Key Takeaways

- High demand and limited supply in core offices and retail parks fuel occupancy, rental growth, and resilience in revenue and asset values.

- Strategic portfolio shifts, disciplined capital management, and a focus on sustainability drive profit margins and attract premium tenants and investors.

- Rising costs, increased competition, evolving market trends, execution challenges, and tightening ESG requirements threaten future profitability and margin resilience.

Catalysts

About British Land- British Land is a UK commercial property company focused on real estate sectors with the strongest operational fundamentals: London campuses, retail parks, and London urban logistics.

- Structural undersupply of high-quality and sustainable office space in London core locations, combined with a clear return to office working, is driving strong rental growth and high occupancy rates in British Land's core office campuses; this is expected to support above-peer revenue and underlying earnings growth over the next several years.

- Limited new supply and strong demand for retail parks-where British Land has aggressively expanded-are driving rental growth, high retention rates, and rising property values; this trend is likely to continue underpinning net rental income and margins.

- Portfolio recycling into higher-yielding assets (notably retail parks and prime developments), paired with upfront capital discipline and no near-term refinancing needs, is optimizing return on capital and will support long-term improvement in profit margins and future earnings.

- Ongoing repositioning and development of mixed-use spaces (such as Canada Water and Regent's Place) target future urban population growth and the rising demand for "experience-driven" and flexible environments, providing multi-cycle drivers for occupancy and revenues.

- Demonstrated and growing sustainability credentials (high percentage of assets rated EPC A/B, top-tier GRESB and other ESG benchmarks) enable British Land to command rent premiums and attract strong investor and occupier demand, supporting both near

- and long-term revenue growth and resilience in asset values.

British Land Future Earnings and Revenue Growth

Assumptions

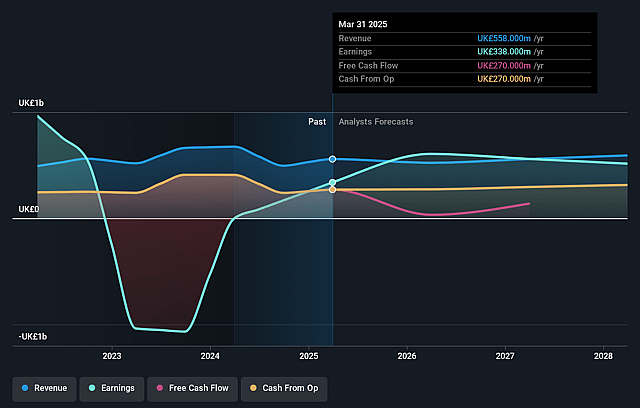

How have these above catalysts been quantified?- Analysts are assuming British Land's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 60.6% today to 86.9% in 3 years time.

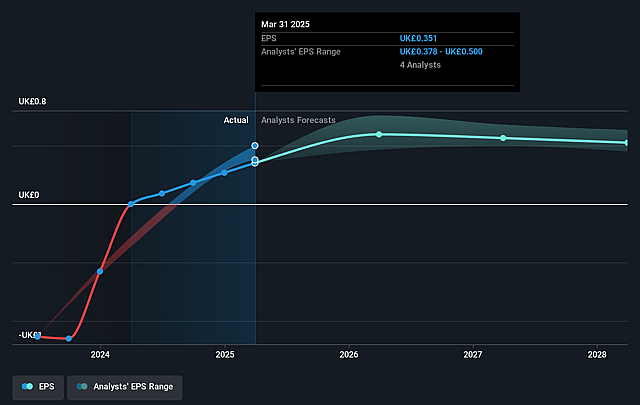

- Analysts expect earnings to reach £514.7 million (and earnings per share of £0.53) by about August 2028, up from £338.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £679.5 million in earnings, and the most bearish expecting £318.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the GB REITs industry at 10.2x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.19%, as per the Simply Wall St company report.

British Land Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent cost pressures, including high interest rates (with an 8% cost of capital and LTV at 38.1%), could limit future revenue and net margin growth, especially if refinancing conditions worsen or property values plateau, impacting earnings and asset valuations.

- Increased competition for retail park assets, with more capital (including US REITs and core/core-plus investors) chasing limited stock, may drive up acquisition prices and reduce yields, putting pressure on British Land's returns and potentially squeezing future net margins.

- Continued structural shifts to e-commerce and hybrid work, despite management's contrarian positioning, pose long-term risks to the traditional retail and office segments; if these secular trends reassert or accelerate, it could lead to sustained lower occupancy and rental growth, reducing revenue and profits.

- Execution risk on the sizable development pipeline (notably in schemes like Regent's Place, Canada Water, and Broadgate) could impact cash flow and net margins if market demand weakens, build costs escalate, or projects are delayed, especially given flat anticipated EPS in FY26 and high ongoing capital commitments.

- Growing ESG regulation and the need for additional sustainability capex (despite current strong credentials) could increase compliance costs and capital expenditure, potentially eroding profitability and impacting the company's ability to maintain strong net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.436 for British Land based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.1, and the most bearish reporting a price target of just £2.98.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £592.2 million, earnings will come to £514.7 million, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of £3.47, the analyst price target of £4.44 is 21.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.