Last Update 04 Dec 25

Fair value Increased 9.95%3393: Subsidiary Tender Wins Will Support Steady Outlook Ahead

Analysts have raised their price target for Wasion Holdings from CNY 13.25 to CNY 14.57, citing slightly higher long term revenue growth expectations and a modestly higher future earnings multiple that more than offset a small downward revision to profit margins.

What's in the News

- Wasion Group Limited, a subsidiary of Wasion Holdings, secured contracts worth approximately RMB201.16 million in China Southern Power Grid's first 2025 framework tender for metering equipment (company announcement)

- Willfar Information Technology Company Limited, another subsidiary of Wasion Holdings, won additional contracts worth approximately RMB168.97 million in the same 2025 framework tender (company announcement)

- Wasion Holdings ranked first by total contract value in China Southern Power Grid's first 2025 metering equipment framework tender, reinforcing its leading position in the smart metering market (company announcement)

Valuation Changes

- The fair value estimate has risen moderately from CNY 13.25 to CNY 14.57 per share, reflecting a higher intrinsic value assessment for Wasion Holdings.

- The discount rate has increased marginally from 9.09 percent to 9.10 percent, implying a slightly higher required return applied in the valuation model.

- Revenue growth has risen slightly from 19.40 percent to 20.99 percent, indicating a modestly more optimistic view of long-term top line expansion.

- The net profit margin has edged down from 10.52 percent to 10.16 percent, reflecting a small reduction in expected profitability levels.

- The future P/E has increased from 9.32x to 10.15x, signaling a modest rerating in the valuation multiple applied to Wasion Holdings’ future earnings.

Key Takeaways

- Rapid global expansion and strong partnerships in emerging sectors are driving Wasion's revenue diversification and positioning it for sustained international and recurring earnings growth.

- Technological innovation, operational efficiency, and alignment with green energy trends enable Wasion to move up the value chain and support stable profit margins.

- Intensifying competition, technological shifts, and rising regulatory risks threaten margins, revenue stability, and overseas growth while demanding higher investment amid mounting operational uncertainties.

Catalysts

About Wasion Holdings- An investment holding company, engages in the research and development, production, and sale of energy metering and energy efficiency management solutions for energy supply industries.

- Wasion is experiencing strong overseas expansion, with factories in Indonesia, Malaysia, and Hungary now operational; major new contracts in regions like Mexico, Tanzania, and the Middle East point to sustained international growth, benefiting from rising global urbanization and electricity consumption-likely to drive top-line revenue increases and improved revenue diversification.

- Ongoing modernization and digitalization of power grids worldwide-including AMI 2.0 replacement cycles in the US and Europe, and new policy mandates for decarbonization and grid transformation in China-put Wasion in a favorable position to capture long-term demand for advanced metering and grid-automation products, directly supporting revenue and earnings growth.

- The shift toward green energy, energy storage, and electrification (including data centers and electric mobility) aligns with government and regulatory pushes for decarbonization; Wasion's new partnerships (e.g., GDS, DayOne, ByteDance) and record orders in these sectors are likely to provide sustained margin expansion and recurring revenue streams.

- Aggressive investment in R&D (7.2% of 2025 operating income) and successful rollouts of new technologies (e.g., carbon metering, AI-powered IoT solutions, liquid cooling systems) enable Wasion to move up the value chain, introduce higher-margin products, and maintain competitiveness, which can enhance net profit margins in the medium-to-long term.

- Robust cost control measures, automation, and vertical integration strategies have kept gross profit margins stable despite competitive and downward pricing pressures in China, signaling potential for continued improvement in operational efficiency and resulting in enhanced earnings and profit growth.

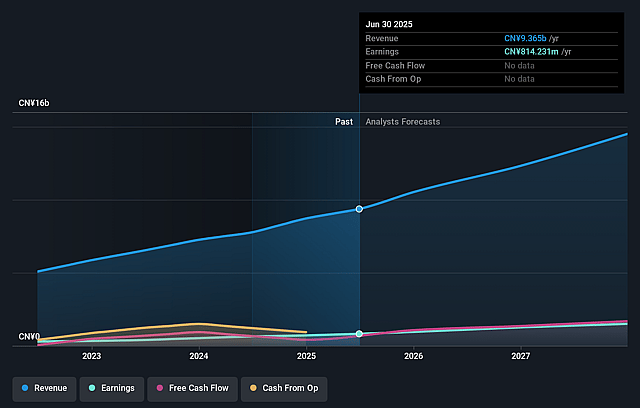

Wasion Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wasion Holdings's revenue will grow by 18.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 10.9% in 3 years time.

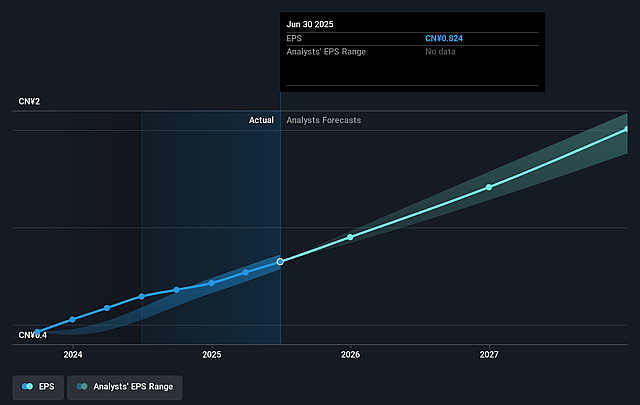

- Analysts expect earnings to reach CN¥1.7 billion (and earnings per share of CN¥1.5) by about September 2028, up from CN¥814.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, down from 12.4x today. This future PE is lower than the current PE for the HK Electronic industry at 12.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.95%, as per the Simply Wall St company report.

Wasion Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying price competition and commoditization in both domestic and overseas smart meter markets-highlighted by executives noting tender price drops and fierce battles with other Chinese companies-could compress gross margins and limit long-term profitability growth.

- Rising customer concentration risk, especially dependence on large centralized tenders from China State Grid and Southern Grid, generates earnings volatility if major contracts are lost or procurement schedules change, directly impacting annual revenue stability.

- Rapid technological evolution towards software-based, interoperable digital solutions and integrated smart grids could reduce demand for traditional or proprietary metering hardware, risking product obsolescence and potentially shrinking Wasion's addressable market over time, impacting future revenue streams.

- Heightened geopolitical and regulatory risks-including localization requirements, potential trade tensions between China and Western countries, and global ESG pressures-may restrict Wasion's access to international markets, increase compliance costs, and limit anticipated overseas revenue and margin expansion.

- Escalating R&D and capital expenditures required to maintain technology leadership and global expansion, coupled with the risk of delayed certification or slower-than-expected ramp-up at new overseas factories, could pressure cash flow and earnings growth if revenue conversion lags investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$12.211 for Wasion Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$14.99, and the most bearish reporting a price target of just HK$11.03.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥15.7 billion, earnings will come to CN¥1.7 billion, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of HK$11.04, the analyst price target of HK$12.21 is 9.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Wasion Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.