Last Update01 May 25Fair value Decreased 4.95%

AnalystConsensusTarget has decreased profit margin from 11.3% to 7.9% and increased future PE multiple from 62.9x to 86.2x.

Read more...Key Takeaways

- Targeting high-growth biopharma and industrial segments diversifies revenue, mitigating traditional funding risks and driving significant revenue growth.

- Innovation-driven platform adoption and CapEx-first strategy improve revenue visibility, enhancing gross margins and supporting mid-term earnings growth.

- Oxford Nanopore Technologies faces revenue risks from U.S. funding cuts, export controls, rising competition, CapEx shifts, and contract concentration in biopharma.

Catalysts

About Oxford Nanopore Technologies- Engages in the research, development, manufacture, and commercialization of a nanopore based sequencing platform that allows the real-time analysis of deoxyribonucleic acid (DNA) or ribonucleic acid (RNA) in the Americas, Europe, the Middle East, Africa, India, and the Asia Pacific.

- Oxford Nanopore Technologies is targeting high-growth potential markets such as biopharma, clinical applications, and applied industrial markets, which are expected to drive significant revenue growth. The focus on these segments, including synthetic biology and biopharma manufacturing quality control, could diversify revenue streams and mitigate risks from the traditional research funding constraints, positively impacting overall revenue growth.

- The company's emphasis on enhancing platform adoption through innovation and end-to-end workflows supports the increased utilization of its sequencing platforms, particularly the PromethION. This could lead to higher revenue per device and contribute to improving net margins as scalable platforms like PromethION become more widely adopted.

- The shift to a CapEx-first approach for larger devices and planned enhancements in pricing models could enhance revenue visibility and improve gross margins. This strategic change, along with the simplification in customer pricing, is expected to result in mid-single-digit revenue growth and a 50 to 100 basis points improvement in margins over the medium term, which could positively affect earnings.

- Continued improvements in manufacturing efficiencies, particularly in the yield and recycling of PromethION Flow Cells, are anticipated to drive gross margin improvements. The move towards a projected 62% gross margin by 2027 is supported by these operational enhancements, leading to better financial performance and contributing to achieving adjusted EBITDA breakeven by 2027.

- Strategic investments in commercial infrastructure and operational efficiencies are expected to sustain cost discipline and improve the company's financial profile. With a focus on controlling costs within a 3% to 8% CAGR range, Oxford Nanopore aims to achieve cash flow positivity by 2028, positively impacting the bottom line and financial sustainability.

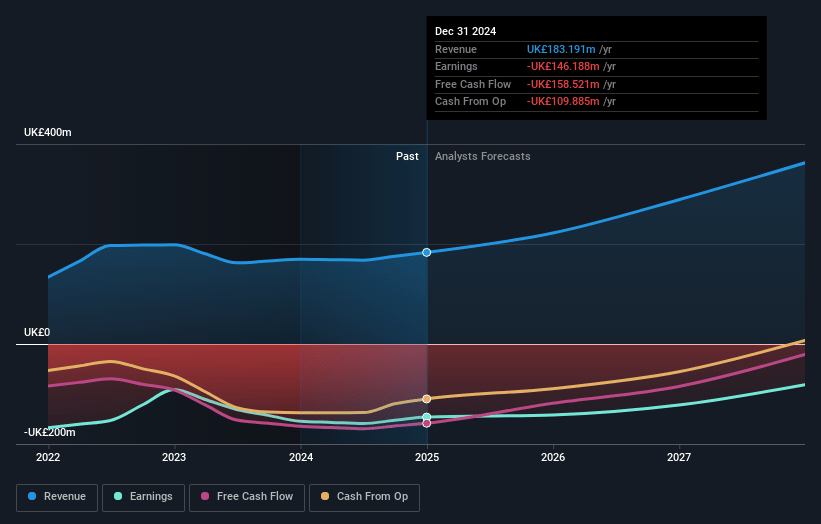

Oxford Nanopore Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Oxford Nanopore Technologies's revenue will grow by 25.8% annually over the next 3 years.

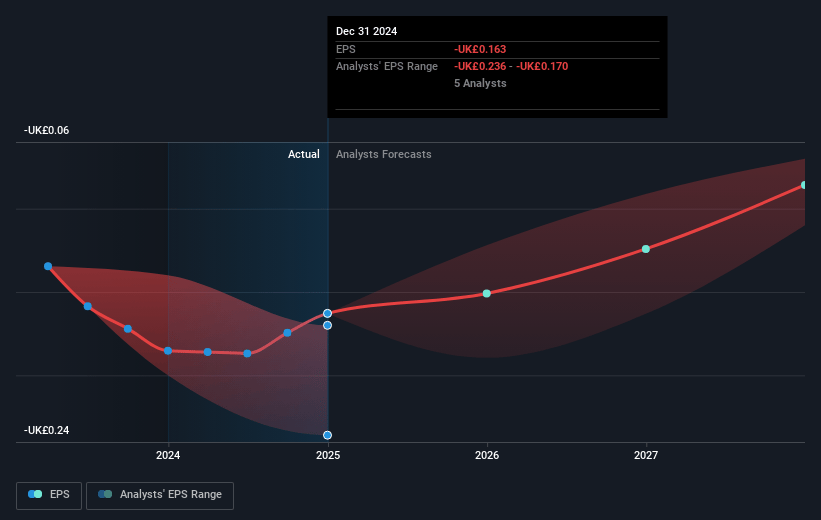

- Analysts are not forecasting that Oxford Nanopore Technologies will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Oxford Nanopore Technologies's profit margin will increase from -79.8% to the average GB Life Sciences industry of 7.9% in 3 years.

- If Oxford Nanopore Technologies's profit margin were to converge on the industry average, you could expect earnings to reach £28.8 million (and earnings per share of £0.02) by about May 2028, up from £-146.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 86.2x on those 2028 earnings, up from -7.8x today. This future PE is greater than the current PE for the GB Life Sciences industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 6.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.15%, as per the Simply Wall St company report.

Oxford Nanopore Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Oxford Nanopore Technologies faces potential risks from U.S. federal funding cuts, specifically NIH funding, which could impact its revenue projections considering their estimate that 10% to 15% of group revenue is exposed to these sources.

- Export control restrictions in China present a further risk, potentially limiting market access and affecting revenue from a significant region where demand for their products exists.

- Increasing competition from new entrants, such as Roche with their SBX sequencing platform, may challenge Oxford Nanopore's market position and could pressure pricing and revenue growth in markets where they overlap.

- Changes in business models to more capital expenditure (CapEx) oriented for larger devices could slow adoption rates where customers may not want or have budget to purchase equipment directly, potentially impacting revenue growth from new device sales.

- There is concentration risk associated with large contracts in the biopharma segment; delays or cancellations in significant contracts could impact future revenue growth in this prospective high-growth area.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £1.73 for Oxford Nanopore Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.5, and the most bearish reporting a price target of just £1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £364.3 million, earnings will come to £28.8 million, and it would be trading on a PE ratio of 86.2x, assuming you use a discount rate of 7.2%.

- Given the current share price of £1.19, the analyst price target of £1.73 is 31.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.