Key Takeaways

- Rapid export expansion and premium global contracts with major OEMs are set to structurally elevate both growth and profitability.

- Leadership in affordable EV and hybrid systems, aligned with regulatory shifts and Make in India, ensures high-margin, scalable, and resilient future earnings.

- Heavy reliance on traditional products and key clients, slow EV adaptation, and rising competition threaten profit margins and long-term growth prospects.

Catalysts

About Divgi TorqTransfer Systems- Engages in the manufacture and sale of transfer cases, automatic locking hubs, and synchronizers and components to automotive OEMs in India, the United States, China, Mexico, the United Kingdom, Germany, Sweden, Thailand, South Korea, and internationally.

- Analysts broadly agree that expanding into international markets will boost revenue, but this may be significantly understated given Divgi's rapidly accelerating export approvals and deepening relationships with Japanese, Korean, and American OEMs, which could make exports contribute well above a double-digit share of revenue and structurally raise both top-line growth and average realized margins due to premium global contracts.

- Analyst consensus projects a strong uplift from the widening EV transmission portfolio and new model wins from FY '26, but this could drive a more dramatic inflection point since Divgi is uniquely positioned to dominate the affordable EV and hybrid segments across multiple OEMs, with scalability into both Indian and international vehicle markets, leading to exponential revenue growth and margin expansion.

- Divgi's progression into next-generation hybrid and automatic transmission systems aligns perfectly with upcoming emission regulations and the global shift to electrification, enabling the company to capture high-value, next-gen drivetrain contracts ahead of competitors, ensuring multi-year, high-margin earnings streams as regulatory compliance pressures rise.

- The strengthening "Make in India" policy push, together with consolidation among global Tier-1 suppliers, positions Divgi to increasingly become the supplier of choice for both domestic and global OEMs, significantly enhancing pricing power, order volumes, and margin resilience as dependency on imports wanes.

- Divgi's unmatched track record of quality-demonstrated by zero-defect export shipments and industry-best PPM metrics-creates a powerful competitive moat, fostering deep customer stickiness with leading OEMs and enabling premium pricing, which should directly translate to sustainably higher net profit margins over time.

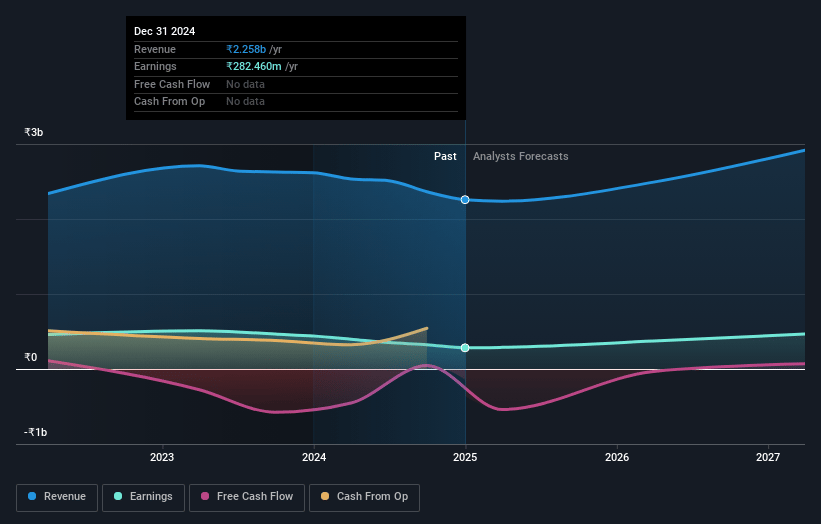

Divgi TorqTransfer Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Divgi TorqTransfer Systems compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Divgi TorqTransfer Systems's revenue will grow by 19.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 11.1% today to 22.0% in 3 years time.

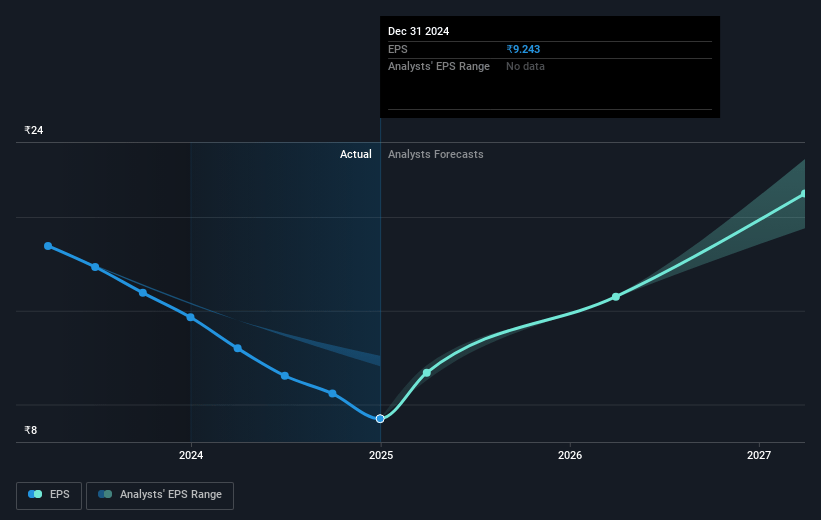

- The bullish analysts expect earnings to reach ₹819.5 million (and earnings per share of ₹26.77) by about July 2028, up from ₹243.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.9x on those 2028 earnings, down from 78.7x today. This future PE is greater than the current PE for the IN Auto Components industry at 31.5x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.77%, as per the Simply Wall St company report.

Divgi TorqTransfer Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Divgi's core business remains heavily concentrated in traditional transfer cases and transmission systems, which are increasingly threatened by the global shift towards electric vehicles and electrification, leading to a shrinking long-term market and putting sustained revenue growth at risk.

- Overdependence on a small set of domestic OEMs, primarily Mahindra and Tata, exposes Divgi to significant client concentration risk; any downturn, loss, or renegotiation of contracts with these clients could directly and materially impact its top line and earnings visibility.

- While the company is investing in next-generation and EV-hybrid technologies, its transition appears gradual and could lag behind the auto industry's rapid pivot to software-driven, EV-centric platforms, potentially eroding margins as its existing high-margin products risk obsolescence.

- Intensifying competition from global Tier-1 component suppliers, as well as increasing vertical integration by OEMs developing in-house EV powertrain solutions, threatens Divgi's pricing power and export growth aspirations, pressuring both margins and export-related revenue streams.

- Substantial capital expenditures on R&D, capacity, and global expansion, ahead of visible, sustained topline growth, have already translated into higher depreciation and declining returns on capital employed; if execution falls short or market transitions outpace company adaptation, earnings and return on equity could remain muted.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Divgi TorqTransfer Systems is ₹610.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Divgi TorqTransfer Systems's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹610.0, and the most bearish reporting a price target of just ₹408.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ₹3.7 billion, earnings will come to ₹819.5 million, and it would be trading on a PE ratio of 32.9x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹627.8, the bullish analyst price target of ₹610.0 is 2.9% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.