Key Takeaways

- Late-stage pipeline progress, geographic expansion, and international partnerships position the company for strong, sustainable revenue and margin growth.

- Robust R&D, portfolio diversification, and demographic trends drive increased patient demand, innovation, and long-term earnings potential.

- Rising competition, dependence on key drugs and partners, regulatory and geopolitical risks, and high R&D spending threaten HUTCHMED's profitability and revenue growth.

Catalysts

About HUTCHMED (China)- HUTCHMED (China) Limited, together with its subsidiaries, discovers, develops, and commercializes targeted therapeutics and immunotherapies to treat cancer and immunological diseases in Hong Kong, the United States, and internationally.

- Multiple late-stage pipeline assets are approaching regulatory approval (e.g., savolitinib in new lung cancer indications, fruquintinib in additional cancer types), positioned to benefit from rising cancer prevalence and treatment demand in China and globally, supporting future top-line revenue growth.

- Expansion of commercialized drugs such as FRUZAQLA/Elunate into new geographies (U.S., EU, Japan) and indications, supported by established international partnerships and increasing global acceptance of innovative treatments from emerging markets, lays groundwork for sustained long-term revenue and margin improvement.

- Robust R&D and commercialization pipeline leveraging the company's strong cash position and potential future M&A/in-licensing, enabling continued portfolio diversification and enhanced operating leverage, which can translate into higher earnings growth.

- The innovative ATTC platform, now entering clinical development, capitalizes on advances in targeted therapies and precision medicine, with the potential to create first-in-class drugs addressing large unmet needs, likely to drive significant long-term revenue and valuation uplift.

- Demographic shifts including the continued aging of China's population, combined with rising middle-class income and greater access to healthcare, are expected to significantly increase patient volumes, directly boosting demand for HUTCHMED's therapies and underpinning sustained revenue growth into the next decade.

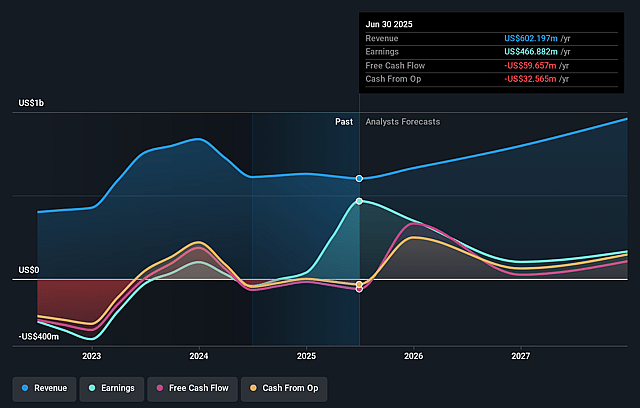

HUTCHMED (China) Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming HUTCHMED (China)'s revenue will grow by 16.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 17.2% in 3 years time.

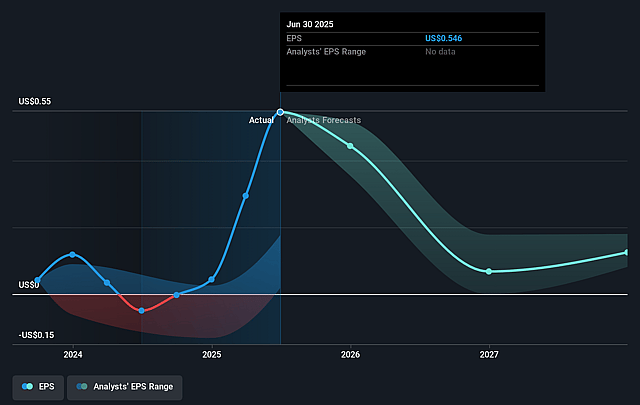

- Analysts expect earnings to reach $169.7 million (and earnings per share of $0.14) by about July 2028, up from $37.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $326.4 million in earnings, and the most bearish expecting $71.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.8x on those 2028 earnings, down from 80.6x today. This future PE is greater than the current PE for the US Pharmaceuticals industry at 28.5x.

- Analysts expect the number of shares outstanding to grow by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.64%, as per the Simply Wall St company report.

HUTCHMED (China) Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from both local and multinational biopharma firms in the Chinese oncology market (e.g., 5-MET inhibitors now present, increasing generics for fruquintinib, new entrants in neuroendocrine tumors), risks eroding HUTCHMED's market share, pricing power, and long-term revenue growth.

- Heavy reliance on a small number of late-stage drugs and specific partners (e.g., Fruzaqla commercialized globally by Takeda, Savolitinib with AstraZeneca) increases vulnerability to clinical trial setbacks, regulatory delays, and adverse commercial contract terms, which could abruptly impact top-line revenue and net margins.

- The company's ambitious pipeline expansion and ongoing investment in new platforms such as ATTCs, while promising, require sustained high R&D expenditure that may pressure operating margins and delay the path to consistently positive earnings if clinical or commercial milestones are missed.

- Uncertainties around evolving global geopolitical dynamics, such as U.S. tariff risks on Chinese pharmaceutical imports and increasing scrutiny of Chinese companies, have the potential to disrupt supply chains, delay market entries, and compress international revenue and margins.

- Growing pricing and reimbursement pressures in China (as seen with recent NRDL coverage changes for competitors) combined with potential future regulatory shifts, threaten to further tighten margins and delay revenue recognition for new and existing product launches.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.725 for HUTCHMED (China) based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.49, and the most bearish reporting a price target of just £1.98.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $985.1 million, earnings will come to $169.7 million, and it would be trading on a PE ratio of 30.8x, assuming you use a discount rate of 6.6%.

- Given the current share price of £2.62, the analyst price target of £3.73 is 29.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.