Key Takeaways

- Rapid site conversions, tech-driven inventory systems, and own-brand expansion are positioning Wickes for sustained margin gains and accelerated market share in a consolidating market.

- Strong emphasis on sustainability, digital capabilities, and AI personalization is unlocking new growth opportunities and fostering long-term customer loyalty and revenue resilience.

- Limited geographic focus, operational cost pressures, and intensifying online competition threaten Wickes' long-term growth, margin resilience, and ability to retain market share.

Catalysts

About Wickes Group- Operates as a retailer of home improvement products and services in the United Kingdom.

- While analyst consensus highlights store openings and refits as supporting steady sales growth, this likely understates the scope for accelerated market share gains-Wickes is set to capitalize even further as consolidation in UK home improvement accelerates, especially by rapidly converting recently closed competitor sites and rolling out agile refit programs, which can drive both revenue acceleration and operating leverage.

- The consensus view is positive on tech investments improving efficiency, but in reality, Wickes' machine learning-driven inventory and demand systems are not just boosting margins-they are creating a flywheel effect, enabling industry-leading customer experience, lower working capital needs, and best-in-class stock turns, setting up persistent gross margin outperformance as volumes return to growth.

- Wickes is uniquely positioned to tap into the surge in sustainable home renovation and energy efficiency upgrades, as evidenced by its national rollout of solar installations and branded trust in complex projects, opening a substantial and structural new growth avenue in high-margin categories supporting future revenue and earnings growth.

- The integration of digital platforms, omnichannel capabilities, and proprietary AI personalization is driving rapid online conversion and high customer loyalty, positioning Wickes to accelerate share while benefiting from the long-term shift of trade and retail customers to digital-first shopping ecosystems-supporting both incremental revenue and improved cost-to-serve.

- The ongoing expansion and strengthening of own-brand (private label) ranges is building significant margin tailwinds, as higher-margin products continue to take share from branded alternatives, which should deliver step-change improvements to group net margins as volume growth resumes and the economic cycle turns.

