Key Takeaways

- Continued investment in AI-driven personalization and user experience is boosting customer retention, operating efficiency, and margin improvement.

- Diversification through new categories, brand partnerships, and international expansion reduces UK reliance and supports sustainable, long-term revenue growth.

- Secular shifts to digital, competition, rising costs, UK market reliance, and leadership change pose threats to Moonpig's growth, margins, and business stability.

Catalysts

About Moonpig Group- Operates as a data and technology platform for online greeting cards and gifting in the Netherlands, Ireland, Australia, the United States, and the United Kingdom.

- Consumer demand for personalized, digital gifting solutions continues to rise, benefiting Moonpig's online-first, tech-enabled platform and driving sustained customer acquisition, order frequency, and ultimately revenue growth.

- Investments in AI-powered personalization, data-driven algorithms, and seamless user experience (e.g., Magic Link, social log-in, AI card tagging) are increasing customer retention, improving conversion rates, and enhancing operating efficiencies-supporting higher net margins and improved lifetime value.

- Expansion and premiumization of the gifting and experiences categories, plus onboarding new brand partnerships, are diversifying revenue streams and increasing average order values, providing a long runway for top-line revenue growth.

- Ongoing international growth in markets like Ireland, Australia, and the U.S., along with operational momentum in Experience and Greetz, lay the foundation for incremental revenue and mitigate reliance on the UK-supporting future earnings stability.

- Moonpig's strong cash generation, negative working capital cycle, and capital-light model fuel continued investment in technology and fulfillment, enabling operational improvements and underpinning both net margin resilience and the potential for shareholder returns through buybacks and dividends.

Moonpig Group Future Earnings and Revenue Growth

Assumptions

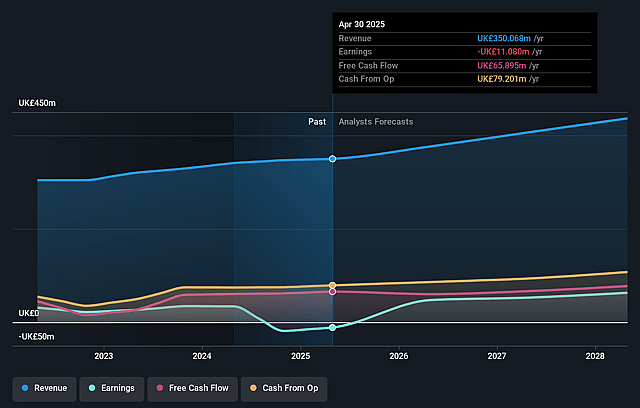

How have these above catalysts been quantified?- Analysts are assuming Moonpig Group's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -3.2% today to 14.5% in 3 years time.

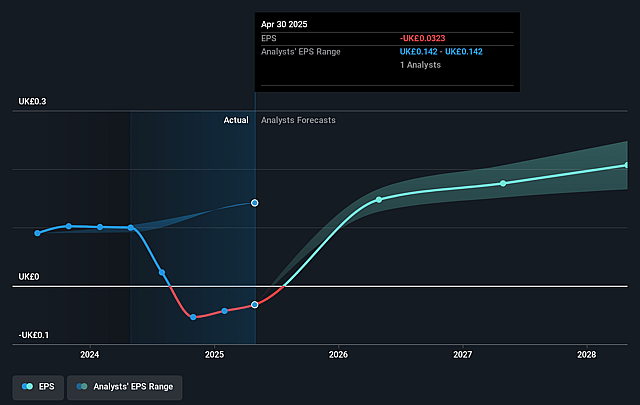

- Analysts expect earnings to reach £63.4 million (and earnings per share of £0.21) by about September 2028, up from £-11.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £77.3 million in earnings, and the most bearish expecting £49.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, up from -57.0x today. This future PE is lower than the current PE for the GB Specialty Retail industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 3.21% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.8%, as per the Simply Wall St company report.

Moonpig Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Declining use of physical greeting cards as digital communication methods (e.g., social media, messaging apps) increasingly replace traditional gifting, suggesting a long-term secular shift that may shrink Moonpig's core addressable market and put downward pressure on revenue growth.

- Rising customer acquisition costs and a challenging consumer environment could persist, as highlighted by Moonpig's recent need to drive growth through technical changes and marketing improvements rather than through organic market expansion, ultimately squeezing net margins and profitability.

- Moonpig's over-reliance on the UK market makes it vulnerable to local economic downturns and consumer confidence issues-as seen in post-Christmas softness-potentially leading to volatile revenues and inconsistent earnings if diversification efforts stall.

- Intensifying competition from e-commerce giants and technological innovation could commoditize personalized gifting and erode Moonpig's pricing power; the company notes increased efforts on AI and partnerships, but barriers to entry may fall, impacting long-term margins and earnings.

- The recent CEO transition introduces leadership uncertainty at a pivotal time for international expansion and product diversification; execution risk around maintaining momentum and strategic discipline could disrupt both operational stability and long-term profit growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.005 for Moonpig Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.6, and the most bearish reporting a price target of just £2.35.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £436.7 million, earnings will come to £63.4 million, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of £1.93, the analyst price target of £3.0 is 35.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.