Key Takeaways

- Refocusing on high-value, recurring cyber security contracts and global operational efficiencies positions the company for improved revenue quality and margin recovery.

- Strategic partnerships, pipeline expansion in regulated sectors, and potential asset sales support future growth, capital returns, and increased market share.

- Pressure from price competition, talent shortages, automation, and unsuccessful acquisitions threaten NCC Group's growth, profitability, and differentiation in the increasingly commoditized cyber security market.

Catalysts

About NCC Group- Engages in the cyber and software resilience business in the United Kingdom, the Asian-Pacific, North America, and Europe.

- NCC Group has repositioned its Cyber Security business to focus on larger, multi-year strategic projects-particularly in complex, regulated sectors-resulting in higher-value, recurring contracts that should meaningfully improve revenue visibility and quality over time.

- With the pipeline building strongly in high-growth areas such as Digital Identity, Operational Technology, and regulated red teaming-underpinned by the rising frequency and sophistication of cyber threats and increased regulatory pressure-the company is poised for outsized revenue growth from FY '26 onward.

- The successful integration of a global delivery model (notably the Manila hub) and the introduction of AI-powered automation in both internal and client-facing services are driving operational efficiencies and cost reductions, supporting a sustainable recovery in net margins and EBITDA.

- The likely sale of Escode, which has posted 10 consecutive quarters of growth and improved gross margins, provides a catalyst for capital returns to shareholders and increased investment in the higher-growth Cyber business, benefiting future earnings potential.

- NCC's strategic partnerships with major technology vendors and its shift to a multidisciplinary, consultative sales approach (the "flywheel" model) increase client stickiness and cross-sell opportunities, setting the stage for expanding market share and long-term EPS growth.

NCC Group Future Earnings and Revenue Growth

Assumptions

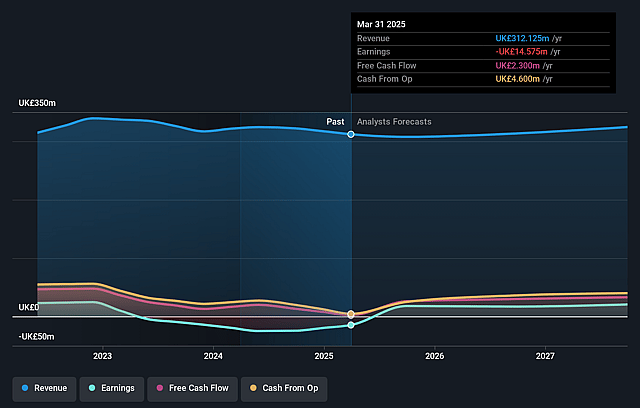

How have these above catalysts been quantified?- Analysts are assuming NCC Group's revenue will grow by 1.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.7% today to 9.4% in 3 years time.

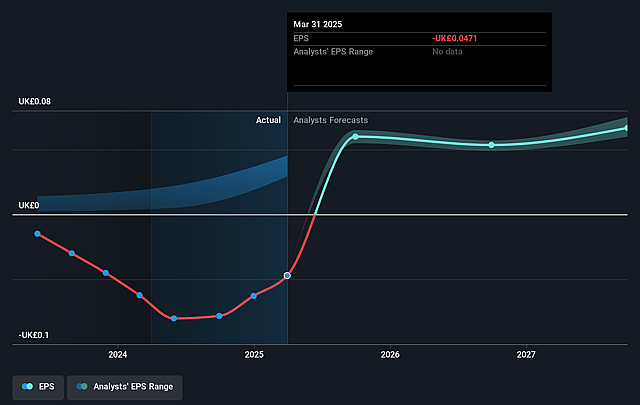

- Analysts expect earnings to reach £30.4 million (and earnings per share of £0.07) by about September 2028, up from £-14.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.1x on those 2028 earnings, up from -30.6x today. This future PE is lower than the current PE for the GB IT industry at 25.4x.

- Analysts expect the number of shares outstanding to decline by 0.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.09%, as per the Simply Wall St company report.

NCC Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged revenue decline in the core Cyber Security division, particularly ongoing pressures on the historically high-volume, lower-value transactional penetration testing business, indicate that NCC Group is struggling to offset these headwinds quickly with higher-margin strategic contracts-posing medium-term risks to group-wide revenue growth and earnings recovery.

- Intense and escalating price competition, especially in the Managed Services and mid-market sectors-where boutique firms are "buying work"-creates challenges for both renewals and new wins, increasing the risk of client churn, compressing margins, and causing revenue volatility, particularly as NCC pivots away from transactional business.

- Talent acquisition and retention pressures within the cyber security labor market-where skilled professionals remain scarce and wage costs are rising-can threaten NCC's ability to deliver projects profitably and at scale, potentially inflating operating expenses and squeezing net margins despite utilization of overseas delivery hubs.

- Increased automation and use of AI-driven penetration testing agents-both by NCC and competitors-could lead to commoditization of core assurance services, making it harder to differentiate offerings, driving down industry prices, and placing downward pressure on gross margins and future revenue streams, especially if clients shift to automated, in-house, or integrated solutions from larger providers.

- Historic integration issues following prior acquisitions, plus the risk of further inorganic growth failing to deliver expected synergies, threaten to undermine operational efficiency and future profitability-especially as the group's strategy continues to emphasize targeted M&A and organizational transformation to address capability gaps and support international expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.752 for NCC Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £324.4 million, earnings will come to £30.4 million, and it would be trading on a PE ratio of 23.1x, assuming you use a discount rate of 10.1%.

- Given the current share price of £1.45, the analyst price target of £1.75 is 17.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.