Key Takeaways

- Strategic investment in sales infrastructure, SaaS migration, and AI-driven operations positions accesso for accelerated market penetration, recurring revenue, and profit margin outperformance.

- Cross-sell and upsell opportunities within its unified platform, plus exposure to mobile-first digital transformation globally, open avenues for long-term top-line compounding and client retention.

- Heavy dependence on major clients, industry consolidation, and shifting entertainment trends threaten revenue stability and limit growth visibility amid uncertain macroeconomic conditions.

Catalysts

About accesso Technology Group- Develops technology solutions for the attractions and leisure industry.

- While analyst consensus expects accesso's optimization of sales and marketing infrastructure to modestly accelerate new wins, the company's more granular approach-redistributing operational resources, hiring a new global commercial leader, and enhancing sales enablement-could enable a step-change in win-rate and market penetration well beyond expectations, driving higher revenue growth and greater scalability than currently forecast.

- Analysts broadly agree that transitioning existing customers from on-premise to SaaS solutions will expand recurring high-margin revenue; however, accesso's aggressive migration path-paired with early Freedom product traction and pilots for large-scale contracts-could rapidly pivot a substantial portion of its customer base to SaaS within the next two years, materially boosting both total recurring revenue and group-level net margins above prevailing estimates.

- The accelerating global shift across leisure, entertainment, and venue management to mobile-first platforms and cloud-based digital transformation, especially in emerging and international markets like the Middle East, positions accesso's unified suite for outsized total addressable market capture and multi-year compounding top-line growth.

- The company's rapidly expanding cross-sell and upsell opportunity-leveraging its unified platform (ticketing, virtual queuing, retail/restaurant, and payments)-is only just beginning to show in reported numbers, with a massive untapped installed client base and the potential to meaningfully expand ARPU and retention, leading to sustained revenue and profit outperformance.

- Accesso's ongoing investment in AI-driven product development, process automation, and backend integration-including proactive use of AI to cut technical debt and speed up product delivery-will likely yield a structurally lower cost base and shorter go-to-market cycles, unlocking stronger-than-expected operating leverage and accelerating earnings growth.

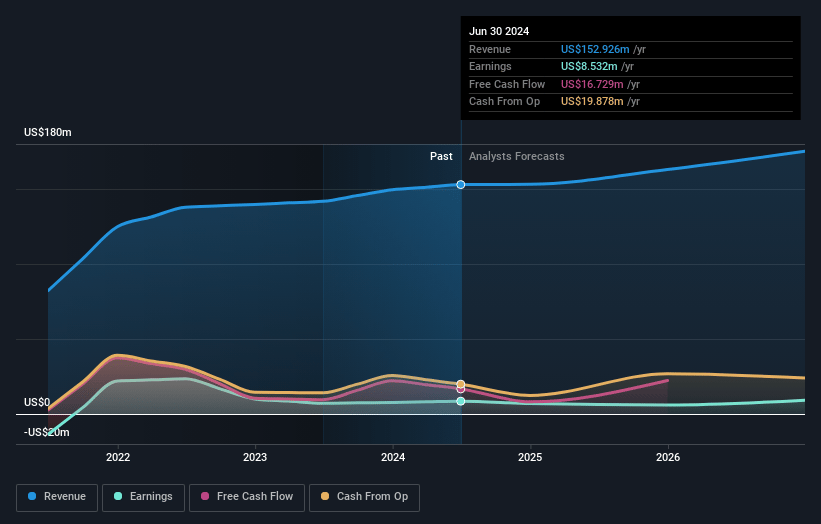

accesso Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on accesso Technology Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming accesso Technology Group's revenue will grow by 4.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.0% today to 7.3% in 3 years time.

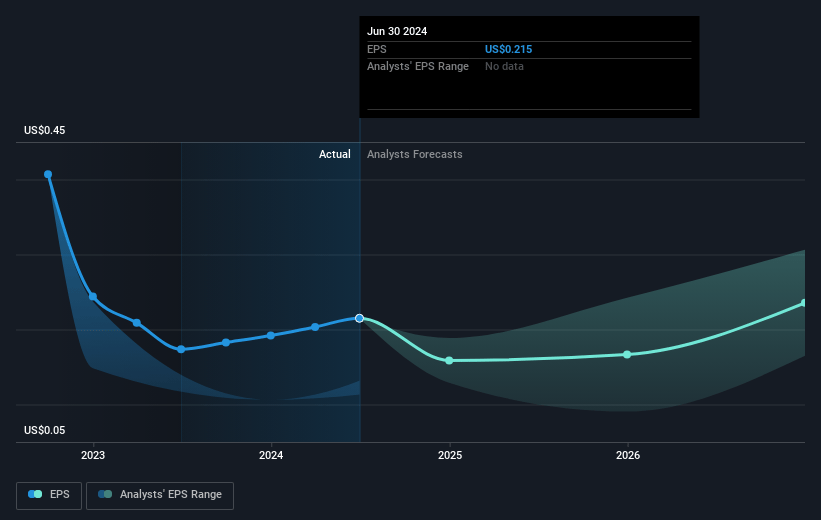

- The bullish analysts expect earnings to reach $12.6 million (and earnings per share of $0.24) by about July 2028, up from $9.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.1x on those 2028 earnings, up from 24.9x today. This future PE is lower than the current PE for the GB Software industry at 35.8x.

- Analysts expect the number of shares outstanding to decline by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.62%, as per the Simply Wall St company report.

accesso Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged macroeconomic uncertainty and stagnation in key geographies have resulted in flat or inconsistent visitor attendance at attractions, making revenue growth less predictable and reducing visibility on future earnings.

- Heavy reliance on a concentrated set of large clients such as Six Flags and Cedar Fair exposes the company to significant contract renewal and pricing risk; loss or renegotiation of these contracts could cause substantial revenue volatility and margin compression.

- Exposure to shifting consumer preferences as alternative entertainment options like VR, AR, and at-home experiences accelerate, potentially leading to a shrinking addressable market for physical venue-focused solutions and limiting long-term revenue growth.

- Ongoing industry consolidation and increasing customer bargaining power, as venue operators adopt in-house digital solutions, could lead to shorter contract durations, downward pricing pressure, and reduced revenue predictability.

- Execution and integration risk from recent and future acquisitions, including potential product compatibility issues or delayed synergies, may drive up operational expenses and undermine stability in net margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for accesso Technology Group is £5.81, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of accesso Technology Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.81, and the most bearish reporting a price target of just £4.36.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $172.4 million, earnings will come to $12.6 million, and it would be trading on a PE ratio of 30.1x, assuming you use a discount rate of 8.6%.

- Given the current share price of £4.25, the bullish analyst price target of £5.81 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives