Key Takeaways

- Strategic fleet flexibility and a dual-brand approach position Cathay Pacific to surpass competitors in capturing rising Asia-Pacific travel and e-commerce cargo demand.

- Ongoing fleet modernization and digital investments will cut operating costs, driving industry-leading efficiency and stronger margins over the long term.

- Continued operational constraints, yield pressures, and exposure to cargo volatility threaten Cathay Pacific's revenue growth, cost control, and competitive position amid industry-wide supply challenges.

Catalysts

About Cathay Pacific Airways- Offers international passenger and air cargo transportation services.

- While analyst consensus expects capacity expansion to drive moderate revenue growth, this view underestimates the company's built-in flexibility around aircraft retirements and lease extensions, which enables Cathay Pacific to aggressively capture burgeoning Asia-Pacific travel demand and outpace competitors with limited delivery schedules, leading to above-consensus uplift in both ASK and top line revenues.

- Although analysts broadly agree e-commerce cargo growth favors Cathay, the actual structural shift toward cross-border parcel movement via Hong Kong positions Cathay Cargo to become the preeminent regional consolidator for global e-commerce fulfillment, potentially resulting in sustained double-digit revenue and profit growth as e-commerce volumes as a proportion of exports continue to rise.

- Cathay's dual-brand strategy, combined with the resurgence of Hong Kong as a key international aviation hub post-pandemic, uniquely positions the company to reclaim, and even exceed, its pre-pandemic international and premium market share, directly supporting higher passenger yields and enabling net margin expansion ahead of industry peers.

- Continued economic integration and rising affluence in the Greater Bay Area will make Cathay Pacific a primary beneficiary of secular increases in both business and leisure travel-translating to structurally higher load factors and resilient RASK growth over the long term.

- The company's accelerating roll-out of next-generation, fuel-efficient aircraft and investments in digital operational excellence will drive industry-leading reductions in operating costs, supporting major efficiency gains and persistent net margin improvements as both maintenance and fuel expenses decline over the next decade.

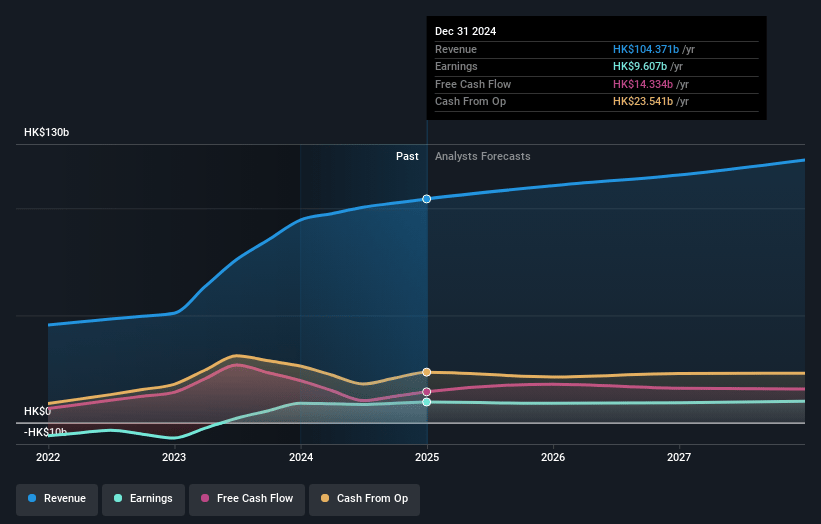

Cathay Pacific Airways Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Cathay Pacific Airways compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Cathay Pacific Airways's revenue will grow by 10.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 9.2% today to 9.5% in 3 years time.

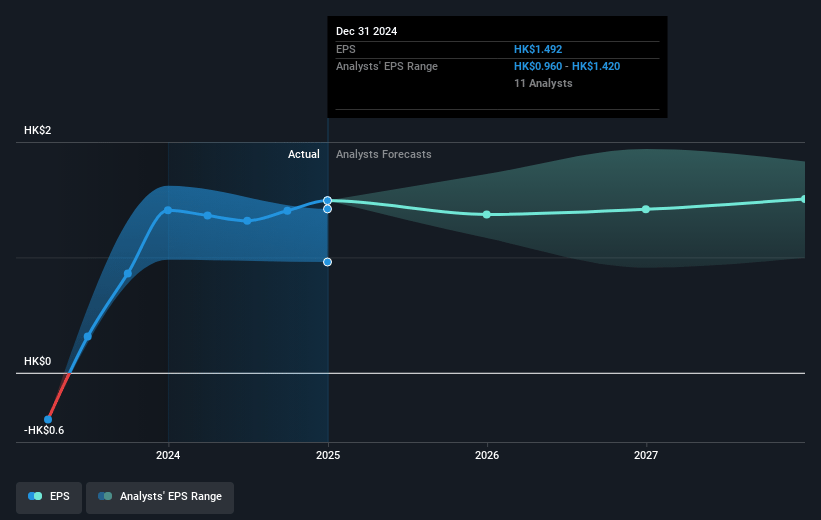

- The bullish analysts expect earnings to reach HK$13.4 billion (and earnings per share of HK$1.87) by about July 2028, up from HK$9.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, up from 7.9x today. This future PE is greater than the current PE for the HK Airlines industry at 7.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Cathay Pacific Airways Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing delays in new aircraft deliveries and persistent engine reliability issues have constrained Cathay Pacific's capacity growth and increased maintenance disruptions, potentially leading to higher costs and limiting future revenue expansion.

- Passenger yields are in a clear normalization trend, with significant declines reported across both long-haul and regional routes, and further declines expected as capacity grows and competition intensifies, which could place sustained pressure on revenue and earnings.

- The uncertain cargo outlook, especially given Hong Kong's exposure as a major air freight hub and the heavy reliance on volatile e-commerce exports, increases the risk of future volatility or downturns in cargo-driven revenues.

- Cathay Pacific's fuel efficiency worsened year-on-year due to an increased share of less efficient aircraft types in active service, making the airline more vulnerable to long-term industry trends of rising fuel costs and carbon regulations, which may erode net margins.

- Industry-wide supply chain constraints affecting aircraft retrofits, maintenance, and new deliveries may persist for several years, hindering Cathay Pacific's ability to upgrade its fleet and keep costs competitive, thereby limiting earnings improvement and market share retention.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Cathay Pacific Airways is HK$13.05, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cathay Pacific Airways's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$13.05, and the most bearish reporting a price target of just HK$8.1.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be HK$141.0 billion, earnings will come to HK$13.4 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 10.2%.

- Given the current share price of HK$11.8, the bullish analyst price target of HK$13.05 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.