Catalysts

About Trade Estates REIC

Trade Estates REIC is a specialized real estate investment company focused on high quality retail parks and omnichannel logistics centers across Greece, Bulgaria and Cyprus.

What are the underlying business or industry changes driving this perspective?

- The shift of retailers toward destination retail parks with strong footfall is supporting robust visitation and turnover based rents. This can drive sustained growth in gross rental income and boost funds from operations over time.

- Rapid expansion of e commerce and regional supply chain reconfiguration is increasing demand for modern logistics hubs. This is positioning Trade Estates logistics developments such as the IKEA international logistics center and the potential Gkonos project to enhance rental revenue and asset values.

- A contracted and largely CPI linked lease structure, combined with a high share of tenants paying turnover rent above minimum guarantees, provides strong inflation pass through and operating leverage. This supports net margins and earnings growth.

- The committed EUR 250 million investment pipeline through 2028, with remaining projects expected to lift gross asset value toward up to EUR 760 million, creates a clear runway for scale benefits. These can expand EBITDA and improve returns on equity.

- Ongoing rollout of rooftop photovoltaic installations and EV charging infrastructure lowers long term energy costs and makes the portfolio more attractive to blue chip tenants. This can support higher occupancy, premium rents and improving net profit margins.

Assumptions

This narrative explores a more optimistic perspective on Trade Estates REIC compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

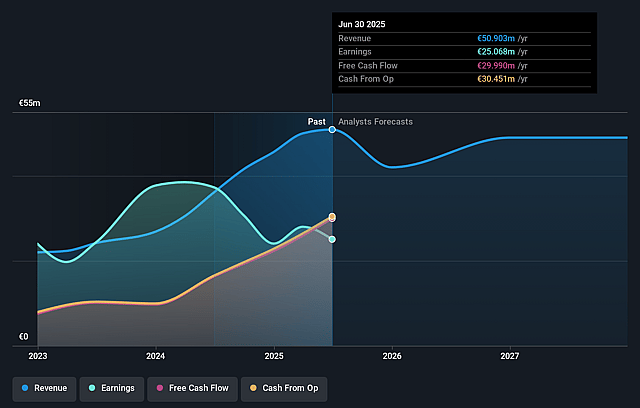

- The bullish analysts are assuming Trade Estates REIC's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 49.2% today to 50.7% in 3 years time.

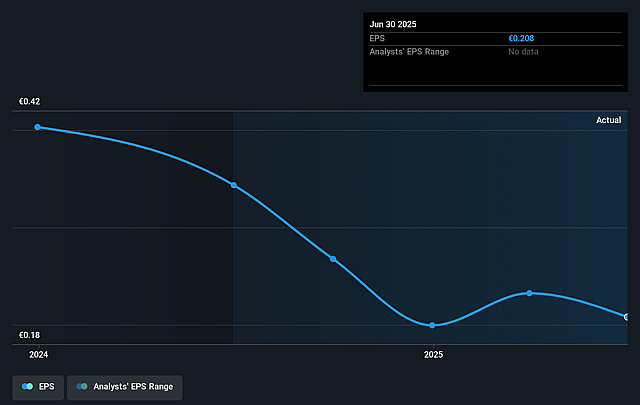

- The bullish analysts expect earnings to reach €31.5 million (and earnings per share of €0.27) by about December 2028, up from €25.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, up from 9.5x today. This future PE is greater than the current PE for the GR Retail REITs industry at 9.4x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.4%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The long duration and scale of the EUR 250 million investment pipeline, combined with already visible delays at key projects such as Hellinikon and Elefsina, raise the risk that construction bottlenecks, permitting issues or weaker tenant demand could push completions and leasing further out, which would slow the expected step up in gross rental income and EBITDA growth over the next several years and reduce earnings.

- Trade Estates strategy is highly concentrated in destination retail parks across Greece, Bulgaria and Cyprus, so any long term shift in consumer behavior toward online shopping or pressure on discretionary spending in these markets could weaken tenant sales, reduce turnover based rents and limit future rental uplifts, ultimately constraining revenue and funds from operations.

- The company relies on meaningful leverage to fund growth, with net LTV around the mid 40 percent range and a large, mostly hedged debt load, so a persistently higher interest rate environment beyond current hedging horizons or tighter credit conditions could raise financing costs, restrict access to new funding for the pipeline and compress net margins.

- The business model depends on a relatively concentrated set of strong tenants and sector exposure, with retail parks representing about 90 percent of fair value, so tenant consolidation, retailer bankruptcies or sector specific downturns in key anchors like IKEA could elevate vacancy risk and rent renegotiations, weighing on occupancy, rental income and net operating income.

- Growth in gross asset value and NAV per share is increasingly tied to successful execution of large logistics projects such as the international IKEA logistics center and potential Gkonos development, therefore any failure to win or fully develop these projects at attractive yields, or a cyclical oversupply of logistics space in the region, would limit valuation uplifts, dampen gross yields and slow NAV and earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Trade Estates REIC is €2.23, which represents up to two standard deviations above the consensus price target of €1.97. This valuation is based on what can be assumed as the expectations of Trade Estates REIC's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €2.23, and the most bearish reporting a price target of just €1.7.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €62.1 million, earnings will come to €31.5 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 12.4%.

- Given the current share price of €1.97, the analyst price target of €2.23 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Trade Estates REIC?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.