Key Takeaways

- Rapid digital transformation and cost efficiencies are driving stronger margins and accelerating long-term earnings growth beyond initial expectations.

- Diverse digital and content production capabilities, along with advanced ad tech, position ITV to outperform peers in evolving media and advertising landscapes.

- Digital disruption, global competition, and legacy cost structures threaten ITV's traditional revenue streams and profitability, with digital initiatives struggling to fully offset linear broadcast declines.

Catalysts

About ITV- A vertically integrated production, broadcasting, and streaming company, which creates, owns, and distributes content on various platforms worldwide.

- While analyst consensus views ITV's ongoing cost transformation and efficiency programs as a modest tailwind to margins, the pace and structural nature of these savings have been materially underestimated; ITV has a proven track record of sustainable, multi-year cost reductions-outpacing targets and enabling meaningful reinvestment-setting the stage for sustained improvements in EBITDA margin and resilient net earnings growth.

- Analysts broadly agree that digital revenue from ITVX and digital studios will offset linear declines, but ITV's accelerated crossover into profitability for ITVX and the doubling of high-margin digital studio revenues by 2027 suggest digital's contribution will far exceed expectations, bringing a step-change in both revenue growth and group-level margin expansion ahead of schedule.

- ITV's transformation from a traditional broadcaster into a scaled digital-first platform is occurring alongside structural industry shifts-specifically, digital ad spending outpacing other media and advertisers demanding more premium, brand-safe, targeted environments-positioning ITV to capture a disproportionate share of the surging connected TV and digital video budgets, driving superior long-term revenue growth.

- As global demand for locally produced and premium original content rises, ITV's extensive production capabilities, global distribution footprint and deep IP catalog enable it to consistently outpace market growth, diversify its revenue geographically, and command recurring high-margin sales through multi-platform syndication, increasingly decoupling group earnings from UK linear ad cycles.

- The expansion of ITV's data-driven advertising technology, including successful vertical-specific targeting initiatives and partnerships with major platforms like YouTube, creates a powerful moat and unlocks new, higher-margin digital revenue streams, positioning ITV to grow earnings faster than peers as targeted advertising and addressable TV become central to brand strategies.

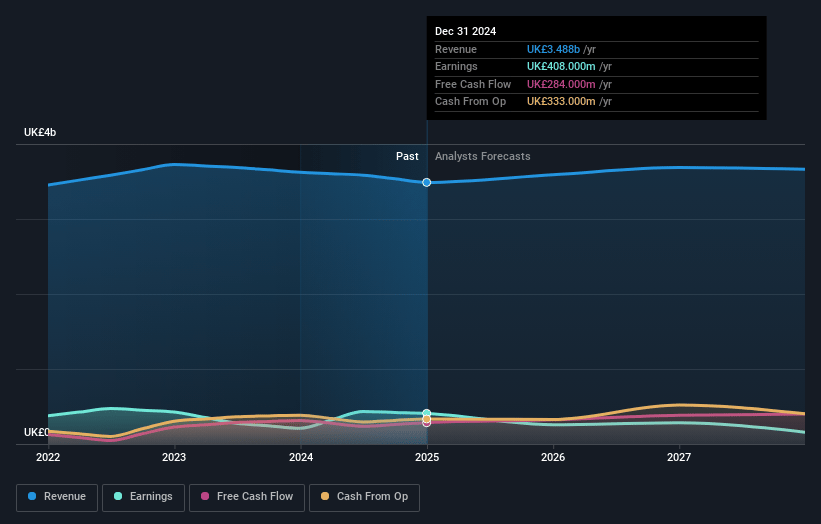

ITV Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on ITV compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming ITV's revenue will grow by 2.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 11.7% today to 5.8% in 3 years time.

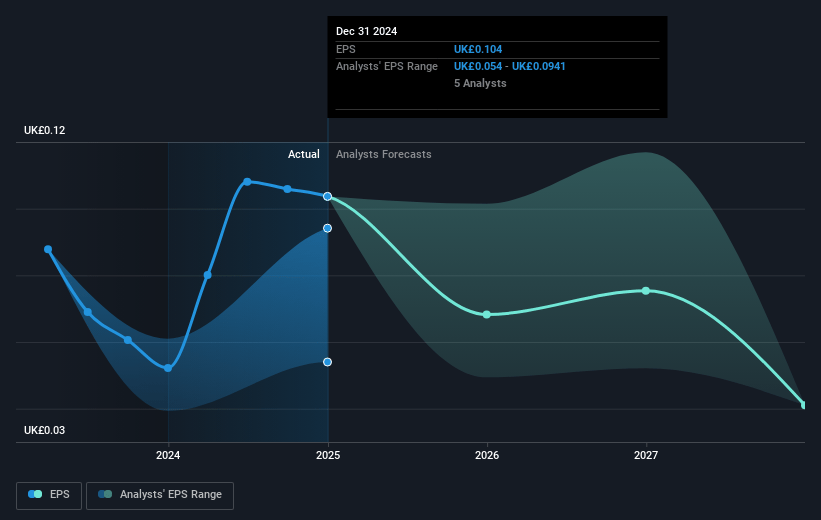

- The bullish analysts expect earnings to reach £216.8 million (and earnings per share of £0.06) by about July 2028, down from £408.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.4x on those 2028 earnings, up from 7.1x today. This future PE is greater than the current PE for the GB Media industry at 12.0x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.28%, as per the Simply Wall St company report.

ITV Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift from linear TV to on-demand streaming and increased audience fragmentation threaten ITV's core advertising revenue as younger generations and advertisers migrate to digital-first global platforms, creating long-term risks to top-line revenue growth.

- ITV faces escalating competition and pricing pressure in digital advertising from dominant global technology companies, making it difficult to sustain digital ad revenue growth and potentially eroding future margins and earnings.

- Long-standing underinvestment in high-quality, globally competitive content compared to larger international peers could limit ITV Studios' ability to drive sustainable international growth, resulting in further margin pressure and hindering earnings expansion over time.

- ITVX, while showing early progress, may face challenges in establishing itself as a profitable, scaled digital platform, and there is risk that digital revenue growth may not be sufficient to offset accelerating declines in high-margin linear broadcast revenue, which would impact overall revenue and net margins.

- The company's high operational leverage and fixed-cost legacy broadcast infrastructure constrain flexibility in periods of rapid market change or industry consolidation, exposing ITV to potential margin compression and earnings volatility if secular headwinds intensify.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for ITV is £1.07, which represents two standard deviations above the consensus price target of £0.8. This valuation is based on what can be assumed as the expectations of ITV's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £1.1, and the most bearish reporting a price target of just £0.61.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be £3.8 billion, earnings will come to £216.8 million, and it would be trading on a PE ratio of 18.4x, assuming you use a discount rate of 7.3%.

- Given the current share price of £0.77, the bullish analyst price target of £1.07 is 27.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.