Catalysts

About Baltic Classifieds Group

Baltic Classifieds Group operates leading online classifieds platforms across real estate, autos, jobs, services and generalist categories in the Baltic region.

What are the underlying business or industry changes driving this perspective?

- Continued migration of activity to digital classifieds in fast growing Baltic economies, combined with structurally low public debt and rising wages, is supporting sustained demand for B2C and C2C listings.

- Growing adoption of premium and longer duration packages across real estate, auto and services, supported by strong market positions and product upgrades, is lifting ARPU and yields per listing, which can expand net margins even if unit volumes remain volatile.

- Rapid rollout of AI and data driven tools, such as smart pricing, salary estimators, fraud screening and lead management, is enhancing platform utility for buyers and sellers, which can help justify ongoing price increases and support EBIT and EBITDA.

- The company’s dominant traffic share and largely organic user acquisition, together with efficient in house development and minimal marketing spend, provide operating leverage as volumes recover and support cash conversion and free cash flow generation.

- Normalization of Estonian auto transactions from tax related disruption, alongside structurally increasing car ownership and continued real estate transaction growth, can restore volume tailwinds in the two largest verticals and influence revenue and EBITDA trends.

Assumptions

This narrative explores a more optimistic perspective on Baltic Classifieds Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

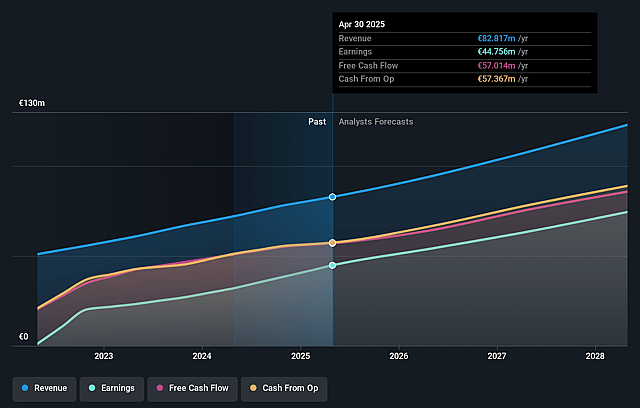

- The bullish analysts are assuming Baltic Classifieds Group's revenue will grow by 13.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 57.7% today to 62.6% in 3 years time.

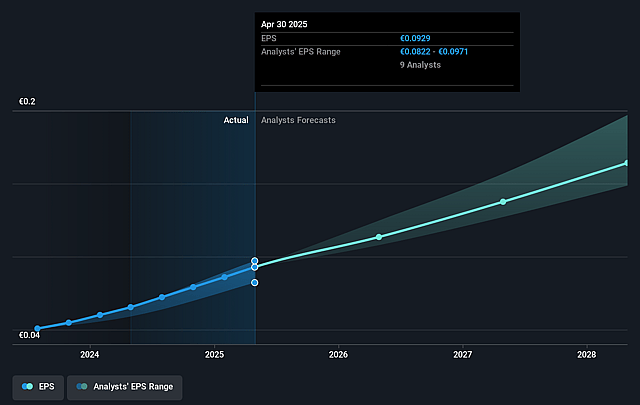

- The bullish analysts expect earnings to reach €78.0 million (and earnings per share of €0.17) by about December 2028, up from €49.5 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €64.8 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.6x on those 2028 earnings, up from 22.0x today. This future PE is greater than the current PE for the GB Interactive Media and Services industry at 22.0x.

- The bullish analysts expect the number of shares outstanding to decline by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.9%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Prolonged disruption in the Estonian auto market from tax uncertainty and political debate around potential changes could mean transaction volumes recover more slowly than management expects. This could limit listing activity and yield growth in the largest vertical and cap revenue and earnings.

- Management is committing to mid teens operating expense growth driven by wage inflation, team expansion and higher data and AI infrastructure costs at a time when inventory growth is uncertain. If volumes and pricing power soften, reduced operating leverage could compress EBITDA margins and slow net income growth.

- The strategy of pushing longer duration and premium packages alongside regular price increases is already reducing C2C listing counts in several segments. If consumers or small businesses push back more forcefully, this could structurally lower inventory and engagement and in turn weigh on ARPU, revenue and free cash flow.

- Growing reliance on public cloud providers and external data for AI and data products, combined with rising data acquisition costs, may structurally raise the cost base. If new AI features fail to meaningfully enhance competitive differentiation, the group could see a persistent drag on net margins and cash conversion.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Baltic Classifieds Group is £3.51, which represents up to two standard deviations above the consensus price target of £2.9. This valuation is based on what can be assumed as the expectations of Baltic Classifieds Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £3.51, and the most bearish reporting a price target of just £1.83.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be €124.7 million, earnings will come to €78.0 million, and it would be trading on a PE ratio of 31.6x, assuming you use a discount rate of 8.9%.

- Given the current share price of £2.02, the analyst price target of £3.51 is 42.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Baltic Classifieds Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.