Last Update 18 Dec 25

1: AS Watson Listing Plan Will Drive A More Positive Risk Reward Profile

Analysts have slightly lifted their price target on CK Hutchison Holdings, citing a modest improvement in long term valuation assumptions, underpinned by stable growth expectations and profitability metrics.

What's in the News

- CK Hutchison Holdings is exploring a potential listing of its health and beauty arm, A.S. Watson, with early-stage discussions under way with financial advisers about timing and structure (Key Developments).

- A Hong Kong listing of A.S. Watson could raise around USD 2 billion or more, reflecting the scale of the business and its contribution to the group’s valuation (Key Developments).

- The company is also considering a possible dual listing of A.S. Watson in Hong Kong and the UK, with a transaction potentially targeted for the first half of next year (Key Developments).

- A.S. Watson operates more than 17,000 stores across 31 markets, including Superdrug in the UK, Rossmann pharmacies in Germany, and Watsons stores across Asia, underscoring its global retail footprint (Key Developments).

- Singapore state investment firm Temasek holds about 25 percent of A.S. Watson, and any listing decisions would likely involve coordination with the minority shareholder (Key Developments).

Valuation Changes

- Fair Value Estimate unchanged at HK$62.01 per share, reflecting stable long term assumptions.

- Discount Rate risen slightly from 10.56 percent to 10.72 percent, implying a marginally higher required return.

- Revenue Growth effectively unchanged at about 10.92 percent, indicating consistent top line expectations.

- Net Profit Margin broadly stable at around 9.23 percent, signaling no material shift in profitability assumptions.

- Future P/E nudged higher from 8.97x to 9.01x, pointing to a modestly stronger relative valuation multiple.

Key Takeaways

- The merger-driven telecom synergies and ongoing retail and ports expansion are expected to enhance margins, recurring earnings, and revenue stability across core divisions.

- Robust financial flexibility and sustainability initiatives position CK Hutchison to capitalize on infrastructure growth and secure steady, long-term returns.

- Heavy reliance on non-recurring gains, weak retail in China, telecom margin pressure, asset underperformance, and complex regulation pose risks to sustainable growth and profitability.

Catalysts

About CK Hutchison Holdings- An investment holding company, primarily operates in ports and related services, retail, infrastructure, and telecommunications businesses in Hong Kong, Mainland China, Europe, Canada, Asia, Australia, and internationally.

- The successful merger of 3 UK and Vodafone UK, along with the broader ongoing review across European telecom operations, is expected to drive substantial operating and capital expense synergies (targeting GBP 700 million a year at run-rate within five years), enhancing recurring net margins and group earnings.

- Sustained investment and efficiency-driven growth in the Ports division, including expanded facilities in key geographies and increased storage income, position the company to benefit from global trade resilience and supply chain optimization-supporting higher revenue and stable cash flows.

- Strategic expansion and modernization of the group's retail arm (notably A.S. Watson's store portfolio and loyalty program development, plus omni-channel/dark store initiatives), are anticipated to drive same-store sales growth and operational leverage, contributing to higher revenue and sustainable bottom-line growth.

- CK Hutchison's strong balance sheet post-merger (with significant liquidity and a lower net debt ratio) increases management's flexibility to pursue value-accretive investments in infrastructure and regulated utilities, sectors poised for growth as urbanization and global infrastructure needs rise-potentially boosting returns on capital and net margins.

- The group's proactive sustainability and decarbonization investments, such as green bonds and operational emissions reductions, may lift the value of its regulated infrastructure assets and secure favorable regulatory returns, creating visible, stable earnings streams over the long term.