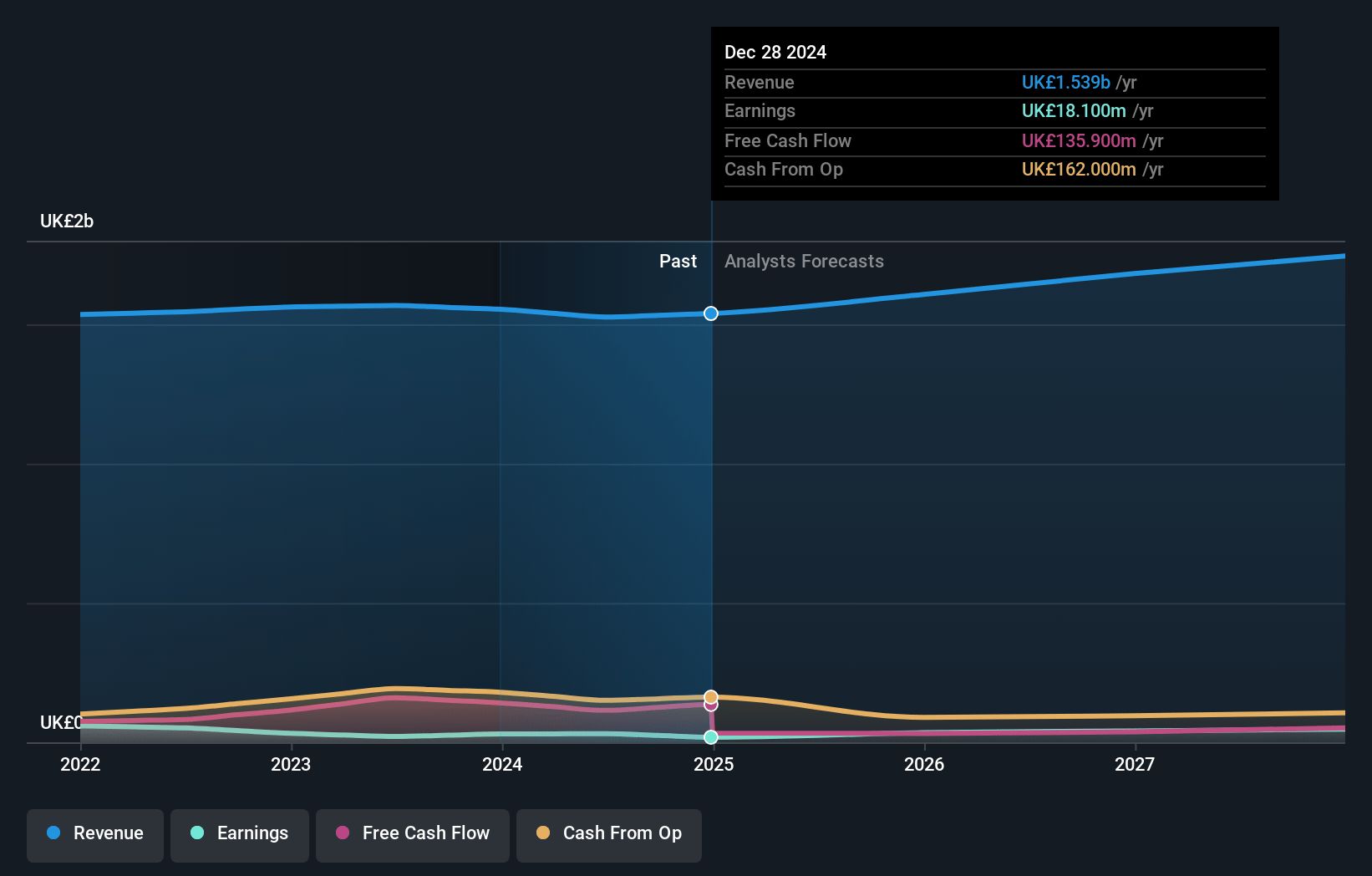

Wickes Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wickes Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wickes Group's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.2% today to 3.4% in 3 years time.

