Key Takeaways

- Demographic shifts and rising competition from tech-enabled rivals threaten to erode market share, constrain profit growth, and diminish the value of pure listing platforms.

- Regulatory pressures and overreliance on estate agent subscriptions expose the company to increased compliance costs, market volatility, and long-term earnings instability.

- Strong digital capabilities, network effects, and diversification into value-added services underpin Rightmove's pricing power, scalable margins, and prospects for sustained growth.

Catalysts

About Rightmove- Operates digital property advertising and information portal in the United Kingdom and internationally.

- Structural demographic headwinds, including an ageing population and declining home ownership among younger generations, are likely to suppress long-term transaction volumes and property listings, directly constraining Rightmove's core revenue growth prospects as its reliance on a high rate of listings would no longer be sustained.

- Intensifying demands from both consumers and agents for an all-in-one digital real estate experience-encompassing transaction, conveyancing, and mortgage services-threaten to erode the relevance of pure listing platforms like Rightmove, requiring steep, costly investment to pivot and risking long-term revenue and margin compression.

- Persistent regulatory pressures around digital advertising, data privacy, and online business operations may increase compliance costs and restrict the ability to monetize user data, which is central to Rightmove's value proposition, putting downward pressure on both top-line and net margins over time.

- Heavy dependence on estate agent subscription fees and the UK market leaves Rightmove acutely exposed to cyclical downturns, economic or regulatory shocks, and domestic competition, driving higher earnings volatility and undermining the company's medium

- and long-term earnings stability.

- The growing threat from proptech competitors-including low-cost or free listing options, tech-enabled disruptors, and the potential entry of global technology giants into property search and digital advertising-will likely erode market share, force pricing concessions, and lead to industry-wide margin compression, severely limiting the company's ability to sustain long-term profit growth.

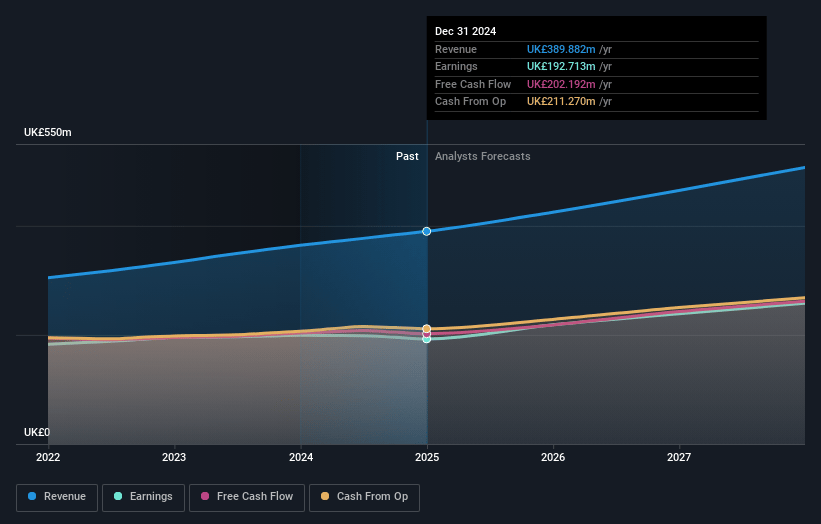

Rightmove Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Rightmove compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Rightmove's revenue will grow by 8.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 49.4% today to 50.8% in 3 years time.

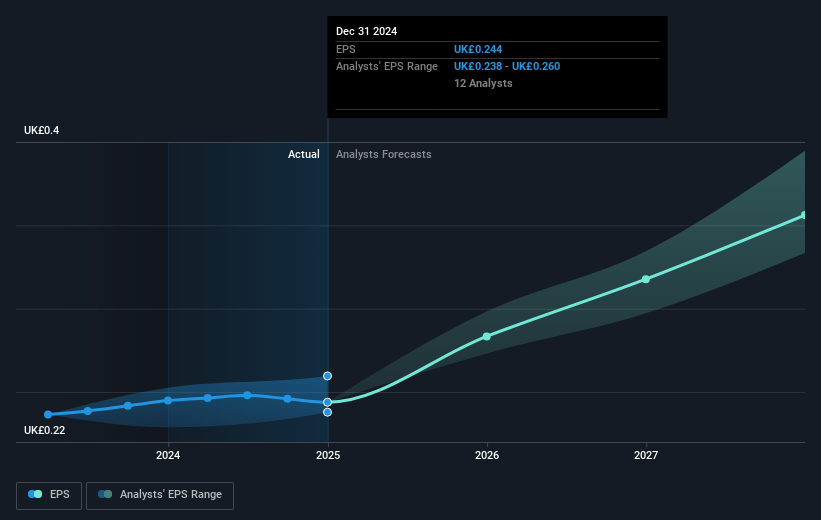

- The bearish analysts expect earnings to reach £254.8 million (and earnings per share of £0.35) by about July 2028, up from £192.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, down from 31.3x today. This future PE is lower than the current PE for the GB Interactive Media and Services industry at 25.6x.

- Analysts expect the number of shares outstanding to decline by 0.69% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Rightmove Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained digitalisation and deepening of AI/data capabilities are strengthening Rightmove's consumer engagement, product innovation, and monetisation opportunities, which can drive both higher revenues and expanding margins over the long term.

- The company's powerful network effects, high brand recognition, and habit-formed consumer loyalty (over 85% direct/organic site visits and more than 80% share of consumer time spent on property portals) provide pricing power and customer retention, supporting predictable earnings growth.

- Expansion into value-added services (such as the Optimiser Edge and Lead to Keys suites) and strong uptake of premium product upgrades are increasing average revenue per advertiser, offering a long runway for revenue and profit growth.

- Rightmove's scalable, asset-light business model consistently delivers industry-leading margins (70% operating margin reported for 2024) and robust cash generation, allowing for continued investment in growth initiatives and shareholder returns.

- The UK property market's structural growth-driven by digital migration, urbanisation, and increasing online property searches-along with Rightmove's strategy to diversify its revenue streams and deepen its role in the property transaction ecosystem, positions the company to achieve above-GDP top-line growth into the next decade.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Rightmove is £4.95, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Rightmove's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £9.44, and the most bearish reporting a price target of just £4.95.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £501.3 million, earnings will come to £254.8 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of £7.81, the bearish analyst price target of £4.95 is 57.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives