Key Takeaways

- Growth in overseas business and focus on wholly-owned brands present opportunities for higher profitability and enhanced margins internationally.

- Automation and strategic investments are poised to improve operating margins, reliability, and return on investments.

- Rising costs and strategic dependencies could pressure NEXT's margins and growth, with risks from retail profitability, freight volatility, marketing spending, and acquisition strategies.

Catalysts

About NEXT- Engages in the retail of clothing, beauty, footwear, and home products in the United Kingdom, rest of Europe, the Middle East, Asia, and internationally.

- The growth in NEXT's overseas business, particularly with great performance from aggregators and direct online sales, presents a significant opportunity to increase overall group sales and potentially higher margins in international markets. This can positively impact revenue and profit margins.

- The strategic focus on wholly-owned brands and licenses, which have shown significant growth, could lead to higher profitability due to better control over margins and pricing. This could enhance overall earnings and net margins.

- The advancement of automation in their Elmsall Way warehouse is expected to reduce costs and improve reliability and delivery accuracy in the future. This could lead to improved operating margins and bottom line.

- The disciplined approach to investments and acquisitions, focusing on high-quality brands, is likely to optimize the company's asset portfolio and increase return on investments, thereby positively affecting earnings per share.

- The increasing online and marketing investments, particularly focusing on customer reach and engagement, are expected to sustain or improve sales growth in both the UK and overseas markets, which would boost overall revenue growth.

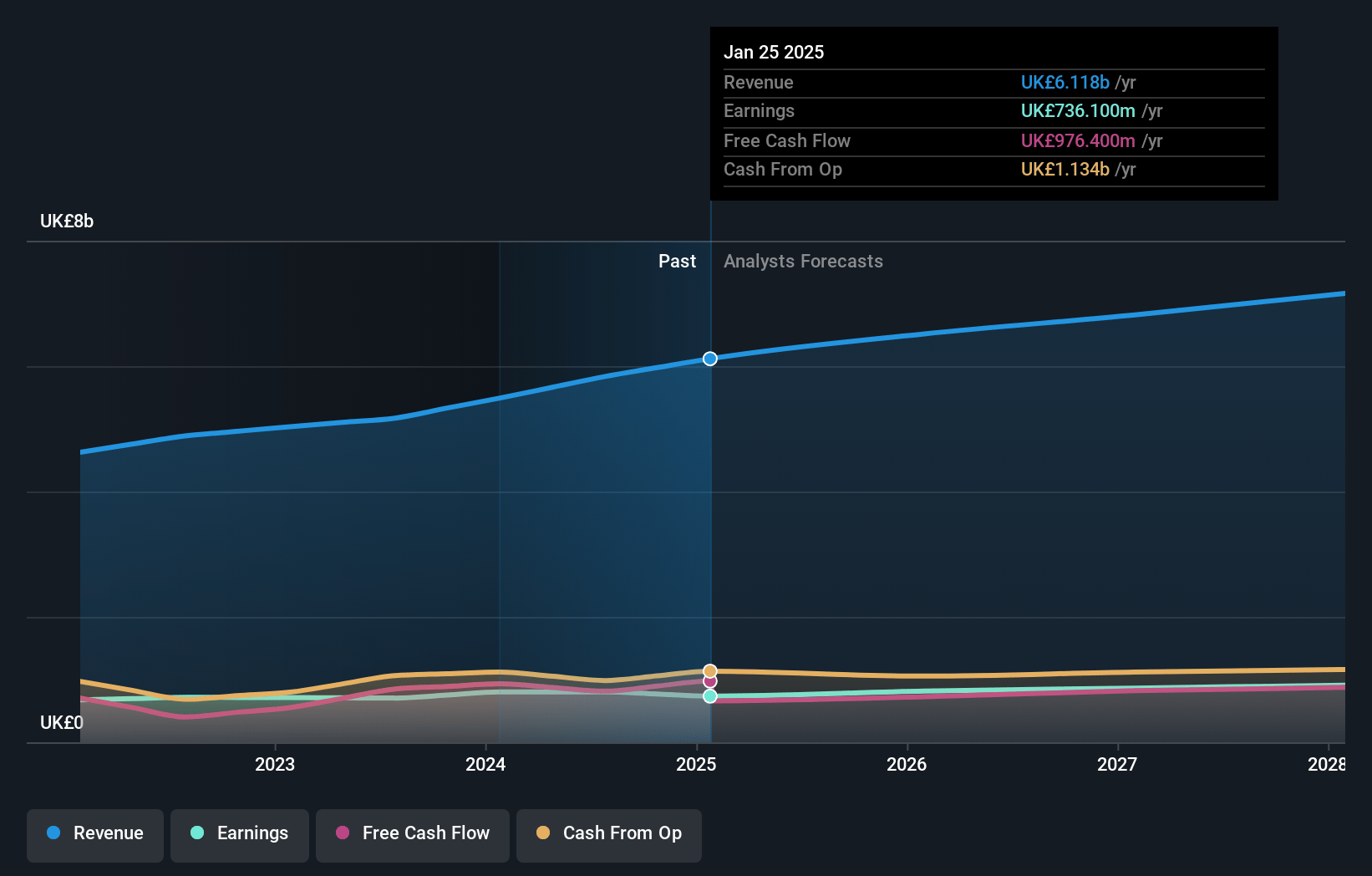

NEXT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NEXT's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.8% today to 12.9% in 3 years time.

