Last Update 01 Dec 25

Fair value Decreased 1.89%SGE: Share Buyback and New Dividend Plan Set to Drive Upside

Analysts have revised Sage Group's price target downward from £13.49 to £13.23 per share. This reflects a modest reduction as they incorporate mixed views on growth prospects and recent updates to revenue and discount rate assumptions.

Analyst Commentary

Analyst sentiment toward Sage Group reflects a mix of optimism about the company’s longer-term strategy and valuation prospects, paired with concerns around short-term growth pressures and risk factors.

Bullish Takeaways

- Bullish analysts highlight Sage Group's strong fiscal 2025 results and improved guidance for fiscal 2026 as evidence of durable business performance.

- There is confidence in Sage’s continuing ability to upgrade forecasts, which they say supports the potential for further upward adjustments in consensus estimates.

- Shares are viewed by some as undervalued relative to Sage’s growth model and execution track record.

- Resilience in revenue streams and a track record of delivering upgrades contribute positively to the bullish valuation case.

Bearish Takeaways

- Bearish analysts cite concern about slowing annual recurring revenue (ARR) growth, which creates downward pressure on consensus expectations.

- The magnitude of risk is considered by some to be underestimated. Analysts note that even slight deceleration in key growth metrics can justify cautious positioning.

- Recent downward price target revisions reflect a more conservative view on near-term growth and underlying business momentum.

- Ongoing debate around fundamental valuation metrics underscores lingering uncertainty over Sage’s growth trajectory and its sustainability.

What's in the News

- The Sage Group plc has proposed a final dividend of 14.40 pence for the financial year ending September 30, 2025, pending approval at the AGM in February 2026. (Key Developments)

- New earnings guidance for fiscal year 2026 projects organic total revenue growth of 9% or above. (Key Developments)

- The Board has authorized a share buyback program, with plans to repurchase up to £300 million in shares through March 2026. (Key Developments)

- Sage announced the UK’s first AI-powered MTD for Income Tax Agent, designed to automate compliance and administration for accountants ahead of the 2026 digital records deadline. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has decreased slightly from £13.49 to £13.23 per share.

- The Discount Rate has risen marginally, moving from 9.13% to 9.16%.

- Revenue Growth projections have increased from 8.53% to 8.85%.

- Net Profit Margin has remained effectively unchanged, shifting slightly from 17.56% to 17.56%.

- The Future P/E ratio has risen noticeably, from 29.04x to 31.73x.

Key Takeaways

- Sage is advancing AI integration to boost operational efficiency and customer engagement, fostering revenue growth through adoption and retention.

- Strategic expansion and disciplined cost control are driving revenue growth and enhancing operating margins, supporting long-term earnings and shareholder value.

- Intensifying competition and slower customer acquisition, mixed with uncertainties in AI monetization, challenge Sage's revenue growth, retention, and long-term innovation.

Catalysts

About Sage Group- Provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

- Sage Group is integrating AI into more business workflows with the introduction of Sage Copilot, a GenAI-powered digital assistant. This innovation can enhance operational efficiencies and customer engagement, driving future revenue growth through increased adoption and retention.

- Sage is focusing on scaling their platform, investing in core product development and integrating solutions into suites. This approach is expected to enhance customer value and cross-sell opportunities, thereby supporting sustained top-line revenue growth.

- The company is strategically expanding its successful products such as Sage Intacct into new markets like Europe. This expansion is likely to drive revenue growth through new customer acquisitions in untapped markets.

- Sage demonstrates disciplined cost control while prioritizing investment in sales, marketing, and R&D, which supports improved operating margins and long-term earnings. This balance of growth and efficiency could help improve net margins and earnings in the coming years.

- Sage has initiated a share buyback program, highlighting strong cash generation and a robust financial position. This can enhance earnings per share (EPS) and drive shareholder value, influencing investor perception positively.

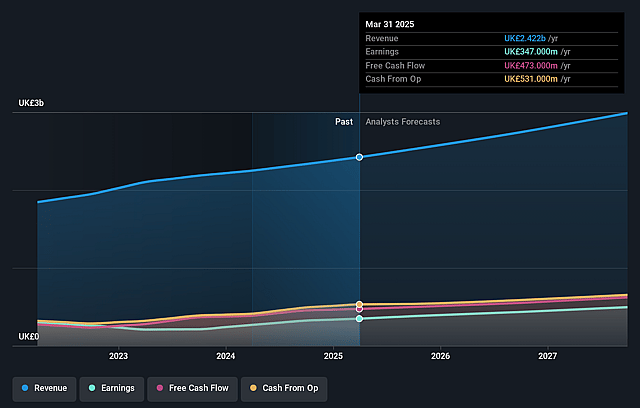

Sage Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sage Group's revenue will grow by 8.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.3% today to 17.6% in 3 years time.

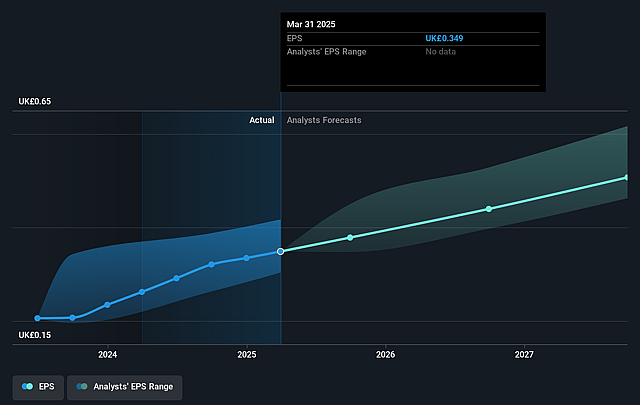

- Analysts expect earnings to reach £543.7 million (and earnings per share of £0.59) by about September 2028, up from £347.0 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £463.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.0x on those 2028 earnings, down from 29.6x today. This future PE is lower than the current PE for the GB Software industry at 37.6x.

- Analysts expect the number of shares outstanding to decline by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.13%, as per the Simply Wall St company report.

Sage Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive environment for Sage Group is intensifying, with companies like Intuit and SAP expanding their offerings toward SMBs. This could potentially impact Sage's revenue growth and market share as customers have more choices.

- Despite strong growth in segments like Sage Intacct, there are signs of slower new customer acquisition (NCA) in North America, primarily due to cautious CFO decision-making. This could affect average revenue per user (ARPU) and limit top-line revenue momentum.

- Sage Copilot, a key AI-driven initiative, has yet to be monetized fully, which adds uncertainty to future earnings from this segment. The gradual scaling and variable monetization strategies could delay revenue realization.

- There is a slight decrease in the renewal rate by value from 102% to 101%, indicating potential challenges in customer retention and upsell, which are crucial for sustaining ARR growth and long-term revenue stability.

- While margin expansion is highlighted as a success, investment in R&D relative to sales has decreased, which may impact future innovation capability and competitive positioning, potentially restraining long-term EPS growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £13.486 for Sage Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £10.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £3.1 billion, earnings will come to £543.7 million, and it would be trading on a PE ratio of 29.0x, assuming you use a discount rate of 9.1%.

- Given the current share price of £10.82, the analyst price target of £13.49 is 19.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Sage Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.