibility and provides a strong base for top-line growth over the next three years.

- Strategic acquisitions such as Greenfuel Energy Solutions, along with the 100% control of IAC India, position Lumax as an integrated Tier 0.5 supplier with scalable operations in clean mobility, sustaining both revenue growth and potential margin expansion.

- Ongoing premiumization trends among passenger and commercial vehicles, coupled with increasing content per vehicle (especially for BEV models), are likely to lift average selling prices and support EBIT and EBITDA margin improvements.

- Continuous investments in innovation, the software-defined vehicle vertical, and the expansion of ADAS and HMI product lines via JVs like Alps Alpine and Yokowo, align the company with long-term automotive technology trends and should drive higher revenue and earnings quality.

- Healthy financials, including stable EBITDA margin, a manageable debt-to-equity ratio near 0.5, and strong free cash reserves, provide the company with ample capacity to invest for future growth, sustain dividend payouts, and deliver steady net profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lumax Auto Technologies is ₹767.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lumax Auto Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹1375.0, and the most bearish reporting a price target of just ₹767.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹48.6 billion, earnings will come to ₹4.8 billion, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 14.1%.

- Given the current share price of ₹1140.9, the bearish analyst price target of ₹767.0 is 48.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.