Key Takeaways

- Geopolitical uncertainty, regulatory risks, and Hong Kong's volatility threaten future passenger and cargo revenue as travel and trade patterns shift.

- Rising costs from fleet delays, capacity expansion, and reduced pricing power may compress margins, limiting the company's long-term earnings growth.

- Strong cargo demand, flexible capacity management, and efficiency improvements position the company for revenue growth, while dual-brand strategy targets both premium and low-cost passenger segments.

Catalysts

About Cathay Pacific Airways- Offers international passenger and air cargo transportation services.

- Despite a history of Asia's rising affluence fueling travel demand, increasing geopolitical uncertainty and potential for new international air traffic restrictions could sharply erode future passenger volumes and undermine revenue growth.

- While e-commerce has driven substantial air cargo growth, ongoing regulatory uncertainty-including measures like changes to de minimis rules and unpredictable trade tensions-raises the risk of a structural decline in cargo volumes, threatening top-line cargo revenues.

- The continued normalization and downward pressure on passenger yields, especially as both Cathay Pacific and competitors add capacity, diminishes pricing power and will likely result in reduced revenue and compressed earnings in the coming years.

- Delays in fleet modernization, persistent engine reliability issues, and reliance on less fuel-efficient aircraft are set to raise maintenance and fuel costs, putting ongoing downward pressure on net margins and limiting long-term earnings growth.

- With Hong Kong's status as a global hub subject to political and economic volatility-and Cathay Pacific's heavy dependence on its continued viability-the company faces a material risk of prolonged stagnation or decline in route profitability and overall revenue base.

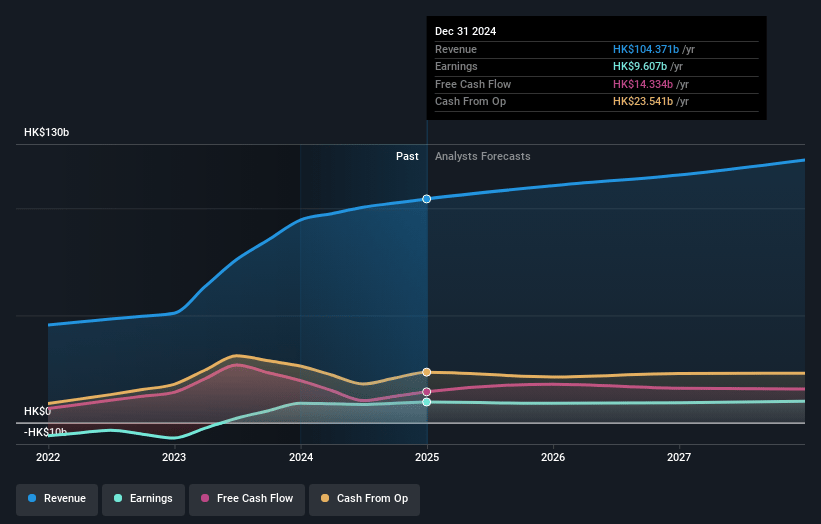

Cathay Pacific Airways Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cathay Pacific Airways compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cathay Pacific Airways's revenue will grow by 4.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 9.2% today to 5.5% in 3 years time.

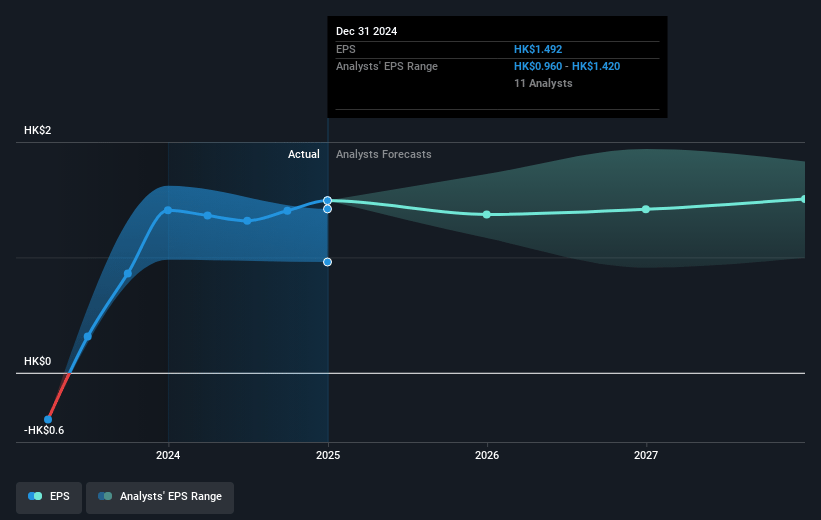

- The bearish analysts expect earnings to reach HK$6.5 billion (and earnings per share of HK$1.0) by about July 2028, down from HK$9.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, up from 7.9x today. This future PE is greater than the current PE for the HK Airlines industry at 8.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.29%, as per the Simply Wall St company report.

Cathay Pacific Airways Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing growth in e-commerce is driving a significant proportion of Hong Kong air cargo exports, and as one of the main cargo carriers in the region, Cathay Pacific is well positioned to benefit from sustained or expanding air freight demand, which may support higher revenues and improved operating profits over the long term.

- Despite supply chain challenges and aircraft delivery delays, the company has maintained flexibility in its capacity planning through aircraft lease extensions and retirement adjustments, reducing the risk of significant negative impacts on available seat capacity and preserving revenue streams.

- Management is confident in the dual-brand strategy, with HK Express targeting the high-growth low-cost carrier segment in Hong Kong and the Greater Bay Area, suggesting potential for passenger volume growth and eventual restored profitability for that subsidiary, which could bolster group earnings in future years.

- The normalization of passenger yields is viewed by management as an expected and manageable trend, while strong passenger growth and rising load factors indicate that aggregate revenues could remain robust even if per-passenger pricing decreases, especially as travel demand continues to recover.

- Continued improvements in aircraft utilization and reductions in unit cost for both Cathay Pacific and HK Express suggest further efficiency gains, which can help offset yield declines, support stronger net margins, and enhance bottom-line earnings as capacity grows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cathay Pacific Airways is HK$8.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cathay Pacific Airways's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$13.05, and the most bearish reporting a price target of just HK$8.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be HK$117.7 billion, earnings will come to HK$6.5 billion, and it would be trading on a PE ratio of 10.8x, assuming you use a discount rate of 10.3%.

- Given the current share price of HK$11.8, the bearish analyst price target of HK$8.1 is 45.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.