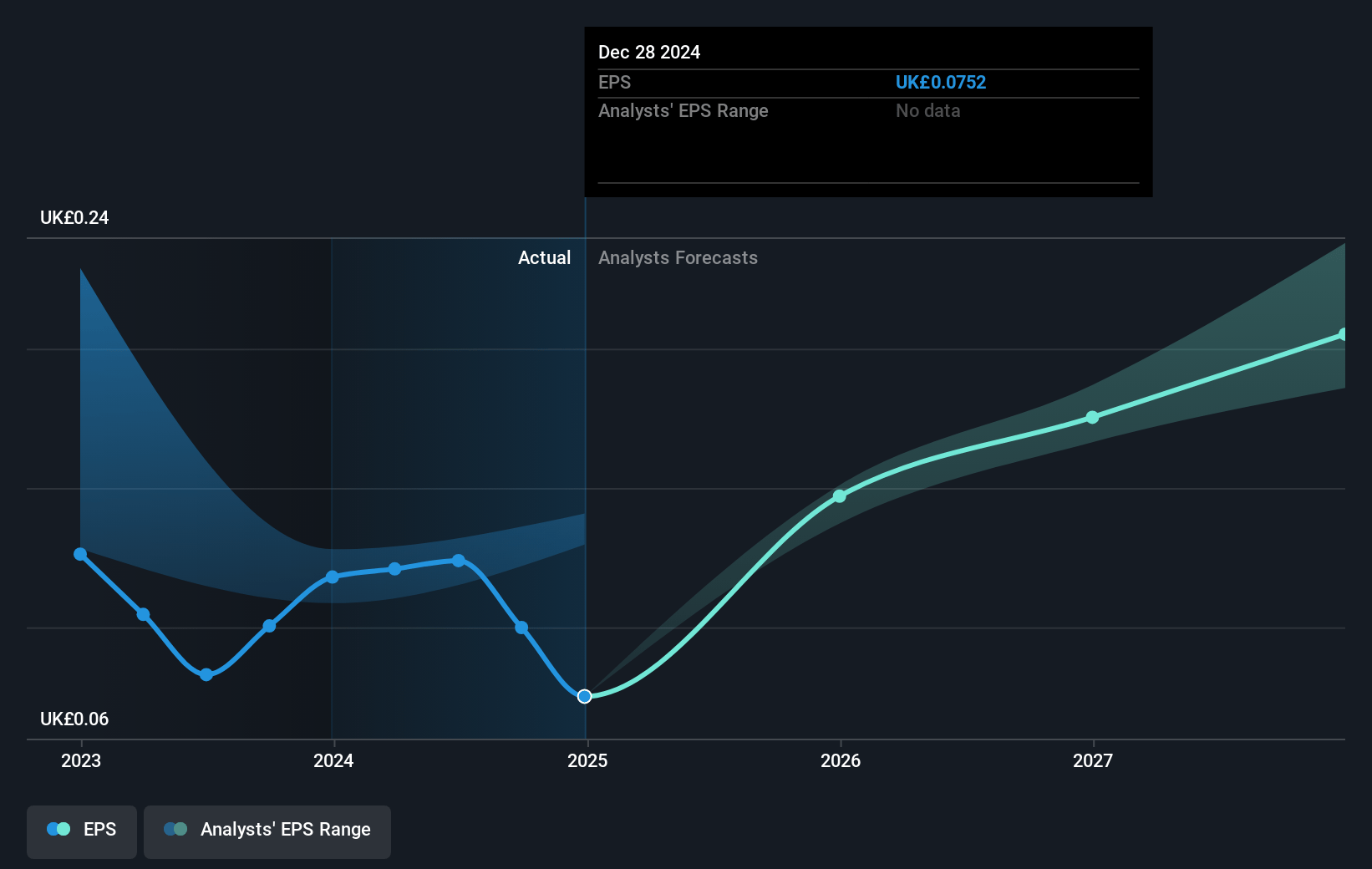

- The bullish analysts expect earnings to reach £62.9 million (and earnings per share of £0.27) by about July 2028, up from £18.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, down from 28.9x today. This future PE is lower than the current PE for the GB Specialty Retail industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 0.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.25%, as per the Simply Wall St company report.

Wickes Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining new home construction and focus on smaller home improvement projects in an aging UK housing stock could limit the long-term demand for big-ticket renovations, dampening Wickes Group's revenue growth prospects.

- Ongoing shift to online-first and digital-native competitors may erode Wickes' market share over time, especially if the company's current investment in digital capabilities and omni-channel experience proves insufficient, potentially leading to sustained margin compression.

- Wickes' exclusive focus on the UK market exposes it to high national market concentration risk and restricts its long-term revenue expansion, especially as more diversified peers can offset regional downturns or changes in UK consumer behavior.

- Rising regulatory and ESG compliance pressures, such as wage inflation, energy efficiency requirements, and climate adaptation, are structurally increasing operational costs; if Wickes cannot offset these with further productivity gains, net margins and future earnings will be under pressure.

- Intensifying competition from generalist e-commerce retailers with advanced logistics and fulfillment capabilities places persistent strain on Wickes' pricing power and customer retention, risking downward pressure on both top-line revenue and operating efficiency as legacy infrastructure becomes a disadvantage.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wickes Group is £3.09, which represents two standard deviations above the consensus price target of £2.34. This valuation is based on what can be assumed as the expectations of Wickes Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.29, and the most bearish reporting a price target of just £1.95.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £1.8 billion, earnings will come to £62.9 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 12.3%.

- Given the current share price of £2.2, the bullish analyst price target of £3.09 is 28.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.