Key Takeaways

- Lack of diversification in both products and customers exposes the company to significant risks from industry shifts and changing client strategies.

- Slow adaptation to electric vehicle technologies and global market disruptions threatens revenue stability and long-term competitiveness.

- Diversification into EV and global markets, strong OEM partnerships, and investments in capacity and innovation position the company for growth, resilience, and improved margins.

Catalysts

About Divgi TorqTransfer Systems- Engages in the manufacture and sale of transfer cases, automatic locking hubs, and synchronizers and components to automotive OEMs in India, the United States, China, Mexico, the United Kingdom, Germany, Sweden, Thailand, South Korea, and internationally.

- The accelerating global transition to electric and hybrid vehicles threatens to erode long-term demand for traditional transmission and 4WD/AWD systems, in which Divgi TorqTransfer Systems maintains significant expertise and product concentration; this structural shift is likely to constrain revenue growth in mature markets and expose the company to obsolescence risk as electrification outpaces its current portfolio evolution.

- Heavy reliance on a few large customers, especially Tata Motors and Mahindra & Mahindra, makes the company highly vulnerable to strategic pivots by these OEMs, such as in-sourcing, technology shifts, or reduced orders; this revenue concentration can magnify earnings volatility and weaken pricing power even as automotive OEMs seek to localize and develop key components internally.

- The company lags global peers in meaningful penetration of next-generation EV drivetrain and hybrid systems, with only early-stage developments and limited commercial deployments; this delay threatens long-term market share, creates a risk of missed growth opportunities as new vehicle platforms emerge, and could result in persistent underperformance versus industry peers, affecting both revenue and earnings trajectories.

- Ongoing geo-political volatility and rising protectionist measures-particularly in major export markets like the United States-introduce significant uncertainty around future order flows, tariff regimes, and cost structures for Indian automotive component exporters like Divgi; such risks could lead to lower export revenues, reduced profitability, and higher operating expenses if trade disruptions persist or worsen.

- High capital expenditure requirements to modernize facilities, redirect R&D for electrification, and scale export capacity may squeeze free cash flow and pressure net margins in the medium term, especially if demand for legacy products continues to fall faster than the ramp-up in new business offsets; this imbalance risks causing prolonged weakness in ROI, lower EPS growth, and diminished shareholder returns.

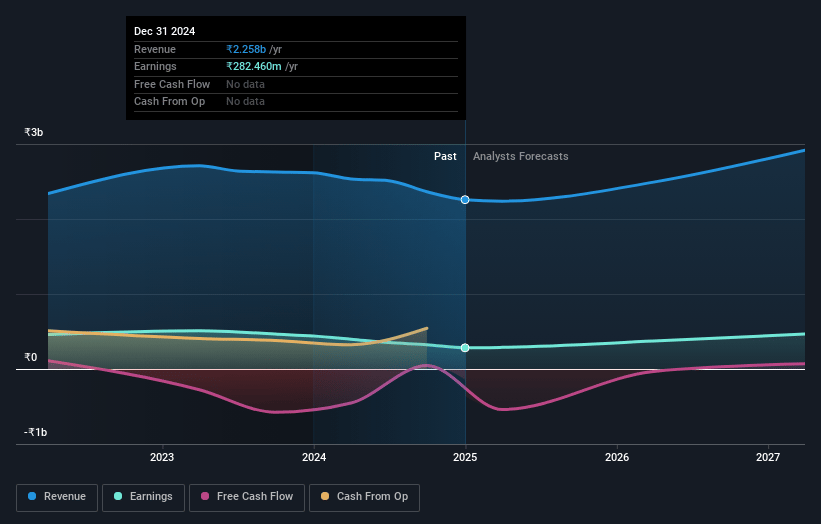

Divgi TorqTransfer Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Divgi TorqTransfer Systems compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Divgi TorqTransfer Systems's revenue will grow by 14.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 11.1% today to 18.8% in 3 years time.

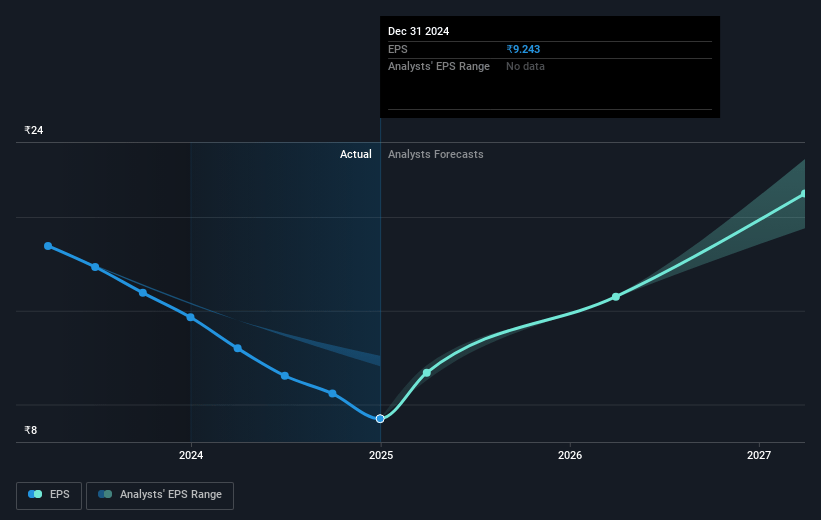

- The bearish analysts expect earnings to reach ₹620.7 million (and earnings per share of ₹20.29) by about July 2028, up from ₹243.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.0x on those 2028 earnings, down from 78.5x today. This future PE is lower than the current PE for the IN Auto Components industry at 32.3x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.76%, as per the Simply Wall St company report.

Divgi TorqTransfer Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's strategic expansion into electric vehicle (EV) and hybrid powertrain products, along with active participation in next-generation transmission solutions for both Indian and global markets, positions Divgi to benefit from the long-term shift toward electrification and stricter emission norms, potentially driving sustained growth in revenue and higher future margins.

- Robust global OEM relationships and new customer acquisition-including significant collaborations with leading Japanese, Korean, European, and American automakers-offer strong visibility for continued order inflow and export growth, which can improve both top-line revenue and earnings resilience even if domestic volumes remain volatile.

- Divgi is successfully penetrating export markets, with a substantial ramp-up in export revenues forecast for FY '26 and multi-country approvals underway; the company aims for double-digit export contributions to total revenues by year-end, increasing its addressable market and diversification, which can bolster overall revenue and mitigate country-specific downturns.

- Recent significant investments in manufacturing capacity, automation, and operational excellence (including quality recognitions from Toyota and Mahindra) are enhancing productivity, cost efficiency, and scalability, which can improve operational leverage and expand net and EBITDA margins as volumes recover.

- Ongoing innovation, localization, and in-house development of advanced transmission systems-including dedicated hybrid and automatic solutions-strengthen Divgi's ability to capture value in increasingly complex vehicle platforms and meet regulatory demands, supporting future revenue streams and protecting against technology obsolescence-related margin risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Divgi TorqTransfer Systems is ₹408.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Divgi TorqTransfer Systems's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ₹610.0, and the most bearish reporting a price target of just ₹408.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ₹3.3 billion, earnings will come to ₹620.7 million, and it would be trading on a PE ratio of 29.0x, assuming you use a discount rate of 13.8%.

- Given the current share price of ₹625.8, the bearish analyst price target of ₹408.0 is 53.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.