Key Takeaways

- Escalating geopolitical risks, regulatory demands, and customer concentration expose ASMPT to profit volatility and threaten long-term revenue stability.

- Rising automation and competition, plus uncertain R&D returns, risk eroding ASMPT's market leadership, margin profile, and future shareholder value.

- Strong technology leadership, customer diversification, and investments in innovation position ASMPT to capitalize on rising advanced packaging demand and drive future revenue and margin growth.

Catalysts

About ASMPT- An investment holding company, engages in the design, manufacture, and marketing of machines, tools, and materials used in the semiconductor and electronics assembly industries internationally.

- The risk of escalating geopolitical tensions and more aggressive export controls could restrict ASMPT's access to key international customers, potentially capping topline revenue growth from high-margin regions and reducing long-term earnings power.

- Increasing regulatory requirements around environmental compliance and carbon reduction may force ASMPT to incur higher operating and capital expenditures, directly eroding net margins and putting downward pressure on long-term profitability.

- Rapid automation and rising competition from vertically integrated, fully automated rivals threaten to undermine ASMPT's differentiation, potentially accelerating market share loss and future revenue declines as the industry standardizes solutions.

- ASMPT remains highly exposed to customer concentration risk, with large bulk orders driving volatility in both revenues and profits; any loss or scaling back of orders from a major HBM or logic customer could trigger significant and lasting drops in both revenue and operating earnings.

- Persistent high spending on R&D without clear, consistent returns-especially if ASMPT's advanced packaging tools fail to maintain technological leadership as next-generation standards evolve-could compress net margins and lead to weakened shareholder returns as the ROIC profile drops below peers.

