Key Takeaways

- Strategic focus on retail parks and logistics, supported by strong tenant relationships and hedged leases, provides resilience and predictable income amid economic cycles.

- Robust development pipeline and favorable market trends in key regions underpin long-term asset growth, rising earnings, and higher investor interest.

- Heavy exposure to Greek retail parks, project delays, and rising capital demands heighten risks to sustainable growth, profit margins, and future return potential.

Catalysts

About Trade Estates REIC- Engages in the rental of commercial real estate properties in Greece, Cyprus, and Bulgaria.

- The company's long-term focus on retail parks and modern logistics hubs is well-aligned with the accelerating growth of e-commerce and omnichannel retailing, resulting in continued high occupancy (94%) and above-market rental growth that should support future revenue and earnings expansion.

- Ongoing urbanization and demographic growth in Greece, Bulgaria, and Cyprus are fueling demand for quality retail and logistics infrastructure, underpinned by a robust investment pipeline and development projects expected to drive asset value appreciation and recurring income, positively impacting NAV and funds from operations.

- Strong tenant relationships-anchored by big-box retailers and e-commerce leaders (e.g., IKEA, Kotsovolos)-and active annual lease indexation (93% CPI-linked, 90% turnover rent clauses) offer a hedge against inflation and economic cycles, supporting margin resilience and predictable cash flows.

- Substantial embedded growth from a €156 million development pipeline (to 2028), including large-scale logistics and retail park projects, positions the company for robust rental income growth and a step-up in gross asset value, translating into higher long-term earnings.

- Lower cost of financing following active debt management (majority of debt hedged at attractive rates, average cost now at 3.06%) improves net margins and earnings, while rising investor appetite for income-generating real assets could catalyze a re-rating toward NAV as capital flows into the sector.

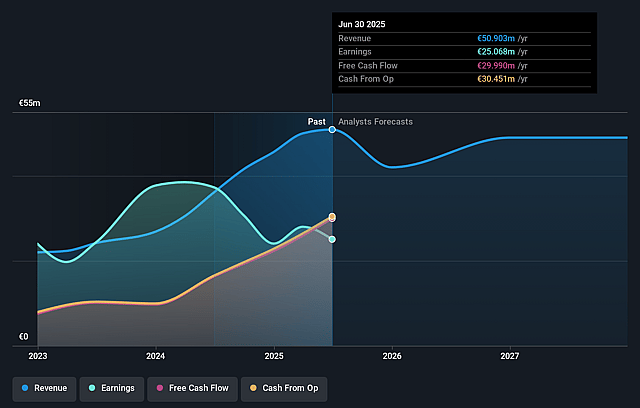

Trade Estates REIC Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trade Estates REIC's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 52.7% today to 64.0% in 3 years time.

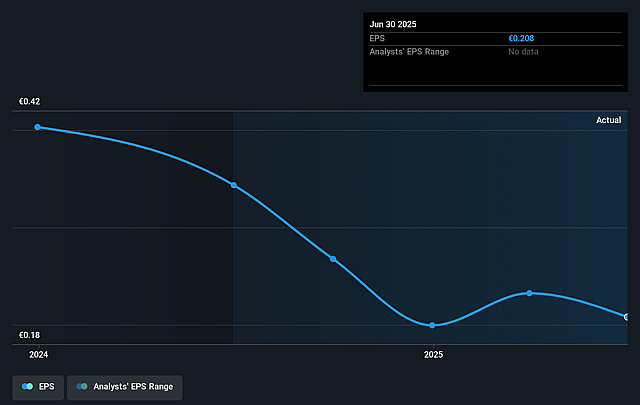

- Analysts expect earnings to reach €33.2 million (and earnings per share of €0.28) by about September 2028, up from €24.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the GR Retail REITs industry at 8.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.44%, as per the Simply Wall St company report.

Trade Estates REIC Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Project delays and postponements, particularly with flagship developments like the Hellinikon and Elefsina projects, could lead to slower portfolio growth and reduced future rental income, which may constrain long-term revenue and earnings growth.

- Heavy concentration in Greek and regional retail and logistics markets exposes Trade Estates REIC to elevated local economic, political, or demographic risks, potentially resulting in volatile occupancy rates and unpredictable net margins.

- Despite a solid occupancy rate and tenant base, the company maintains a substantial focus on retail parks (90% of portfolio), which leaves it exposed to risks from continued shifts toward e-commerce, omnichannel retail, and potential structural decline in physical retail, affecting long-run top-line revenue and occupancy.

- The reliance on significant capital expenditures and a robust acquisition pipeline-paired with rising net debt and only modest growth in net asset value-could place pressure on the company's ability to internally fund expansion, potentially diluting returns and impacting future net margins or dividend growth.

- Delays in project delivery, together with increasing requirements for environmental sustainability investments (e.g., PV panels, EV charging), could elevate ongoing capital expenditure, squeezing net operating income and limiting profit margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €1.925 for Trade Estates REIC based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €2.15, and the most bearish reporting a price target of just €1.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €51.9 million, earnings will come to €33.2 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 13.4%.

- Given the current share price of €1.75, the analyst price target of €1.92 is 9.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.