Key Takeaways

- Expansion in Indonesia and Bangladesh, plus deeper partnerships with major brands, strengthens revenue growth, profit visibility, and margins through enhanced scale and stickier contracts.

- Focus on automation, sustainability, and resolving ramp-up issues supports operational efficiency, labor cost control, and future profitability amid rising demand for premium products.

- Margin pressures, client concentration risk, and rising competition threaten Stella's profitability and growth, while expansion efforts introduce further execution and operational risks.

Catalysts

About Stella International Holdings- An investment holding company, engages in development, manufacture, and sale of footwear products and leather goods in North America, the People’s Republic of China, Europe, Asia, and internationally.

- Stella's ongoing expansion of manufacturing capacity-adding up to 25 million pairs across Indonesia and Bangladesh with dedicated facilities for top global brands-positions the company to benefit from increasing demand for premium and branded footwear as rising middle-class incomes and consumer upgrading trends continue globally; this is set to drive revenue growth and improve long-term earnings visibility.

- The strengthening of partnerships and deeper integration with leading global sports and luxury brands-including onboarding new customers (e.g., Under Armour, SKYLRK)-supports stickier contracts, pricing power, and high plant utilization; this translates into steadier revenues and enhanced gross margins as strategic brands consolidate suppliers.

- The recently achieved MSCI ESG AA rating and Stella's leadership in sustainable manufacturing make it an increasingly attractive partner amid rising brand and consumer focus on responsible sourcing, which should help Stella win incremental orders and premium pricing, supporting both revenue and margin expansion.

- Margin headwinds experienced in 2025 from temporary operational inefficiencies (ramp-up issues in Indonesia/Philippines) are expected to abate in 2026 as factories reach targeted output and labor productivity normalizes, improving operating profit margin and supporting net profit recovery.

- Continued investment in automation, smart manufacturing, and capacity optimization is expected to boost operational efficiency and productivity, reducing labor cost pressures and supporting long-term margin improvement and profitability.

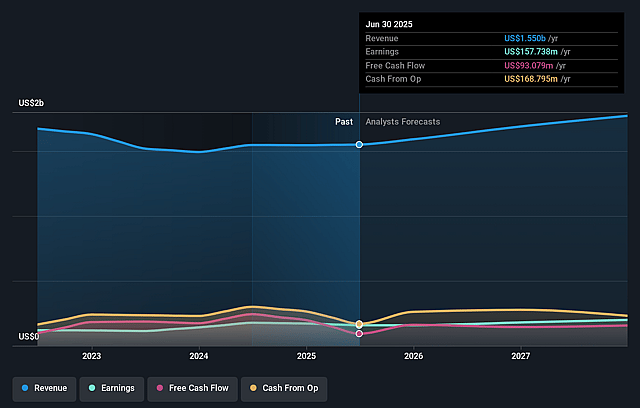

Stella International Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stella International Holdings's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.2% today to 11.3% in 3 years time.

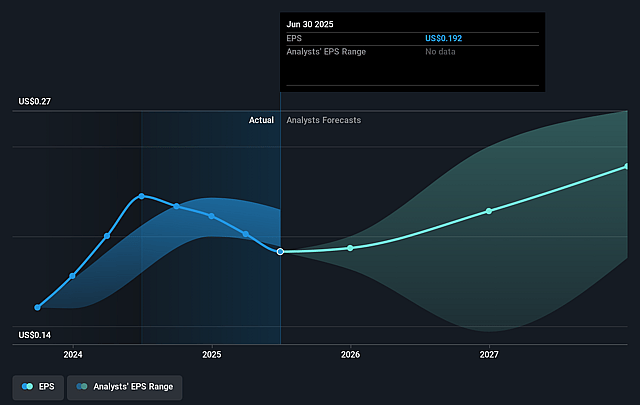

- Analysts expect earnings to reach $205.2 million (and earnings per share of $0.24) by about September 2028, up from $157.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $228 million in earnings, and the most bearish expecting $152.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, up from 10.7x today. This future PE is greater than the current PE for the HK Luxury industry at 10.3x.

- Analysts expect the number of shares outstanding to grow by 0.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.58%, as per the Simply Wall St company report.

Stella International Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising labor and production costs in Indonesia, Philippines, and Vietnam-driven by hiring, training inefficiencies, and the ramp-up of new manufacturing facilities-have led to persistent gross margin compression and lower net margins, threatening the company's long-term profitability trajectory.

- Continued downward pressure on average selling prices (ASP), primarily due to the growing mix of lower-margin sports products, may limit revenue growth and hinder gross margin recovery, especially if the company cannot successfully shift or premiumize its product mix in the coming years.

- Overdependence on a small number of large global sports and luxury brand customers exposes the company to significant client concentration risk; any reduction in major orders, changing sourcing strategies, or contract loss could create revenue and earnings volatility.

- Ongoing investments in capacity expansion-across Indonesia, Bangladesh, and other regions-heighten execution risk; slow or problematic ramp-ups (as seen in recent years) may delay returns on capital, negatively impact short

- to medium-term free cash flow, and increase the risk of operational inefficiencies and lower net profit margins.

- The accelerating shift towards direct-to-consumer and digital-first brands, coupled with rising competitive pressures from lower-cost and/or more technologically advanced manufacturers, threatens Stella's ability to sustain order volumes and pricing power, potentially eroding revenue growth and earnings in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$17.277 for Stella International Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$23.14, and the most bearish reporting a price target of just HK$11.46.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $205.2 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 8.6%.

- Given the current share price of HK$15.78, the analyst price target of HK$17.28 is 8.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Stella International Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.