Last Update 10 Jan 26

AOM: Scalable Model Will Support £100 Million ARR And Higher Margins

Analysts have maintained their fair value estimate for ActiveOps at £3.17 per share, making only small adjustments to inputs such as the discount rate and future P/E, which they describe as refinements rather than a change in view.

What's in the News

- ActiveOps is holding an analyst and investor day focused on how its Decision Intelligence products are used to manage service operations, with management outlining plans to deepen relationships with enterprise customers across key verticals and expand market presence through partners (Key Developments).

- The company is presenting plans to accelerate R&D spending to build new capabilities that support further expansion with existing and new customers (Key Developments).

- Management is emphasising disciplined execution and operational leverage, highlighting a scalable model and a focus on sustainable, profitable growth (Key Developments).

- ActiveOps has shared a financial ambition to become a £100 million ARR business with a 25% EBITDA margin over time, positioning these as longer term targets rather than current performance figures (Key Developments).

- For the first half of fiscal 2026, the group expects revenue of approximately £20.8 million. It states that this would represent around 45% overall revenue growth, or 50% on a constant currency basis, and organic revenue of about £18.7 million that it states would reflect around 34% constant currency growth, with profit before tax for the period expected to increase (Key Developments).

- The company anticipates that full year fiscal 2026 revenues will be comfortably ahead of current consensus expectations. Reported profit before tax for fiscal 2026 is expected to remain in line with consensus as integration and reorganisation costs are incurred, and cost efficiency benefits are targeted from fiscal 2027 onwards (Key Developments).

Valuation Changes

- Fair value estimate: Held steady at £3.17 per share, with no change in the overall valuation outcome.

- Discount rate: Adjusted slightly from 8.74% to 8.72%, reflecting a very small refinement in the risk assumptions used in the model.

- Revenue growth: Kept effectively unchanged at about 14.76%, indicating no shift in the revenue outlook within the valuation framework.

- Profit margin: Left essentially unchanged at around 6.54%, pointing to a consistent view on future profitability in the model.

- Future P/E: Tweaked marginally from 79.24x to 79.20x, a very small change that does not alter the overall valuation stance.

Key Takeaways

- ActiveOps can capitalize on AI demand for decision intelligence tools and significant ARR growth potential from existing clients like Fidelity International.

- New sales hires and the transition to enhanced platforms suggest increased market reach and improved margins from upselling and cross-selling.

- Reliance on a major customer and direct sales alongside marketing expenditures pose revenue and scalability risks, impacting revenue stability and net margins.

Catalysts

About ActiveOps- Engages in the provision of hosted operations management software as a service solution to industries in Europe, the Middle East, India, Africa, North America, and Asia Pacific.

- ActiveOps is well-positioned to capitalize on the growing demand for AI-driven operational solutions, which could significantly drive revenue growth as organizations seek better decision intelligence tools.

- The company's land and expand strategy, particularly with high-profile clients like Fidelity International, indicates potential for substantial ARR growth within existing accounts, directly impacting revenue projections.

- Ongoing investments in new sales channel capacity, with 5 new sales hires and more expected, suggest a potential increase in market reach and customer acquisition, positively affecting future revenue.

- The transition to the new ControliQ platform and the upcoming Series 4 release enables ActiveOps to upsell and cross-sell enhanced products, likely improving net margins as these products carry higher gross margins.

- ActiveOps has identified significant untapped ARR potential from its existing customer base, estimated at £90 million, which could drive long-term revenue growth without needing extensive new customer acquisition efforts.

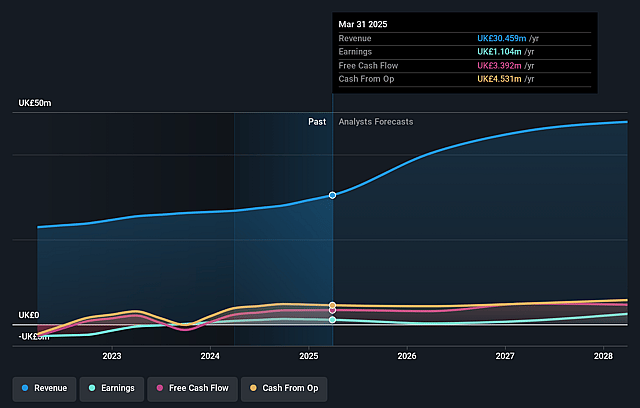

ActiveOps Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ActiveOps's revenue will grow by 16.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 5.2% in 3 years time.

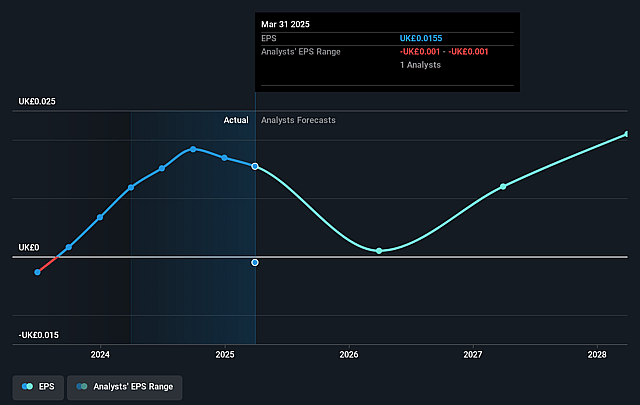

- Analysts expect earnings to reach £2.5 million (and earnings per share of £0.02) by about September 2028, up from £1.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £3.3 million in earnings, and the most bearish expecting £1.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 77.6x on those 2028 earnings, down from 118.9x today. This future PE is greater than the current PE for the GB Software industry at 37.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

ActiveOps Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ActiveOps' reliance on a single significant customer that has indicated a reduction in user base could impact ARR growth, highlighting potential risks to revenue stability.

- Notification from a significant customer about the reduction in user base implies potential vulnerability in customer retention, which might affect revenue and net margins.

- The direct sales model and limited current reliance on channel sales partners suggest potential scalability constraints, which could hinder revenue growth.

- Significant investments in marketing and R&D with varying margins in training implementation could strain net margins if additional revenue is not generated from these investments.

- Execution risk related to expanding sales and marketing capacity without directly correlating increased revenue immediately may temporarily impact earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.133 for ActiveOps based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £47.7 million, earnings will come to £2.5 million, and it would be trading on a PE ratio of 77.6x, assuming you use a discount rate of 8.6%.

- Given the current share price of £1.84, the analyst price target of £2.13 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ActiveOps?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.