Last Update 24 Nov 25

Fair value Increased 1.08%SVT: Margin Improvements And Leadership Transition Will Shape Outlook

Severn Trent’s analyst price target has been revised upward slightly. The consensus fair value has increased from £28.93 to £29.24 per share, as analysts cite improved profit margin forecasts that offset more modest revenue growth expectations.

Analyst Commentary

Recent updates from street research provide a nuanced perspective on Severn Trent, with opinions divided on the valuation and growth outlook for the company. The following summarizes both optimistic and cautious viewpoints among analysts.

Bullish Takeaways- Bullish analysts have raised their price targets, indicating confidence in Severn Trent's ability to achieve stronger profit margins.

- Improved margin forecasts are seen as supporting a higher valuation, even in the context of softer revenue growth expectations.

- The increase in price targets suggests optimism about Severn Trent’s execution and resilience in a challenging market environment.

- Continued overweight ratings reflect the view that the company has attractive long-term growth potential compared to peers.

- Bearish analysts remain cautious, as shown by reduced price targets, signaling concerns about limited upside from current levels.

- There are reservations about the pace of revenue growth, which some view as insufficient to fully justify a significant re-rating.

- Maintaining neutral ratings indicates ongoing uncertainty about the company's ability to outperform sector expectations in the near term.

What's in the News

- Severn Trent declared an interim ordinary dividend of 50.40 pence per share for the six months ending 30 September 2025. The ex-dividend date is 27 November 2025, and payment will be made on 12 January 2026. The full-year dividend for 2025-2026 is expected to increase to 126.02 pence per share, in line with the company's AMP8 policy of annual growth by CPIH. (Key Developments)

- The company provided earnings guidance for the 2025-2026 fiscal year, projecting turnover around £2.6 billion, including HS2 related income. (Key Developments)

- Liv Garfield will step down as CEO and Executive Director on 31 December 2025. James Jesic will succeed her as CEO from 1 January 2026, following a thorough internal and external process. Garfield will remain with Severn Trent until the end of the financial year to help ensure a smooth transition. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from £28.93 to £29.24 per share.

- The discount rate has increased from 6.82% to 7.07%.

- Revenue growth expectations have fallen, moving from 11.39% to 9.57%.

- Net profit margin is forecast to improve, rising from 16.60% to 18.02%.

- The future P/E ratio is expected to decrease, dropping from 19.00x to 17.35x.

Key Takeaways

- Severn Trent's infrastructure investments and strategy focus on reducing spills and operational efficiency, aiming to elevate net margins and enhance performance rewards.

- Proactive increases in enhancement totex and insourcing design signal a strategic approach to statutory requirements, potentially boosting revenue and RCV growth.

- Regulatory changes and performance measures present financial challenges for Severn Trent, potentially affecting capital budgets, margins, earnings, and investor confidence.

Catalysts

About Severn Trent- Provides water and waste water services in the United Kingdom.

- Severn Trent’s commitment to achieving outperformance on Outcome Delivery Incentives (ODIs) for AMP8 suggests that they expect to continue leading in customer metrics and performance rewards, which could enhance future earnings.

- Focus on reducing spills and achieving global best practice levels (8 or fewer) by investing in infrastructure improvements and innovative solutions could lead to significant capital expenditure efficiency and potentially elevate net margins.

- The planned increase in enhancement totex investment, particularly in areas like treatment works and environmental improvements, indicates a proactive approach to meeting new statutory requirements, which could enhance revenue through higher allowable expenditure and RCV growth.

- Severn Trent’s strategy to insource design and expand in-house delivery capabilities for capital projects aims to improve operational efficiency, which may positively impact cost management and net margins.

- The expectation of continued strong performance in financing, despite high inflation, suggests that Severn Trent anticipates maintaining or improving their net interest margins and delivering steady Return on Regulated Equity (RoRE) performance.

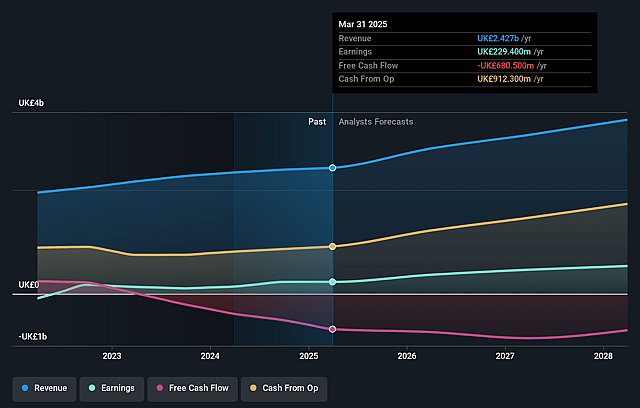

Severn Trent Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Severn Trent's revenue will grow by 11.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.5% today to 16.6% in 3 years time.

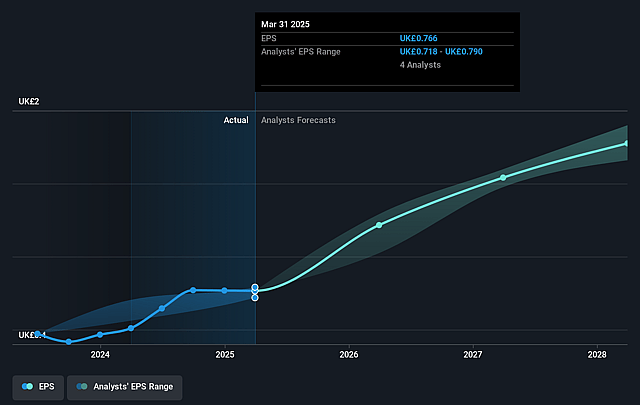

- Analysts expect earnings to reach £556.7 million (and earnings per share of £1.85) by about September 2028, up from £229.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £618 million in earnings, and the most bearish expecting £500.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.1x on those 2028 earnings, down from 32.8x today. This future PE is lower than the current PE for the GB Water Utilities industry at 30.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Severn Trent Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increased investment in enhancement totex spending, driven largely by statutory requirements like PFAS and dry weather flow standards, could pressure capital budgets and impact net margins if not adequately managed.

- Potential penalties or reduced rewards from the next AMP's ODI performance could impact Severn Trent's earnings, especially with concerns about industry-wide performance dragging them down.

- Rising employment costs, despite being partly offset by efficiency and insourcing strategies, may continue to put pressure on operating margins if not matched by sufficient gains in efficiency or revenues.

- The unpredictability of weather and its impact on spill rates poses a risk to meeting regulatory compliance and targets, which could impact operational metrics and associated financial rewards or penalties.

- Uncertainty around Ofwat's final determinations, specifically regarding cost allowances and the cost of equity, could affect future earnings predictions and financial planning, impacting overall investor confidence.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £28.93 for Severn Trent based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £33.85, and the most bearish reporting a price target of just £25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £3.4 billion, earnings will come to £556.7 million, and it would be trading on a PE ratio of 19.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of £25.0, the analyst price target of £28.93 is 13.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.