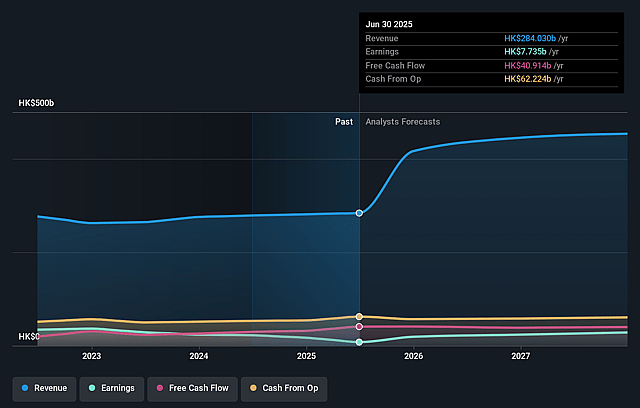

CK Hutchison Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CK Hutchison Holdings's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 9.1% in 3 years time.

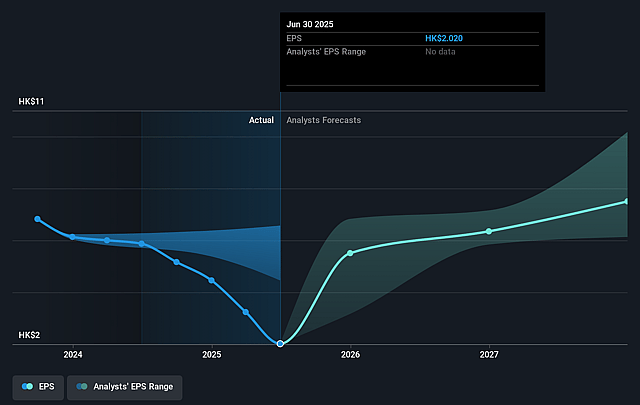

- Analysts expect earnings to reach HK$35.2 billion (and earnings per share of HK$9.23) by about September 2028, up from HK$7.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting HK$39.0 billion in earnings, and the most bearish expecting HK$23.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.2x on those 2028 earnings, down from 25.3x today. This future PE is lower than the current PE for the HK Industrials industry at 9.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.28%, as per the Simply Wall St company report.

CK Hutchison Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CK Hutchison's earnings in the first half were significantly bolstered by favorable foreign exchange movements and non-recurring gains (e.g., Treasury gains, asset disposals), suggesting that the strong net earnings and free cash flow may not be sustainable in future periods if currency moves reverse or noncore gains are not repeated (impact: risk to underlying revenue and net earnings growth).

- The Health & Beauty retail business in Mainland China is facing persistent pressure from subdued consumer spending, increased competition, and margin erosion due to the transition to lower-margin online/delivery channels; management's actions are yet to show sustainable turnaround, posing a long-term risk of declining profitability in a key growth market (impact: risk to group revenue growth and net margins).

- CK Hutchison's European telecom operations, while posting headline growth, have been heavily dependent on one-off treasury gains, with structural challenges such as price wars (notably in Austria) and ongoing heavy capex requirements, indicating medium-term pressure on margins and limited earnings growth in mature, competitive markets (impact: risk to recurring EBITDA and long-term cash flows).

- The conglomerate's Finance & Investment segment experienced underperformance from major assets (e.g., Cenovus Energy, TPG Australia, Marionnaud), reflecting vulnerability to commodity prices, FX shifts, and operational setbacks; this underscores the risk that diversification across disparate industries may dilute management focus and exacerbate persistent structural discounts in valuation (impact: potential drag on group net earnings and shareholder returns).

- Navigating highly regulated infrastructure, utility, and telecom sectors in multiple jurisdictions exposes CK Hutchison to ongoing regulatory and political risks (e.g., required approvals for major transactions, water utility scrutiny in the UK, changing rules impacting pharma in China/US); tightening compliance, changing regulatory resets, and stakeholder activism may increase costs, delay strategic action, or squeeze returns (impact: potential margin compression and dampened revenue growth).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$61.1 for CK Hutchison Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$75.0, and the most bearish reporting a price target of just HK$57.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$385.4 billion, earnings will come to HK$35.2 billion, and it would be trading on a PE ratio of 9.2x, assuming you use a discount rate of 11.3%.

- Given the current share price of HK$51.0, the analyst price target of HK$61.1 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CK Hutchison Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.