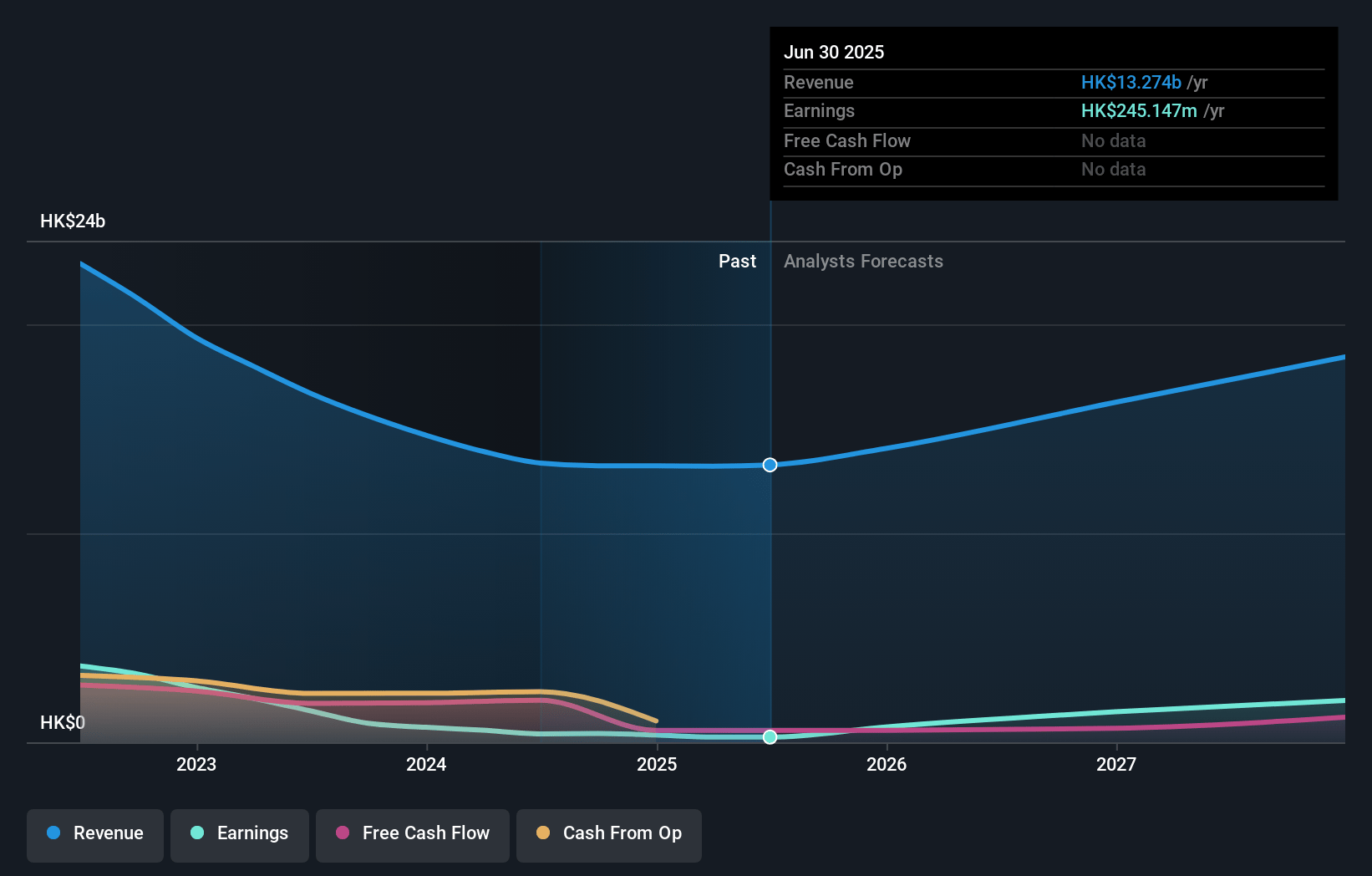

ASMPT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on ASMPT compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming ASMPT's revenue will grow by 8.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.9% today to 10.3% in 3 years time.

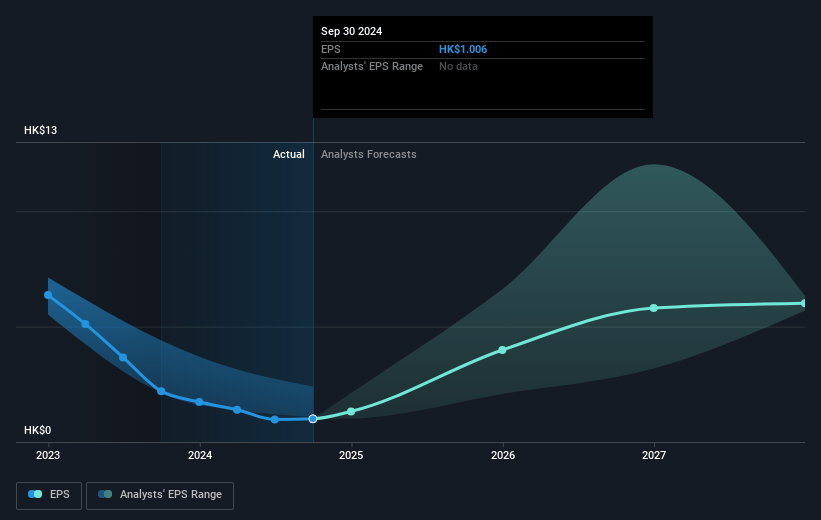

- The bearish analysts expect earnings to reach HK$1.8 billion (and earnings per share of HK$4.22) by about July 2028, up from HK$249.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.0x on those 2028 earnings, down from 96.2x today. This future PE is lower than the current PE for the HK Semiconductor industry at 23.8x.

- Analysts expect the number of shares outstanding to grow by 0.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.82%, as per the Simply Wall St company report.

ASMPT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ASMPT's leadership in advanced packaging and proven technological capabilities, particularly with TCB tools for HBM3E and early HBM4 production, position the company to benefit from surging demand in AI, memory, and high-performance computing, likely supporting order inflows and revenue growth in coming years.

- Despite near-term softness in some segments, the sequential rebound in gross margin above 40%, disciplined cost controls, and rising bookings driven by strategic wins (including new global HBM customers and logic engagements) demonstrate resilience and potential for margin expansion and improved profitability.

- Securing a foothold with multiple major global memory and logic chipmakers, including repeat and pilot production orders, increases ASMPT's customer diversification and heightens its ability to capture a rising share of the growing semiconductor packaging and assembly market, supporting revenue and earnings stability over the long term.

- The company's investments in automation, R&D, and next-generation packaging (such as hybrid bonding and fluxless TCB), as well as cost discipline and scalable production, are building operational leverage that can improve net margins and make earnings more resilient throughout industry cycles.

- Secular industry trends including AI proliferation, growth in data centers, cloud infrastructure, and the miniaturization and complexity of chips are structural tailwinds for advanced packaging demand; ASMPT's technology leadership and product portfolio position it to capture these trends and drive top-line and bottom-line expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for ASMPT is HK$56.6, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of ASMPT's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$100.0, and the most bearish reporting a price target of just HK$56.6.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be HK$17.0 billion, earnings will come to HK$1.8 billion, and it would be trading on a PE ratio of 18.0x, assuming you use a discount rate of 9.8%.

- Given the current share price of HK$57.5, the bearish analyst price target of HK$56.6 is 1.6% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.