Key Takeaways

- Eurobank's strategic acquisitions and improving risk profile may enhance revenue growth and net margins, benefiting overall financial performance.

- A strong capital buffer and increasing dividend payout could attract investors, enriching earnings per share and supporting long-term shareholder returns.

- The integration of Hellenic Bank and regulatory challenges could impact Eurobank's margins, revenue growth, and financial flexibility, posing risks to earnings and capital adequacy.

Catalysts

About Eurobank Ergasias Services and Holdings- Provides retail banking, corporate and private banking, asset management, treasury, capital market, and other services primarily in Greece, rest of Europe, and internationally.

- The expected economic growth in Greece, Cyprus, and Bulgaria, along with strong tourism, declining unemployment, and robust real estate prices, suggests a conducive environment for credit expansion, potentially driving revenue growth for Eurobank in the coming years.

- The acquisition of Hellenic Bank and the anticipated synergies and increased equity stake could lead to enhanced revenue and earnings growth, consequently benefiting net margins through operational efficiencies.

- Eurobank's organic loan growth is expected to exceed initial targets, supported by a lower interest rate environment and ongoing RRF disbursements, indicating potential for increased net interest income and overall earnings.

- With strong asset quality metrics and a declining NPE ratio, Eurobank's risk profile is improving, which could lead to lower provisioning costs and improved net margins.

- The potential increase in the dividend payout ratio alongside a significant capital buffer supports a strategy for shareholder returns, which could enrich earnings per share and attract more investors.

Eurobank Ergasias Services and Holdings Future Earnings and Revenue Growth

Assumptions

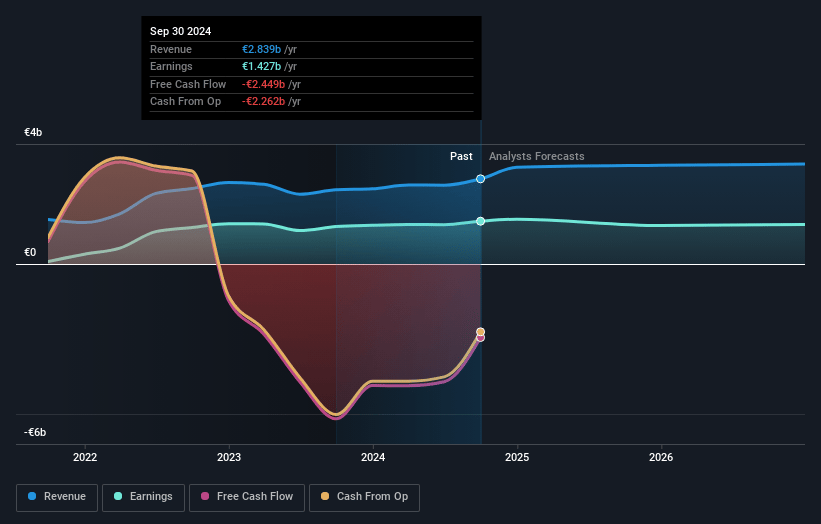

How have these above catalysts been quantified?- Analysts are assuming Eurobank Ergasias Services and Holdings's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 50.3% today to 38.6% in 3 years time.

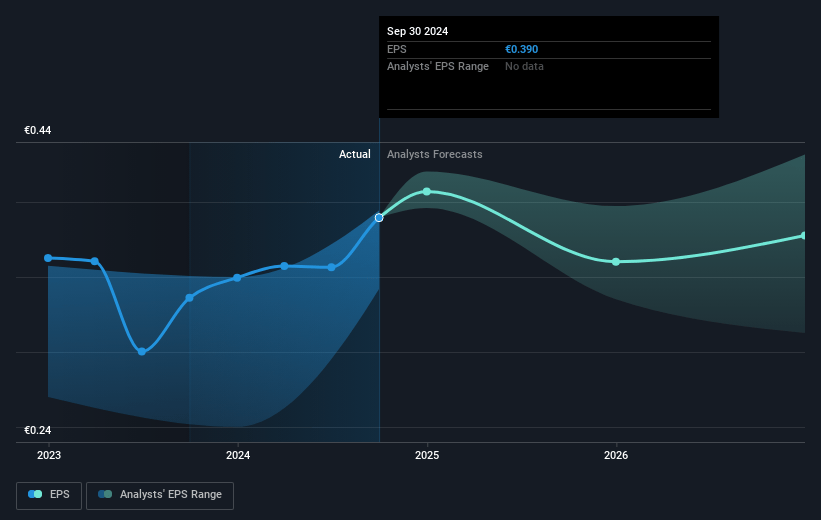

- Analysts expect earnings to reach €1.3 billion (and earnings per share of €0.38) by about January 2028, down from €1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €1.5 billion in earnings, and the most bearish expecting €1.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, up from 6.3x today. This future PE is greater than the current PE for the GB Banks industry at 6.3x.

- Analysts expect the number of shares outstanding to decline by 3.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.47%, as per the Simply Wall St company report.

Eurobank Ergasias Services and Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The consolidated financial position of Hellenic Bank, which is newly integrated into Eurobank, poses execution risks, especially as the bank's financial contribution is yet to be fully quantified and realized, potentially impacting net margins and earnings.

- The commitment to increase equity stake in Hellenic Bank adds uncertainty, as the regulatory approval process may delay anticipated synergies, affecting revenue growth and profit projections.

- The anticipated decline in the interest rate environment may compress net interest margins, leading to potential challenges in maintaining high levels of net interest income, thus impacting earnings.

- The potential acceleration of DTC (Deferred Tax Credit) amortization is expected to reduce regulatory capital by approximately 15 to 20 basis points annually, which could impact the capital adequacy and financial flexibility to pursue growth opportunities.

- The decision to potentially increase payout ratios, including share buybacks, might detract from reinvesting in growth opportunities or strengthening capital buffers, which could affect future revenue and overall financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €2.85 for Eurobank Ergasias Services and Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €3.5, and the most bearish reporting a price target of just €2.08.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €3.3 billion, earnings will come to €1.3 billion, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 10.5%.

- Given the current share price of €2.43, the analyst's price target of €2.85 is 14.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives