Key Takeaways

- Gamma is poised for sustained growth by capitalizing on cloud adoption, hybrid work trends, and migration from legacy networks across underpenetrated European markets.

- Recent acquisitions, technology integration, and platform investments support margin improvement, recurring revenue growth, and expanded market reach.

- Sluggish growth in key European markets and increased operational complexity threaten Gamma's top-line expansion, margin stability, and may drive costs higher than recurring revenue growth.

Catalysts

About Gamma Communications- Provides technology-based communications and software services to small, medium, and large-sized organizations in the United Kingdom, rest of Europe, and internationally.

- The adoption of cloud-based communications in large European markets-especially Germany, which has significantly lower cloud penetration (<20%) than the UK-provides Gamma with long-term growth potential as German SMEs and enterprises migrate from legacy PBX to cloud platforms; this underpins recurring revenue expansion and sustained volume growth.

- Widespread shift toward hybrid and remote work is driving demand for unified, flexible communications and connectivity platforms-a structural change that Gamma is positioned to capture, supporting higher ARPU and improved blended net margins through upselling advanced services like Teams integration, managed security, and contact center solutions.

- Successful consolidation and integration of recent German and broader European acquisitions have created operating scale and geographic diversification, enlarging Gamma's addressable market and giving access to underpenetrated segments-supporting revenue growth and margin resilience over the medium term.

- The accelerating migration away from legacy copper networks (e.g., UK PSTN switch-off) towards all-IP and managed VoIP/SIP solutions creates a multi-year tailwind; Gamma's portfolio and long-standing carrier relationships enable it to capture this transition, driving higher-margin cloud and managed service revenues.

- Ongoing investment in self-service partner portals and integration of best-in-class, third-party platforms (e.g., Cisco, Microsoft, Ericsson) lowers customer acquisition costs, improves retention, and enables seamless cross-sell of higher-value services, supporting long-term EBITDA margin improvement and recurring earnings growth.

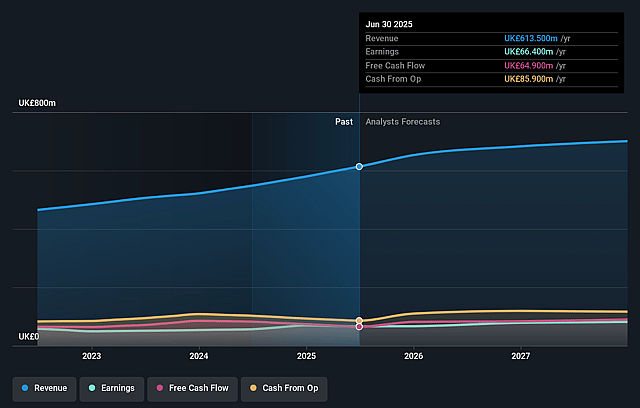

Gamma Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Gamma Communications's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 12.0% today to 11.7% in 3 years time.

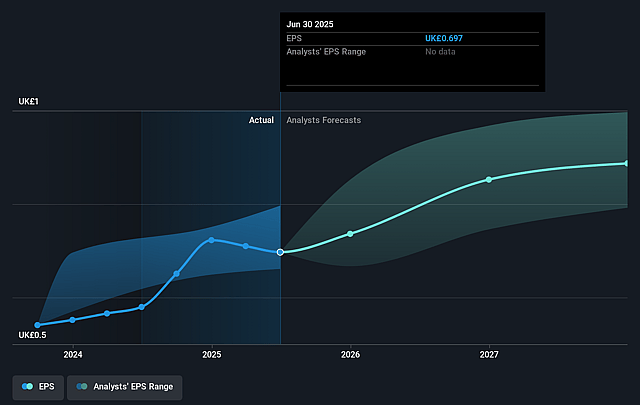

- Analysts expect earnings to reach £82.4 million (and earnings per share of £0.88) by about September 2028, up from £69.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £74.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, up from 13.8x today. This future PE is greater than the current PE for the GB Telecom industry at 16.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.82%, as per the Simply Wall St company report.

Gamma Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slower-than-expected cloud adoption in Germany, which management explicitly acknowledged has shifted but not accelerated, could result in the newly scaled German business delivering only mid-to-high single-digit revenue growth rather than the hoped-for U.K.-style CAGR, dampening the group's long-term top-line expansion.

- The Netherlands, a highly penetrated and mature market with entrenched competitors of greater scale (e.g., KPN and Enreach), is delivering flat or declining organic growth, and the group's inability to gain material share there may point to structural challenges in smaller or saturated European markets, putting future revenue growth at risk.

- Gamma's increasing reliance on integration and successful post-acquisition execution in Germany and across Europe heightens operational risk; failure to achieve synergies, especially with diverse platforms and multiple data centers, could drive up costs and lower net margins.

- Service Provider revenues, a growing yet structurally lower-margin area (confirmed by management), threaten to dilute consolidated gross margin and may put ongoing pressure on EBITDA if that growth outpaces higher-margin UCaaS and enterprise business.

- The accelerating complexity of solutions increases the need for channel partner education and more sophisticated support, raising the cost to serve and risking slower sales cycles, which could blunt EBITDA growth and potentially raise operating expenses faster than recurring revenues can grow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £16.272 for Gamma Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £19.4, and the most bearish reporting a price target of just £14.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £704.0 million, earnings will come to £82.4 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of £10.48, the analyst price target of £16.27 is 35.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.