Catalysts

About Stella International Holdings

Stella International Holdings is a footwear and accessories manufacturer serving leading global sports, luxury and fashion brands.

What are the underlying business or industry changes driving this perspective?

- Planned net capacity additions of 21 million to 26 million pairs across Indonesia and Bangladesh risk outpacing sustainable demand from key sports and luxury customers. This could leave factories underutilized and depress revenue and operating margins over the next three to four years.

- Continued geographic reallocation of production toward Vietnam and Indonesia, driven by shifting tariffs and brand sourcing strategies, increases execution complexity and the chance of repeat ramp-up and training issues. This could structurally cap gross margins and earnings growth.

- Rising labor and overhead costs in diversified manufacturing hubs, combined with mix shift toward lower ASP sports products, suggest that even if volumes grow, unit economics may worsen. This may limit future net margin recovery and dilute profit growth relative to revenue.

- Heavy reliance on a concentrated set of large North American sports brands and new fashion labels exposes the company to any slowdown in innovation-led product cycles. This could stall order growth and lead to chronically lower factory utilization and earnings volatility.

- Expansion into adjacent categories such as handbags and accessory manufacturing requires new craftsmanship capabilities and management bandwidth. If scaling is slower than planned, the additional CapEx and working capital could weigh on free cash flow and depress net profit growth.

Assumptions

This narrative explores a more pessimistic perspective on Stella International Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

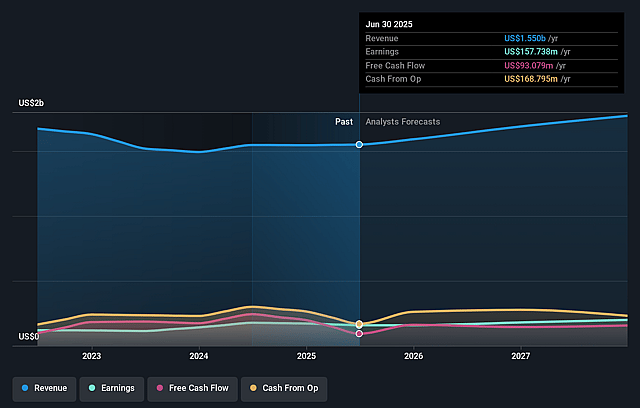

- The bearish analysts are assuming Stella International Holdings's revenue will grow by 4.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 10.2% today to 9.4% in 3 years time.

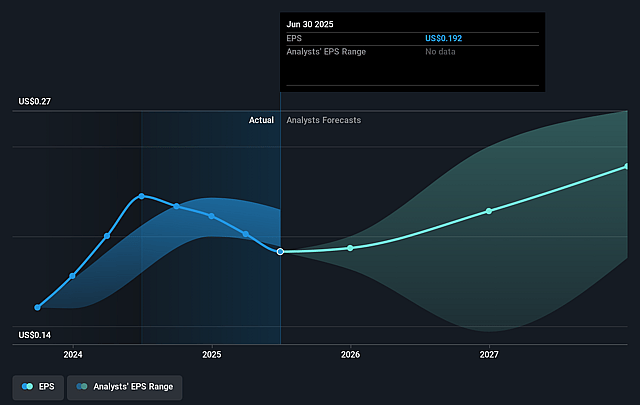

- The bearish analysts expect earnings to reach $165.1 million (and earnings per share of $0.2) by about December 2028, up from $157.7 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $247.3 million.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 10.7x today. This future PE is lower than the current PE for the HK Luxury industry at 10.2x.

- The bearish analysts expect the number of shares outstanding to grow by 1.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Management continues to target and has historically delivered around 10% operating margin, with profit after tax growing at a low-teens compound rate since 2021. This suggests that current efficiency issues in Indonesia and the Philippines may prove temporary and that sustained profitability could support higher earnings and valuation multiples over the long term, which would be positive for earnings and net margins.

- The company is adding 21 million to 26 million pairs of net manufacturing capacity in Indonesia and Bangladesh that is already funded within its CapEx plan and largely backed by demand from major global sports brands. If utilization ramps as planned, this structural volume growth could drive a multi-year increase in revenue and operating leverage.

- Long-term consolidation by global brands toward a smaller group of strategic vendors with differentiated capabilities, evidenced by Stella winning new contracts with Under Armour, Justin Bieber's SKYLRK and a dedicated large customer factory, could enhance pricing power and order visibility. This would support higher revenue resilience and potentially stronger gross margins.

- The group maintains a sizeable net cash balance of 291 million dollars, runs a 70 percent regular dividend payout with an additional multi-year cash return program and currently offers around a 10 percent dividend yield. Capital returns and balance sheet strength could underpin investor confidence and place a floor under the share price even if near-term earnings are under pressure.

- The company is deliberately upgrading its product and customer mix toward higher-value segments in sports, fashion, luxury and handbags, supported by an improved AA ESG rating and a specialist handbag acquisition in Vietnam. If this strategy succeeds, it could raise average selling prices and differentiation over time and drive structurally higher gross margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Stella International Holdings is HK$11.5, which represents up to two standard deviations below the consensus price target of HK$17.19. This valuation is based on what can be assumed as the expectations of Stella International Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$23.12, and the most bearish reporting a price target of just HK$11.5.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $165.1 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of HK$15.75, the analyst price target of HK$11.5 is 37.0% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Stella International Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.