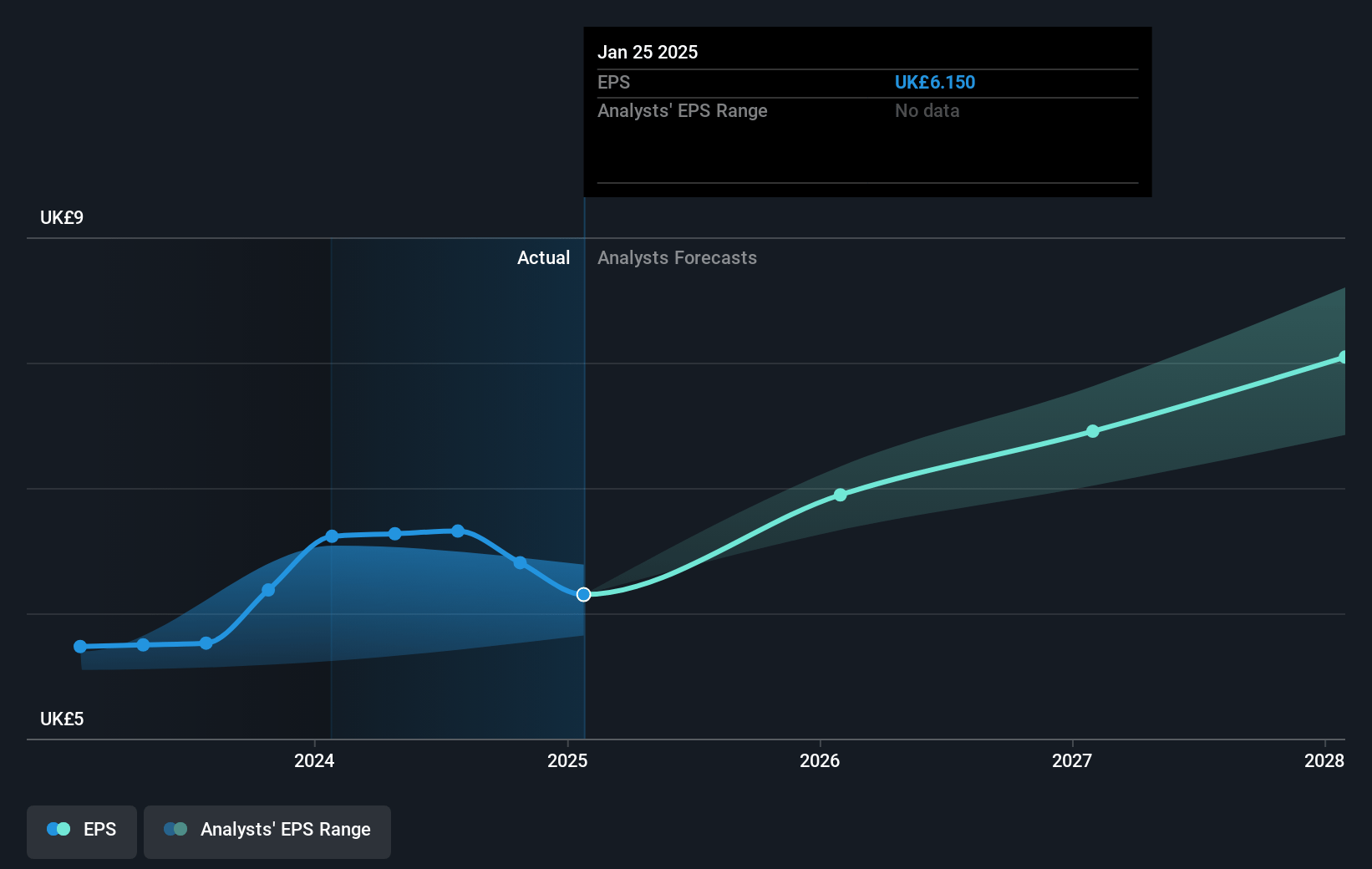

- Analysts expect earnings to reach £863.0 million (and earnings per share of £7.58) by about January 2028, up from £803.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.9x on those 2028 earnings, up from 14.1x today. This future PE is greater than the current PE for the GB Multiline Retail industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 0.96% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

NEXT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing challenges with retail profitability due to rising national living wages and limited headroom for further productivity improvements, which could negatively impact net margins.

- Volatility in freight costs and longer shipping transit times, influenced by geopolitical events and supply chain disruptions, could affect operating costs and ultimately lower net earnings.

- Continued investment in marketing, particularly online, is becoming increasingly necessary, which could erode profit margins if marketing does not yield anticipated sales growth.

- Expansion requires disciplined investments in potential acquisitions that match strict criteria, which may result in missed growth opportunities if competition continues to pay higher prices, potentially impacting revenue growth.

- The reliance on aggregators for overseas sales growth may mask underlying weaknesses, and could lead to volatility if relationships change or if customer demand shifts, thus unpredictably affecting revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £103.97 for NEXT based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £126.0, and the most bearish reporting a price target of just £60.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £6.7 billion, earnings will come to £863.0 million, and it would be trading on a PE ratio of 16.9x, assuming you use a discount rate of 7.4%.

- Given the current share price of £96.56, the analyst's price target of £103.97 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives