Last Update 24 Nov 25

Fair value Increased 4.05%PPC: Cleaner Energy And Higher P E Ratio Will Shape Future Returns

Analysts have raised their price target for Public Power from $18.11 to $18.84. This reflects a modest increase based on updated forecasts for slower revenue growth and lower profit margins, as well as a higher projected future price-to-earnings ratio.

Valuation Changes

- Fair Value Estimate has increased slightly from €18.11 to €18.84.

- Discount Rate remained unchanged at 8.90%.

- Revenue Growth expectation has declined further, from -2.06% to -2.37%.

- Net Profit Margin forecast has fallen from 9.35% to 8.49%.

- Future P/E Ratio has risen significantly, from 8.77x to 13.49x.

Key Takeaways

- Investments in renewables, grid modernization, and digitalization position Public Power for stronger revenue growth, improved margins, and reduced compliance risk.

- Electrification trends and digital service expansion are set to drive new growth opportunities and stable, predictable cash flows.

- High financial leverage, market competition, regulatory dependence, and risky diversification increase operational risks and could constrain profitability and strategic flexibility.

Catalysts

About Public Power- Generates, transmits, and distributes electricity in Greece, Romania, Bulgaria, and North Macedonia.

- The accelerated investments and strong pipeline in renewables (6.3 GW installed, 3.7 GW under construction/tender) position Public Power to benefit from regulatory incentives and increased demand for clean energy driven by policies targeting decarbonization-supporting future revenue and top-line growth.

- Systematic investments in grid modernization, digitalization, and automation-especially with the rollout of smart meters-are expected to lower operational costs and improve reliability, positively impacting future net margins and earnings.

- The full lignite phase-out by 2026 will reduce carbon emissions intensity and compliance risk, improving Public Power's sustainability profile and potentially reducing future regulatory/policy costs, supporting long-term earnings quality.

- Substantial capex in distribution networks within stable regulatory regimes (with RAB-based returns, WACC ~7%, and tariff increases already secured) will drive predictable, higher regulated returns and stable, visible cash flows.

- Increasing electrification across transportation and industry, combined with digital services expansion (e.g., FTTH fiber rollout), is set to boost electricity demand and enable new value-added service offerings, supporting both revenue growth and margin expansion over the medium to long term.

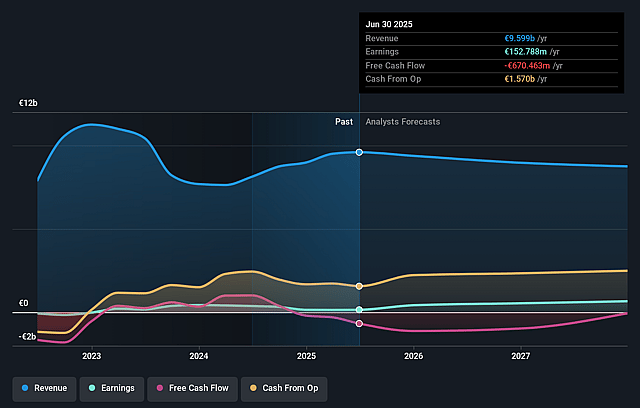

Public Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Public Power's revenue will decrease by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.6% today to 10.2% in 3 years time.

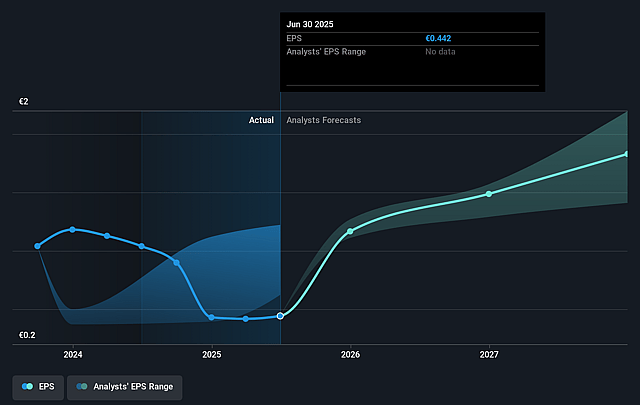

- Analysts expect earnings to reach €866.2 million (and earnings per share of €1.83) by about August 2028, up from €152.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 33.1x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 21.8x.

- Analysts expect the number of shares outstanding to decline by 2.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.77%, as per the Simply Wall St company report.

Public Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Elevated leverage (net debt/EBITDA of 3.2x expected to remain above 3x through 2027 due to continued high capital expenditures on renewables, distribution, and fiber projects) increases financial risk, exposes Public Power to future interest rate rises, and could constrain flexibility, impacting net margins and earnings.

- Rising penetration of distributed energy (rooftop solar, home batteries) and intense market competition in core geographies (notably after Romania's retail price cap removal and heavy advertising/discounting in Greece) threaten long-term retail electricity volumes and market share, potentially eroding revenue growth.

- Heavy reliance on regulatory frameworks for revenue (regulated asset base tariffs, WACC settings, CapEx approval cycles) in both Greece and Romania exposes Public Power to political/regulatory risk; future changes to allowed returns or tariff mechanisms could impair profitability and cash flow predictability.

- Legacy exposure to gas-fired generation (used to offset weak hydro/wind conditions and following lignite phase-out by 2026) leaves Public Power vulnerable to prolonged commodity price spikes (gas, carbon, power) and CO₂ price increases, which could increase operating costs and squeeze net margins.

- Rapid expansion into non-core activities (telecom/fiber, value-added services) involves significant upfront investment (€600–700 million), execution uncertainty, and possible delays in payback horizons; failure to achieve target customer growth or integrate new offerings efficiently may depress overall earnings and stretch balance sheet capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €17.833 for Public Power based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €22.6, and the most bearish reporting a price target of just €15.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €8.5 billion, earnings will come to €866.2 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of €14.4, the analyst price target of €17.83 is 19.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.